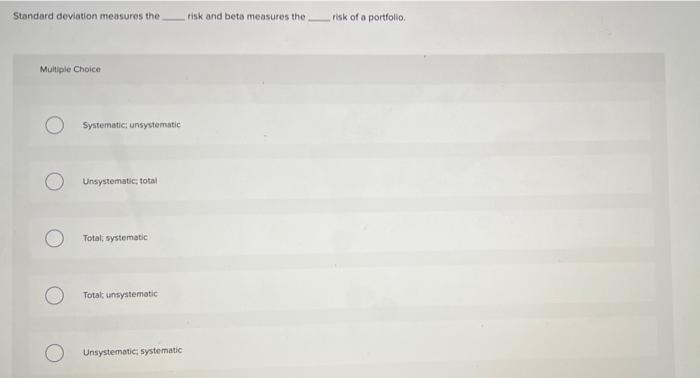

Question: Standard deviation measures the risk and beta measures the risk of a portfolio. Multiple Choice Systematic: unsystematic Unsystematic; total Total, systematic Total, unsystematic Unsystematic systematic

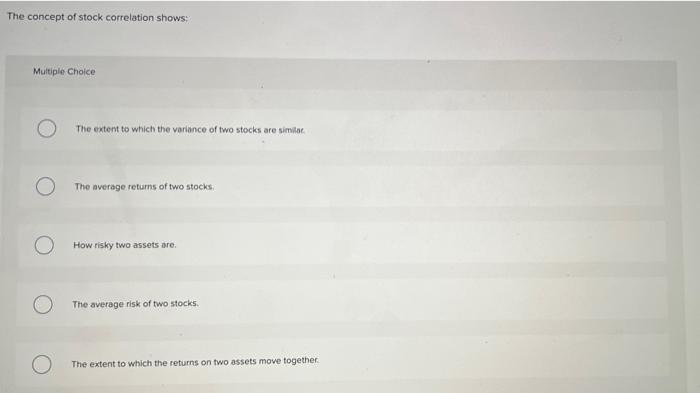

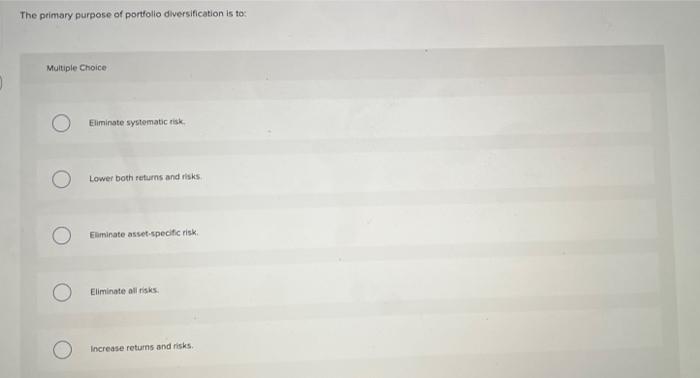

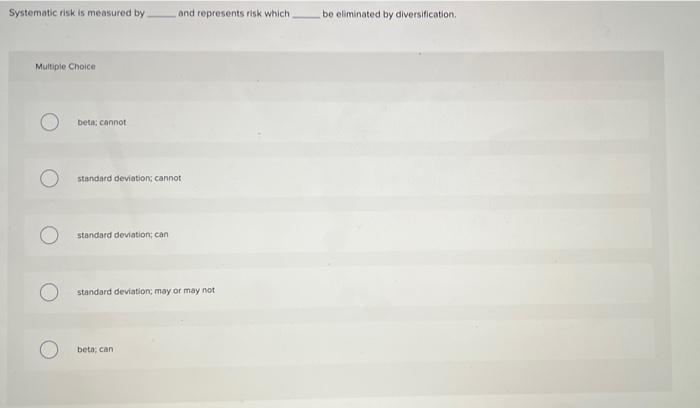

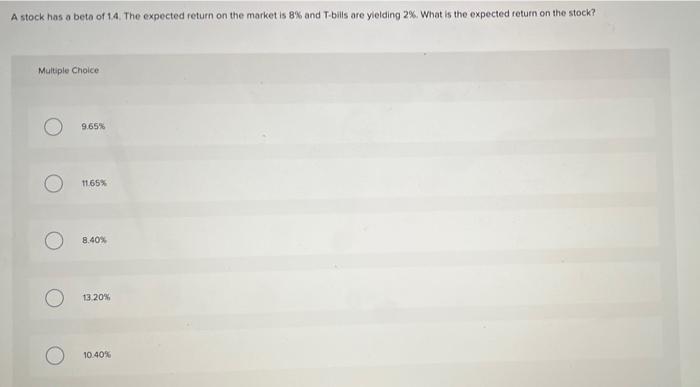

Standard deviation measures the risk and beta measures the risk of a portfolio. Multiple Choice Systematic: unsystematic Unsystematic; total Total, systematic Total, unsystematic Unsystematic systematic The concept of stock correlation shows: Multipie Choice The extent to which the variance of two stocks are similoe. The average returns of two stocks. How risky two assets are. The average risk of two stocic5. The extent to which the returns on two assets move together. The primary purpose of portfolio diversification is to: Multiple Choice Eliminate systematic risk. Lower both peturns and risks Elaminate asset.specifc risk. Eliminate all risks. increase retums and risks. Systematic risk is measured by and represents risk which be eliminated by diversification. Multiple Choice beta; cannot standard deviations cannot standard deviation; can standard deviation; may of may not beta; can A stock has a bete of 1.4. The expected return on the market is 8% and T-bills are yielding 2%. What is the expected return on the stock? Multiple Choice 9.65% 11.65% 8.40% 1320% 10.4096

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts