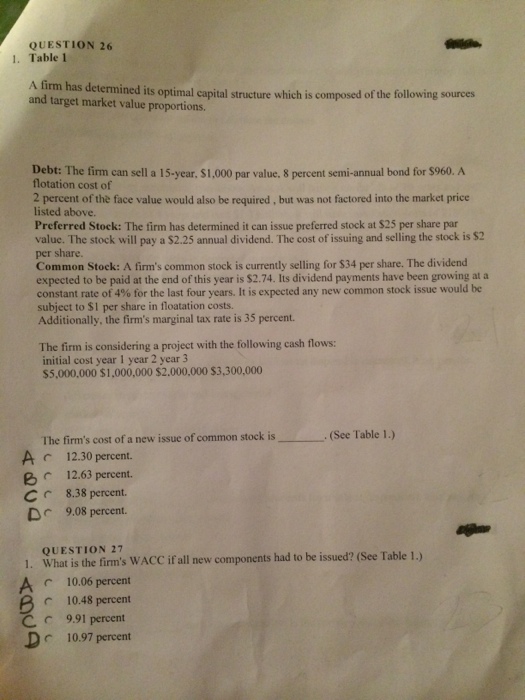

Question: Afirm has determined its optimal capital structure which is composed of the following sources and target market value proportions. The firm can sell a 15-year,

Afirm has determined its optimal capital structure which is composed of the following sources and target market value proportions. The firm can sell a 15-year, $1,000 per value, 8 percent semi-annual bond for $960. A notation cost of 2 percent o| the face value would also be required , but was not factored into the market price listed above. The firm has determined it can issue preferred stock at $25 per share par value. I he stock will pay a $2.25 annual dividend. The cost of issuing and selling the stock is $2 per share. A firm's common stock is currently selling for S34 per share. The dividend expected to be paid at the end of this year is $2.74. Its dividend payments have been growing at a constant rate of 4% for the last four years. It is expected any new common stock issue would be subject to $1 per share in floatation costs. Additionally, the firm's marginal tax rate is 35 percent. The firm is considering a project with the following cash flows: initial cost year 1 year 2 year 3 $5,000,000 $1.000.000 $2,000,000 $3,300,000 The firm's cost of a new issue of common stock is . (See Table 1.) What is the firm's WACC if all new components had to be issued? (See Table 1.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts