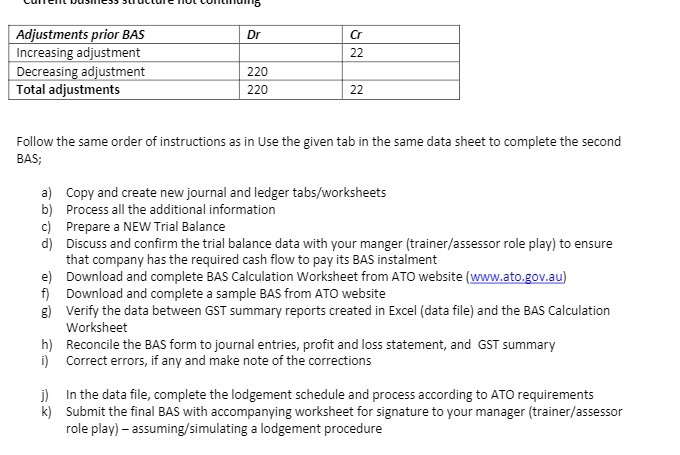

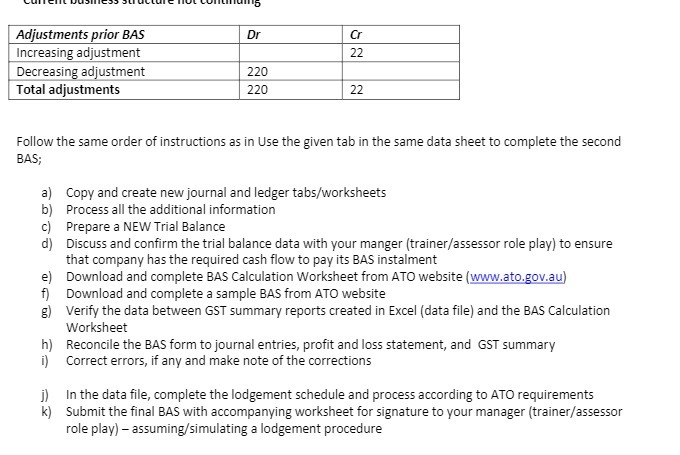

Question: Adjustments prior BAS Dr Cr Increasing adjustment 22 Decreasing adjustment 220 Total adjustments 220 22 Follow the same order of instructions as in Use the

Adjustments prior BAS Dr Cr Increasing adjustment 22 Decreasing adjustment 220 Total adjustments 220 22 Follow the same order of instructions as in Use the given tab in the same data sheet to complete the second BAS; a) Copy and create new journal and ledger tabs/worksheets b) Process all the additional information c) Prepare a NEW Trial Balance d) Discuss and confirm the trial balance data with your manger (trainer/assessor role play) to ensure that company has the required cash flow to pay its BAS instalment e) Download and complete BAS Calculation Worksheet from ATO website (www.ato.gov.au) f) Download and complete a sample BAS from ATO website g) Verify the data between GST summary reports created in Excel (data file) and the BAS Calculation Worksheet h) Reconcile the BAS form to journal entries, profit and loss statement, and GST summary i) Correct errors, if any and make note of the corrections j) In the data file, complete the lodgement schedule and process according to ATO requirements k) Submit the final BAS with accompanying worksheet for signature to your manager (trainer/assessor role play) - assuming/simulating a lodgement procedure

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts