Question: ADE Utara Sca PART B Total 80 marks Question B-1 125 marks) You have reviewed the characteristics and historical prices of two companies (A and

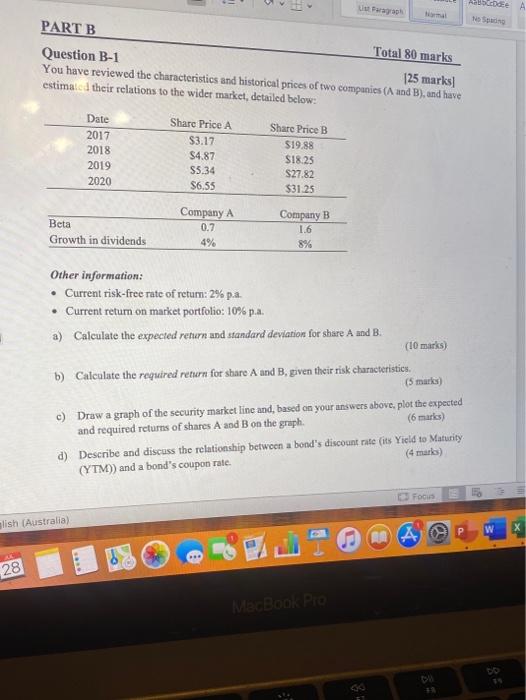

ADE Utara Sca PART B Total 80 marks Question B-1 125 marks) You have reviewed the characteristics and historical prices of two companies (A and B), and have estimated their relations to the wider market, detailed below: Date 2017 2018 2019 2020 Share Price A $3.17 S4.87 S5.34 S6.55 Share Price B $19.88 $18.25 $27.82 $31.25 Beta Company A 0.7 4% Company B 1.6 8% Growth in dividends Other information: Current risk-free rate of return: 2% p.a. Current return on market portfolio: 10% p.a. a) Calculate the expected return and standard deviation for share A and B. (10 marks) b) Calculate the required return for share A and B, given their risk characteristics (5 marki c) Draw a graph of the security market line and, based on your answers above, plot the expected and required returns of shares A and B on the graph. (6 mars) d) Describe and discuss the relationship between a bond's discount rate (its Yield to Maturity (YTM)) and a bond's coupon rate. Focus lish (Australia) W ADA be 28 MacBook Pro so

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts