Question: Adjusted Basis (LO. 3) Determine the adjusted basis for each of the following assets a. Leineia purchased an automobile 2 years ago for $30,000. She

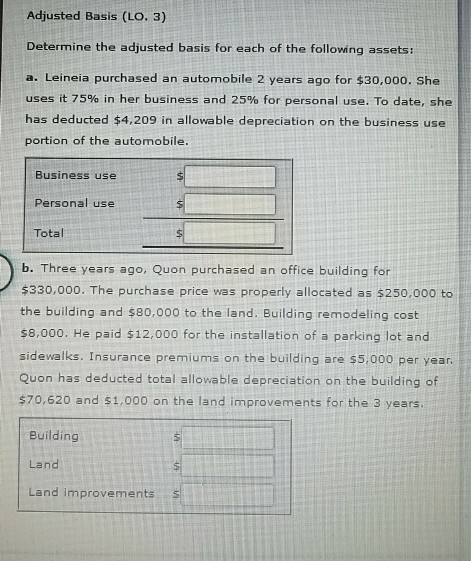

Adjusted Basis (LO. 3) Determine the adjusted basis for each of the following assets a. Leineia purchased an automobile 2 years ago for $30,000. She uses it 75% in her business and 25% for personal use. To date, she has deducted $4,209 in allowable depreciation on the business use portion of the automobile Business use Personal use Tota b. Three years ago, Quon purchased an office building for $330,000. The purchase price was properly allocated as $250,000 to the building and $80,000 to the land. Building remodeling cost $8,000. He paid $12,000 for the installation of a parking lot and sidewalks. Insurance premiums on the building are $5,000 per year Quon has deducted total allowable depreciation on the building of $70,620 and $1,000 on the land improvements for the 3 years Building Land Land improvements S

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts