Question: ADDITIONAL QUESTION 1 Share buybacks are sometimes motivated by the desire to increase earnings per share. Falcon Ltd recorded an operating profit of $2 million

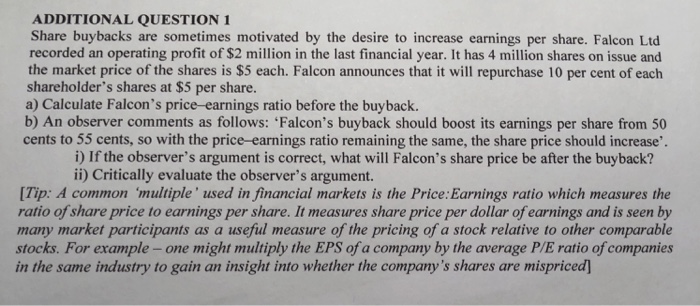

ADDITIONAL QUESTION 1 Share buybacks are sometimes motivated by the desire to increase earnings per share. Falcon Ltd recorded an operating profit of $2 million in the last financial year. It has 4 million shares on issue and the market price of the shares is $5 each. Falcon announces that it will repurchase 10 per cent of each shareholder's shares at $5 per share. a) Calculate Falcon's price-earnings ratio before the buyback. b) An observer comments as follows: 'Falcon's buyback should boost its earnings per share from 50 cents to 55 cents, so with the price-earnings ratio remaining the same, the share price should increase i) If the observer's argument is correct, what will Falcon's share price be after the buyback? ii) Critically evaluate the observer's argument. [Tip: A common 'multiple' used in financial markets is the Price: Earnings ratio which measures the ratio of share price to earnings per share. It measures share price per dollar of earnings and is seen by many market participants as a useful measure of the pricing of a stock relative to other comparable stocks. For example -one might multiply the EPS of a company by the average P/E ratio of companies in the same industry to gain an insight into whether the company's shares are mispriced

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts