Question: Additional Practice Problems: Capital Budgeting: NPV The Bates Brewery is considering the purchase of a new beer-making machine to replace the old one. The new

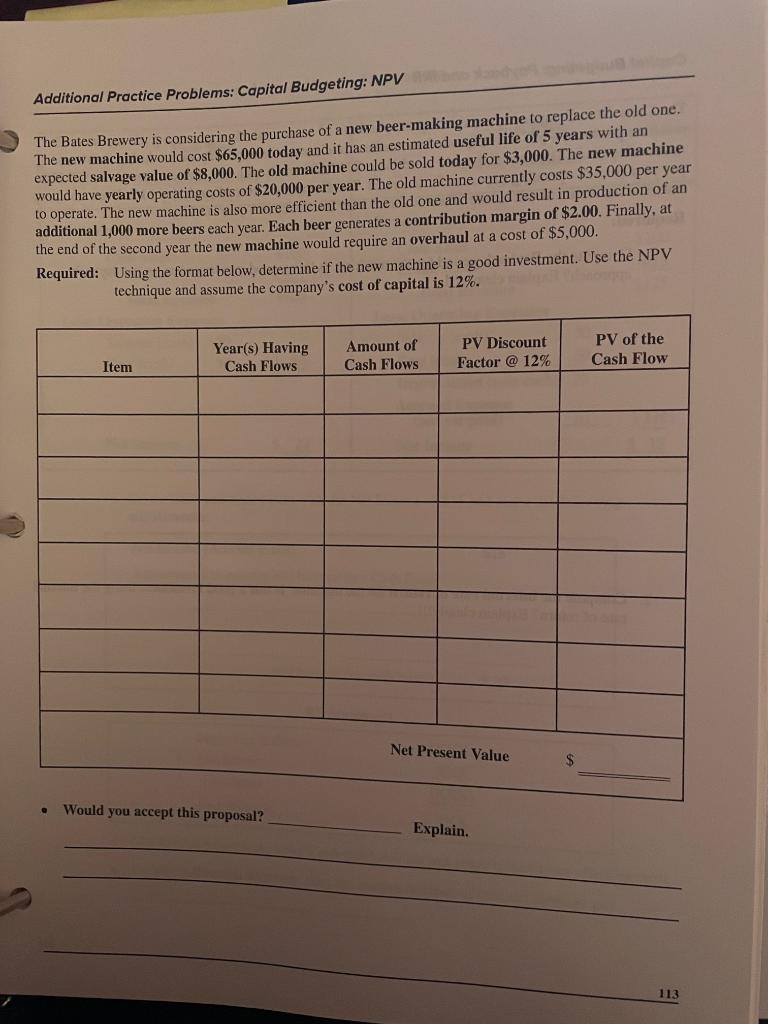

Additional Practice Problems: Capital Budgeting: NPV The Bates Brewery is considering the purchase of a new beer-making machine to replace the old one. The new machine would cost $65,000 today and it has an estimated useful life of 5 years with an expected salvage value of $8,000. The old machine could be sold today for $3,000. The new machine would have yearly operating costs of $20,000 per year. The old machine currently costs $35,000 per year to operate. The new machine is also more efficient than the old one and would result in production of an additional 1,000 more beers each year. Each beer generates a contribution margin of $2.00. Finally, at the end of the second year the new machine would require an overhaul at a cost of $5,000. Required: Using the format below, determine if the new machine is a good investment. Use the NPV technique and assume the company's cost of capital is 12%. Year(s) Having Cash Flows Amount of Cash Flows PV Discount Factor @ 12% PV of the Cash Flow Item Net Present Value S Would you accept this proposal? Explain. 113

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts