Question: Affinity Ltd plans to reduce debt through a $10 million equity issue at $20 per share. The company is currently financed by debt of

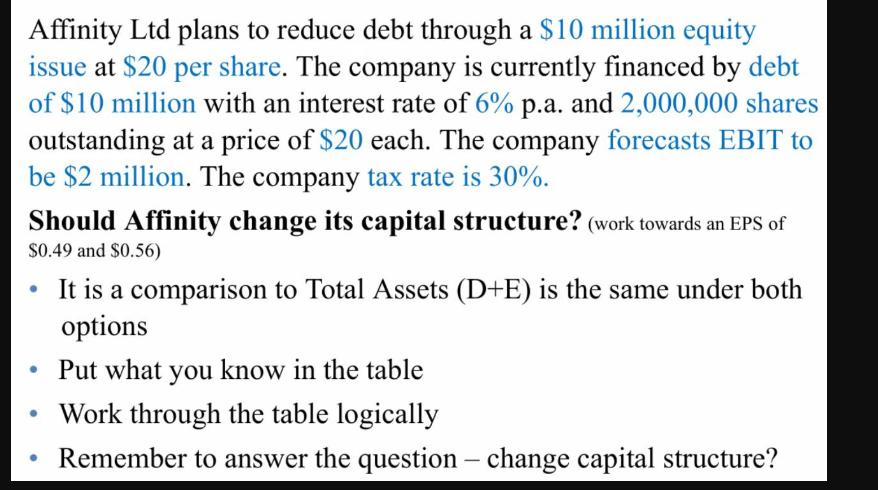

Affinity Ltd plans to reduce debt through a $10 million equity issue at $20 per share. The company is currently financed by debt of $10 million with an interest rate of 6% p.a. and 2,000,000 shares outstanding at a price of $20 each. The company forecasts EBIT to be $2 million. The company tax rate is 30%. Should Affinity change its capital structure? (work towards an EPS of $0.49 and $0.56) It is a comparison to Total Assets (D+E) is the same under both options Put what you know in the table Work through the table logically Remember to answer the question - change capital structure?

Step by Step Solution

There are 3 Steps involved in it

Impact of Equity Issue on Affinity Ltd Table Scenario Current After Equity Issue Debt 10 million 0 E... View full answer

Get step-by-step solutions from verified subject matter experts