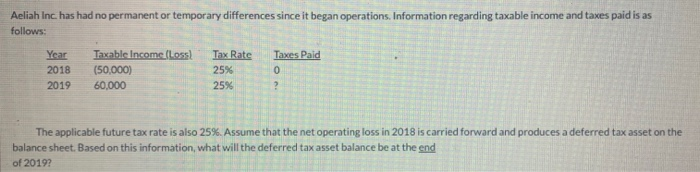

Question: Aeliah Inc. has had no permanent or temporary differences since it began operations. Information regarding taxable income and taxes paid is as follows: Year 2018

Aeliah Inc. has had no permanent or temporary differences since it began operations. Information regarding taxable income and taxes paid is as follows: Year 2018 2019 Taxable income (Loss) (50,000) 60,000 Tax Rate 25% 2596 Taxes Paid 0 ? The applicable future tax rate is also 25%. Assume that the net operating loss in 2018 is carried forward and produces a deferred tax asset on the balance sheet. Based on this information, what will the deferred tax asset balance be at the end of 2019

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock