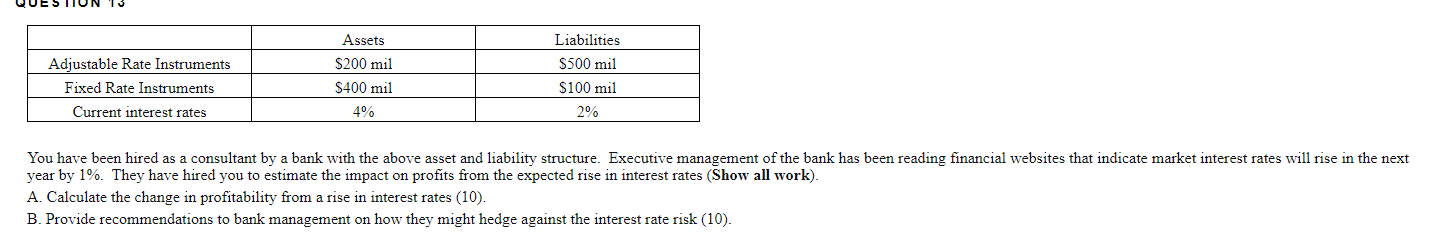

Question: Adjustable Rate Instruments Fixed Rate Instruments Current interest rates Assets $200 mil $400 mil 4% Liabilities $500 mil $100 mil 2% You have been hired

Adjustable Rate Instruments Fixed Rate Instruments Current interest rates Assets $200 mil $400 mil 4% Liabilities $500 mil $100 mil 2% You have been hired as a consultant by a bank with the above asset and liability structure. Executive management of the bank has been reading financial websites that indicate market interest rates will rise in the next year by 1%. They have hired you to estimate the impact on profits from the expected rise in interest rates (Show all work). A. Calculate the change in profitability from a rise in interest rates (10). B. Provide recommendations to bank management on how they might hedge against the interest rate risk (10). Adjustable Rate Instruments Fixed Rate Instruments Current interest rates Assets $200 mil $400 mil 4% Liabilities $500 mil $100 mil 2% You have been hired as a consultant by a bank with the above asset and liability structure. Executive management of the bank has been reading financial websites that indicate market interest rates will rise in the next year by 1%. They have hired you to estimate the impact on profits from the expected rise in interest rates (Show all work). A. Calculate the change in profitability from a rise in interest rates (10). B. Provide recommendations to bank management on how they might hedge against the interest rate risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts