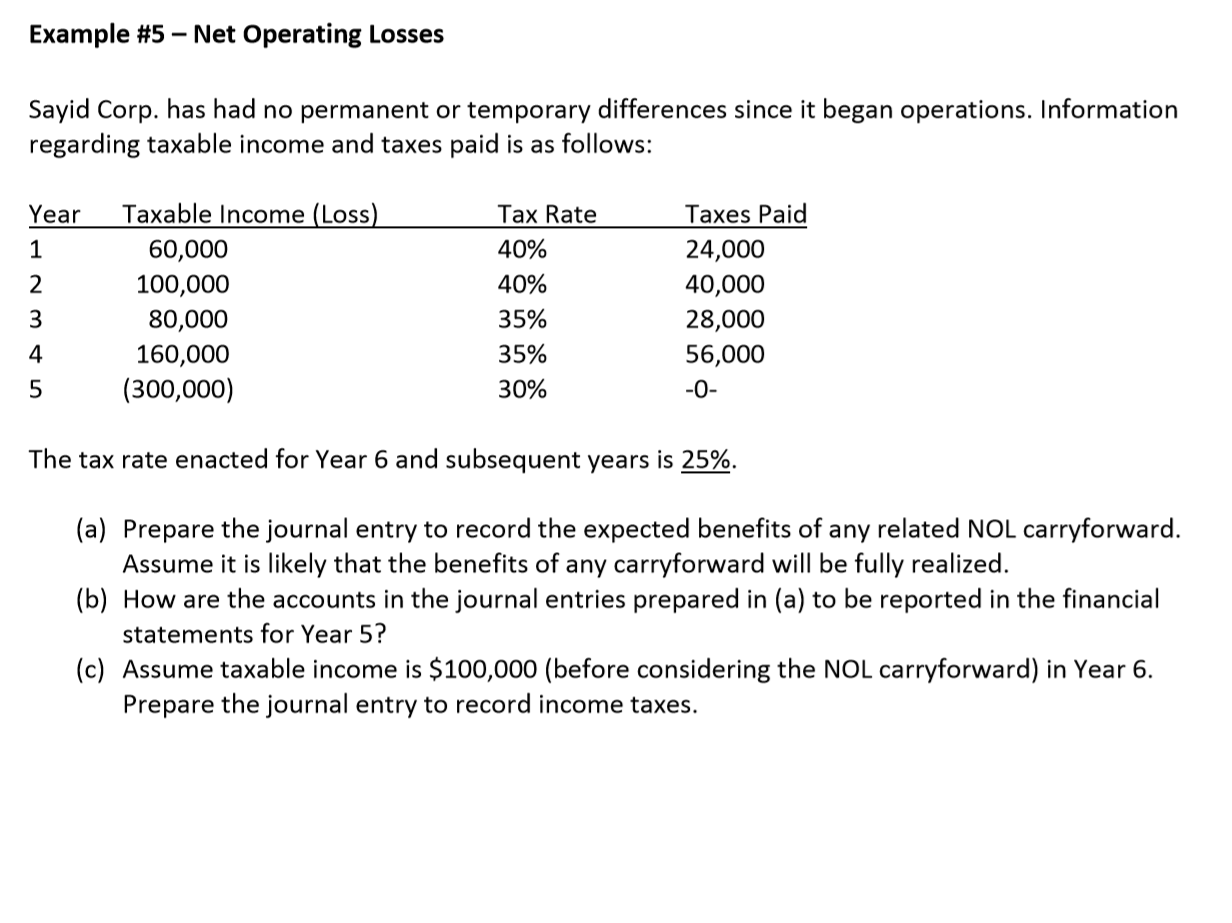

Question: Example #5 - Net Operating Losses Sayid Corp. has had no permanent or temporary differences since it began operations. Information regarding taxable income and taxes

Example #5 - Net Operating Losses Sayid Corp. has had no permanent or temporary differences since it began operations. Information regarding taxable income and taxes paid is as follows: Year nmin Taxable Income (Loss) 60,000 100,000 80,000 160,000 (300,000) Tax Rate 40% 40% 35% 35% 30% Taxes Paid 24,000 40,000 28,000 56,000 -O- The tax rate enacted for Year 6 and subsequent years is 25%. (a) Prepare the journal entry to record the expected benefits of any related NOL carryforward. Assume it is likely that the benefits of any carryforward will be fully realized. (b) How are the accounts in the journal entries prepared in (a) to be reported in the financial statements for Year 5? (c) Assume taxable income is $100,000 (before considering the NOL carryforward) in Year 6. Prepare the journal entry to record income taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts