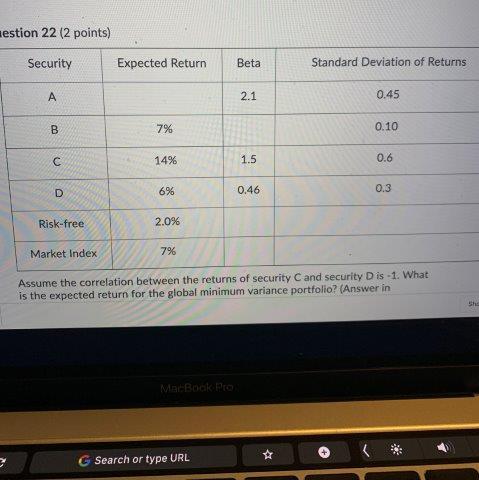

Question: aestion 22 (2 points) Security Expected Return Beta Standard Deviation of Returns 2.1 0.45 B 7% 0.10 c 14% 0.6 1.5 D 6% 0.46 0.3

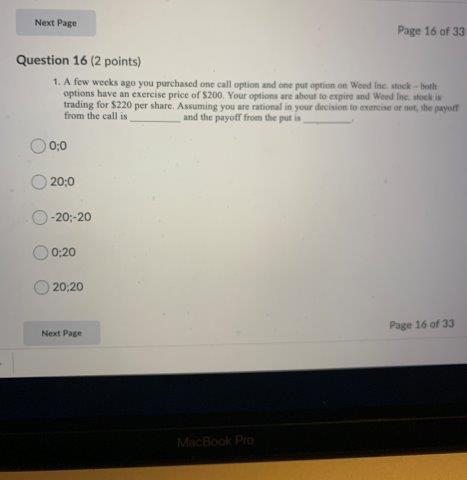

aestion 22 (2 points) Security Expected Return Beta Standard Deviation of Returns 2.1 0.45 B 7% 0.10 c 14% 0.6 1.5 D 6% 0.46 0.3 Risk-free 2.0% Market Index 7% Assume the correlation between the returns of security C and security Dis - 1. What is the expected return for the global minimum variance portfolio? (Answer in Mar Boca 4 G Search or type URL Next Page Page 16 of 33 Question 16 (2 points) 1. A few weeks ago you purchased one call option and one put option on Wood Incestock - both options have an exercise price of $200. Your options are about to expired Wendine stock trading for $220 per share. Assuming you are rational in your decision to exercise or not the off from the call is and the payoff from the put a 0:0 20:0 -20:-20 0:20 20:20 Page 16 of 33 Next Page MacBook Pro

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts