Question: AFAR Answer the following Denmark Construction Lid uses the percentage-of-completion method of accounting. In the 2010 reporting period, Denmark began work on a contract it

AFAR

Answer the following

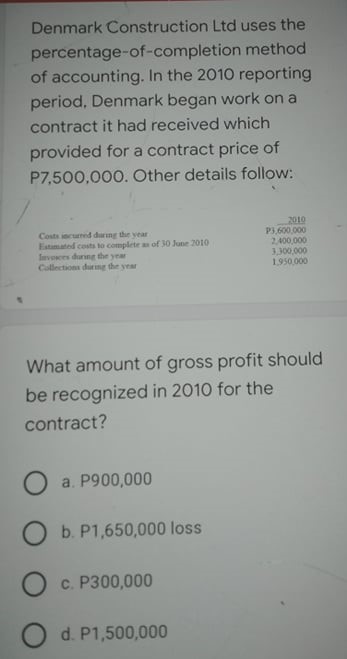

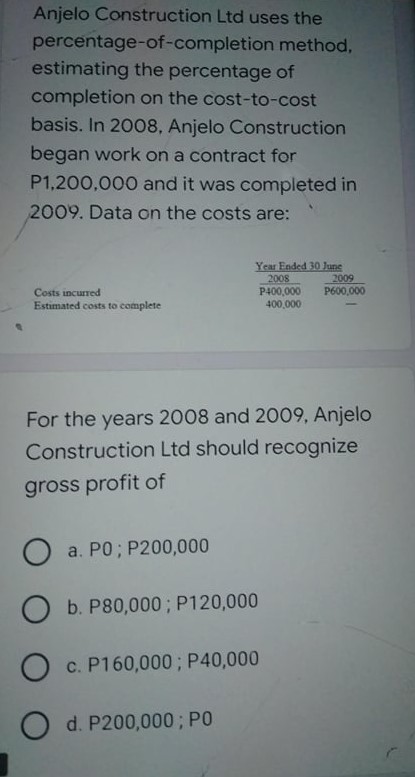

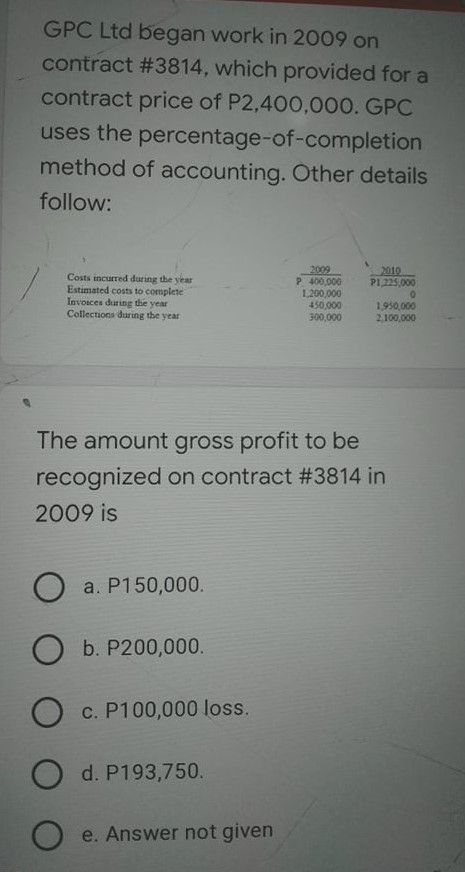

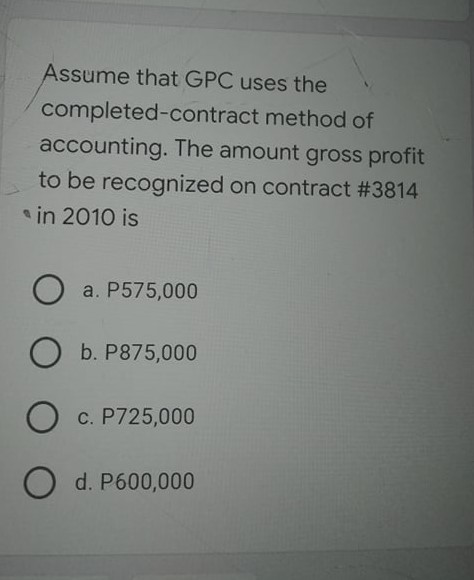

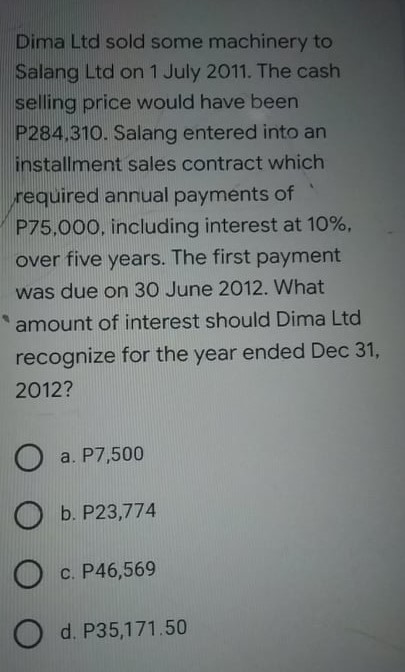

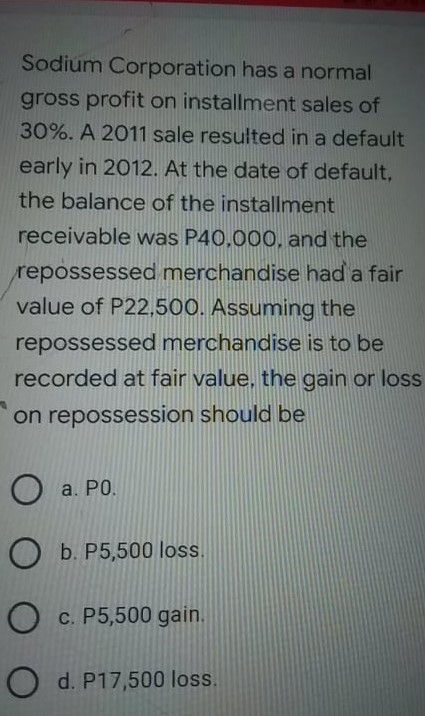

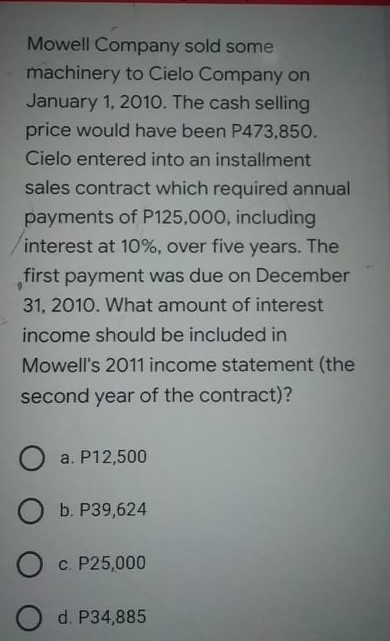

Denmark Construction Lid uses the percentage-of-completion method of accounting. In the 2010 reporting period, Denmark began work on a contract it had received which provided for a contract price of P7,500,000. Other details follow: Coun jpruned during the year Bumped costs to complete in of 30 June 2010 2 400,000 Invoices during the year 3.309 000 Collection during the wra 1 950 000 What amount of gross profit should be recognized in 2010 for the contract? O a. P900,000 O b. P1,650,000 loss O c. P300,000 d. P1,500,000Anjelo Construction Ltd uses the percentage-of-completion method, estimating the percentage of completion on the cost-to-cost basis. In 2008, Anjelo Construction began work on a contract for P1,200,000 and it was completed in 2009. Data on the costs are: Year Ended 30 June 2008 2009 Costs incurred P400.000 P600,000 Estimated costs to complete 400.000 For the years 2008 and 2009, Anjelo Construction Ltd should recognize gross profit of O a. PO ; P200,000 O b. P80,000 ; P120,000 O c. P160,000 ; P40,000 O d. P200,000 ; POGPC Ltd began work in 2009 on contract #3814, which provided for a contract price of P2,400,000. GPC uses the percentage-of-completion method of accounting. Other details follow: 2009 2010 Costs incurred during the year P 410,DOG PI.225,000 Estimated costs to complete 1 200,000 Invoices during the year 450.000 1,950,000 Collections during the year 300,000 2 100.000 The amount gross profit to be recognized on contract #3814 in 2009 is O a. P150,000. O b. P200,000. C. P100,000 loss. d. P193,750 O e. Answer not givenAssume that GPC uses the completed-contract method of accounting. The amount gross profit to be recognized on contract #3814 in 2010 is O a. P575,000 O b. P875,000 O C. P725,000 O d. P600,000Dima Ltd sold some machinery to Salang Ltd on 1 July 2011. The cash selling price would have been P284,310. Salang entered into an installment sales contract which required annual payments of P75,000, including interest at 10%, over five years. The first payment was due on 30 June 2012. What amount of interest should Dima Ltd recognize for the year ended Dec 31, 2012? O a. P7,500 b. P23,774 C. P46,569 O d. P35,171.50Sodium Corporation has a normal gross profit on installment sales of 30%. A 2011 sale resulted in a default early in 2012. At the date of default, the balance of the installment receivable was P40,000. and the repossessed merchandise had a fair value of P22,500. Assuming the repossessed merchandise is to be recorded at fair value, the gain or loss on repossession should be O a. PO. O b. P5,500 loss O c. P5,500 gain O d. P17,500 loss.Mowell Company sold some machinery to Cielo Company on January 1, 2010. The cash selling price would have been P473,850. Cielo entered into an installment sales contract which required annual payments of P125,000, including interest at 10%, over five years. The first payment was due on December 31, 2010. What amount of interest income should be included in Mowell's 2011 income statement (the second year of the contract)? O a. P12,500 O b. P39,624 O C. P25,000 O d. P34,885

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts