Question: Additional Notes a. Stock at year end was valued at $91,150b. Wages is prepaid by $9,000c. Insurance is owing by $1,500d. During the year the

Additional Notes a. Stock at year end was valued at $91,150b. Wages is prepaid by $9,000c. Insurance is owing by $1,500d. During the year the owner took goods values at $7,500. This was not yet recordede. The rent received is prepaid by $20,000f. Commission income is owing by $9,000g. The provision for bad debts is to be adjusted to 5% of debtorsh. Depreciation charges are to be applied as followsASSET RATE METHODLand and Building 10% Straight LineMotor Vehicle 10% Straight LineMachinery and Equipment10% Reducing Balancea. The Statement of Profit and Loss for the year ending December 31, 2020 ( 27 marks ) b. The Statement of Financial Position at at December 31, 2020 ( 23 marks )

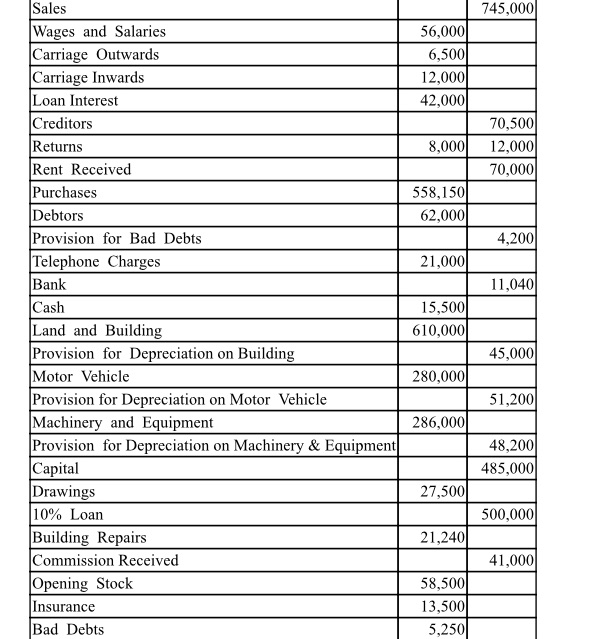

Sales 745,000 Wages and Salaries 56,000 Carriage Outwards 6,500 Carriage Inwards 12,000 Loan Interest 42,000 Creditors 70,500 Returns 8,000 12,000 Rent Received 70,000 Purchases 558,150 Debtors 62,000 Provision for Bad Debts 4.200 Telephone Charges 21,000 Bank 11,040 Cash 15,500 Land and Building 610,000 Provision for Depreciation on Building 45,000 Motor Vehicle 280,000 Provision for Depreciation on Motor Vehicle 51,200 Machinery and Equipment 286,000 Provision for Depreciation on Machinery & Equipment 48,200 Capital 485,000 Drawings 27,500 10% Loan 500,000 Building Repairs 21,240 Commission Received 41,000 Opening Stock 58,500 Insurance 13,500 Bad Debts 5,250

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts