Question: Adjusting entries will be needed every month to expense this from Dec through Nov of next year. OCT: NOV: DEC: 10/1-$1,500 rent check cut &

Adjusting entries will be needed every month to expense this from Dec through Nov of next year.

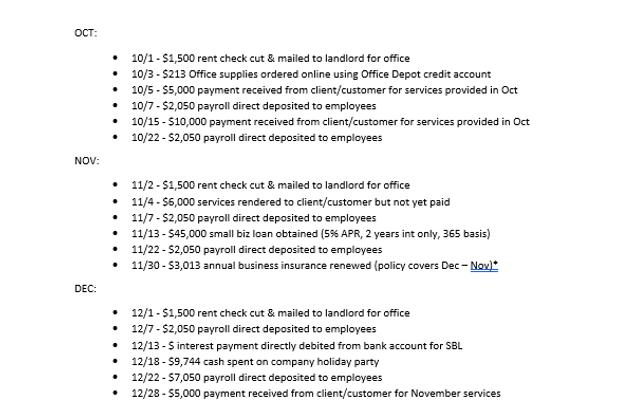

OCT: NOV: DEC: 10/1-$1,500 rent check cut & mailed to landlord for office 10/3-$213 Office supplies ordered online using Office Depot credit account 10/5 - $5,000 payment received from client/customer for services provided in Oct . 10/7-$2,050 payroll direct deposited to employees 10/15 - $10,000 payment received from client/customer for services provided in Oct 10/22 - $2,050 payroll direct deposited to employees . . . . . . 12/1-$1,500 rent check cut & mailed to landlord for office 12/7-$2,050 payroll direct deposited to employees 12/13 - $ interest payment directly debited from bank account for SBL . . . 11/2-$1,500 rent check cut & mailed to landlord for office 11/4-$6,000 services rendered to client/customer but not yet paid 11/7-$2,050 payroll direct deposited to employees 11/13 - $45,000 small biz loan obtained (5 % APR, 2 years int only, 365 basis) . 11/22-$2,050 payroll direct deposited to employees 11/30-$3,013 annual business insurance renewed (policy covers Dec - Nov)* 12/18-$9,744 cash spent on company holiday party 12/22 - $7,050 payroll direct deposited to employees 12/28 - $5,000 payment received from client/customer for November services

Step by Step Solution

There are 3 Steps involved in it

03... View full answer

Get step-by-step solutions from verified subject matter experts