Question: Additional Requirement: Depreciation Expense for year 2024 Problem 11-6 (IFRS) On January 1, 2022, Bronze Company entered into a lease for floor space with the

Additional Requirement: Depreciation Expense for year 2024

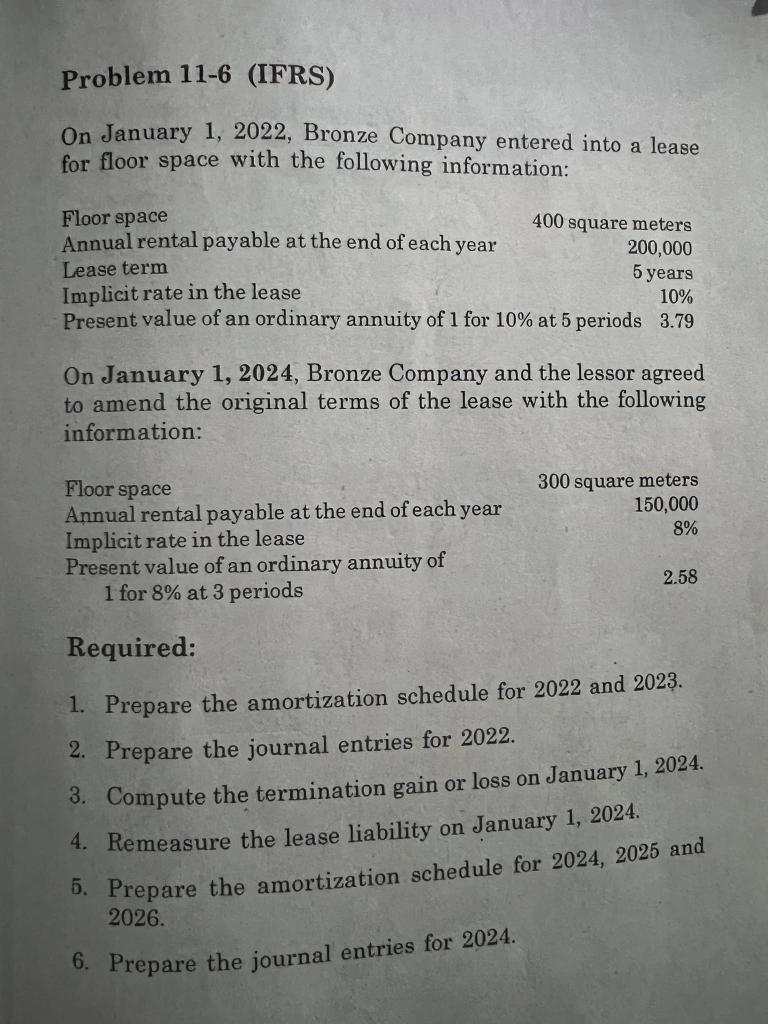

Problem 11-6 (IFRS) On January 1, 2022, Bronze Company entered into a lease for floor space with the following information: On January 1, 2024, Bronze Company and the lessor agreed to amend the original terms of the lease with the following information: Required: 1. Prepare the amortization schedule for 2022 and 2023. 2. Prepare the journal entries for 2022 . 3. Compute the termination gain or loss on January 1,2024. 4. Remeasure the lease liability on January 1,2024. 5. Prepare the amortization schedule for 2024,2025 and 2026. 6. Prepare the journal entries for 2024

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock