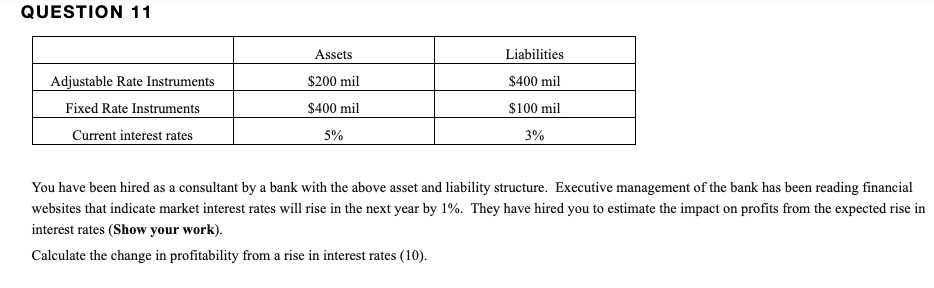

Question: QUESTION 11 Assets Liabilities $400 mil Adjustable Rate Instruments Fixed Rate Instruments Current interest rates $200 mil $400 mil 5% $100 mil 3% You have

QUESTION 11 Assets Liabilities $400 mil Adjustable Rate Instruments Fixed Rate Instruments Current interest rates $200 mil $400 mil 5% $100 mil 3% You have been hired as a consultant by a bank with the above asset and liability structure. Executive management of the bank has been reading financial websites that indicate market interest rates will rise in the next year by 1%. They have hired you to estimate the impact on profits from the expected rise in interest rates (Show your work). Calculate the change in profitability from a rise in interest rates (10). QUESTION 11 Assets Liabilities $400 mil Adjustable Rate Instruments Fixed Rate Instruments Current interest rates $200 mil $400 mil 5% $100 mil 3% You have been hired as a consultant by a bank with the above asset and liability structure. Executive management of the bank has been reading financial websites that indicate market interest rates will rise in the next year by 1%. They have hired you to estimate the impact on profits from the expected rise in interest rates (Show your work). Calculate the change in profitability from a rise in interest rates

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts