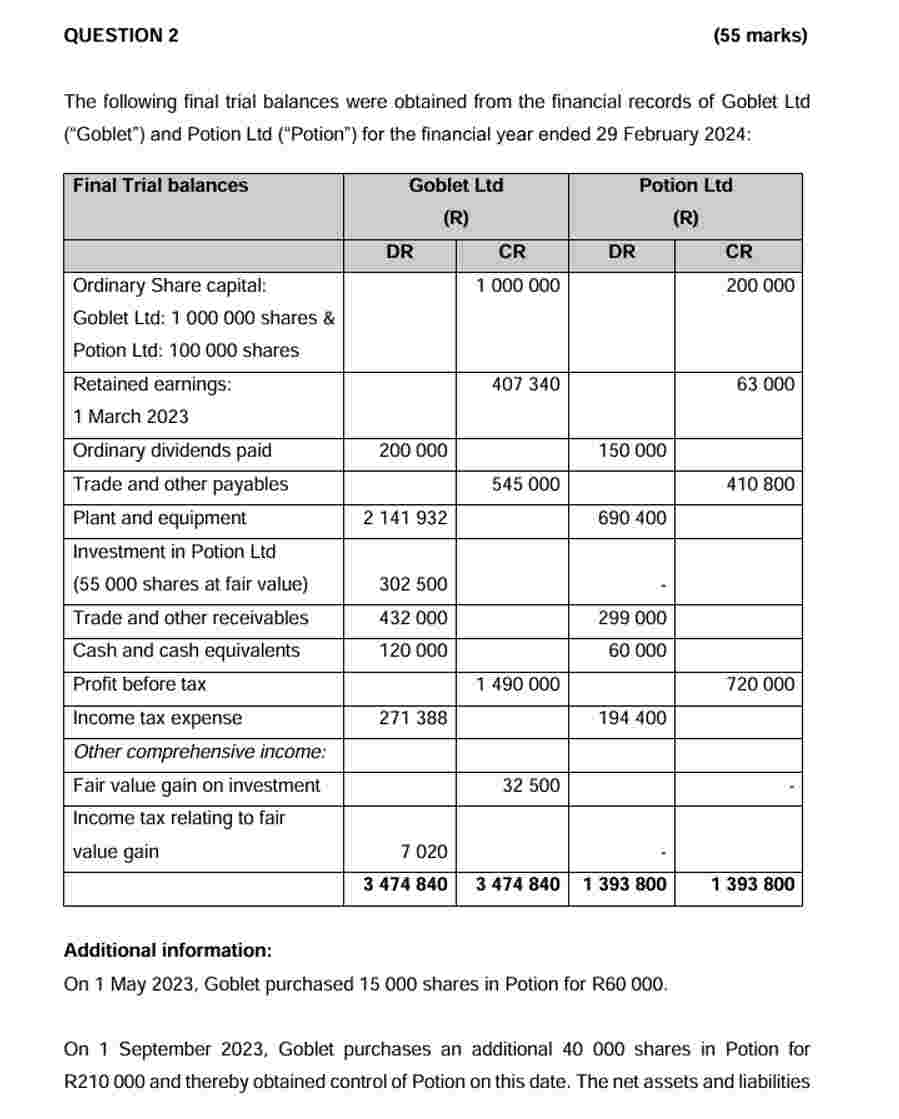

Question: Additional information: On 1 May 2 0 2 3 , Goblet purchased 1 5 0 0 0 shares in Potion for R 6 0 0

Additional information:

On May Goblet purchased shares in Potion for R

On September Goblet purchases an additional shares in Potion for

R and thereby obtained control of Potion on this date. The net assets and liabilities of Potion were considered to be fairly valued on the acquisition date. The fair value of Goblets initial investment in Potion was R on September In Goblets separate financial statements, Goblet classified its investment in Potion as fair value through other comprehensive income FVTOCI Fair value adjustments regarding the investment in Potion were therefore accounted for in other comprehensive income of Goblet both before and after the additional shares in Potion were acquired. Goblet does not have investments in any other entity and therefore their entire other comprehensive income relates to fair value adjustments in Potion. On February the fair value of Goblets total shareholding in Potion was R ie R per share. Potion both declared and paid dividends in February Other information: of Potions profit before tax and related tax expense was earned during the first months of the current financial and during the last months of the current financial year. Goblet elected to measure the noncontrolling interest at its proportionate share of Potions identifiable net assets at the acquisition date. There were no changes to the Ordinary Share Capital and the number of issued shares of Goblet and Potion during the current financial year. Goblet elects to transfer aftertax cumulative fair value gainslosses previously recognised in other comprehensive income, from the marktomarket reserve to retained earnings when the underlying IFRS equity investment in Potion is derecognised. Goblet is not a share dealer for income tax purposes. All companies in the Goblet Ltd Group have a February financial yearend. The Income Tax rate is and of capital gains are included in taxable income. are included in taxable income in all periods at the time gains are realised.

Ignore the effects of Dividend Tax and Value Added Tax VAT REQUIRED:

Prepare the Consolidated Statement of Changes in Equity of the Goblet Ltd Group for the year ended February The total columns are not required. Show and reference all your workings and calculations clearly. Round off to the nearest Rand. marks

Prepare the Statement of Financial Position of the Goblet Ltd Group as at February Notes to the financial statement are not required. Comparatives are not required. Use relevant workings calculationsamounts from and reference it clearly. Show new workings clearly. Round off to the nearest Rand. marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock