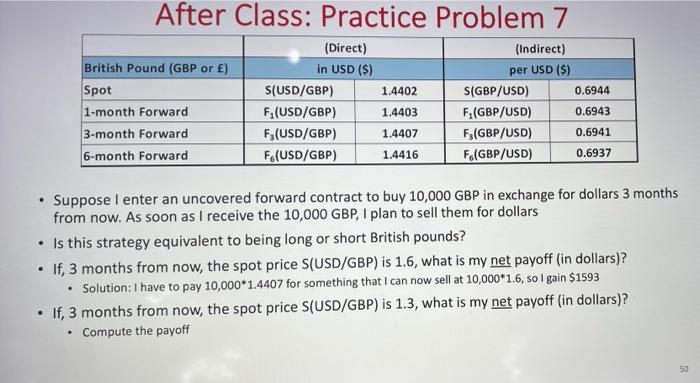

Question: After Class: Practice Problem 7 (Direct) (Indirect) British Pound (GBP or ) in USD ($) per USD ($) Spot S(USD/GBP) 1.4402 S(GBP/USD) 0.6944 1-month Forward

After Class: Practice Problem 7 (Direct) (Indirect) British Pound (GBP or ) in USD ($) per USD ($) Spot S(USD/GBP) 1.4402 S(GBP/USD) 0.6944 1-month Forward F (USD/GBP) 1.4403 F(GBP/USD) 0.6943 3-month Forward F (USD/GBP) 1.4407 F(GBP/USD) 0.6941 6-month Forward F.(USD/GBP) 1.4416 F.(GBP/USD) 0.6937 . Suppose I enter an uncovered forward contract to buy 10,000 GBP in exchange for dollars 3 months from now. As soon as I receive the 10,000 GBP, I plan to sell them for dollars Is this strategy equivalent to being long or short British pounds? If, 3 months from now, the spot price (USD/GBP) is 1.6, what is my net payoff (in dollars)? Solution: I have to pay 10,000*1.4407 for something that I can now sell at 10,000*1.6, so I gain $1593 If, 3 months from now, the spot price S(USD/GBP) is 1.3, what is my net payoff (in dollars)? Compute the payoff . . 50 After Class: Practice Problem 7 (Direct) (Indirect) British Pound (GBP or ) in USD ($) per USD ($) Spot S(USD/GBP) 1.4402 S(GBP/USD) 0.6944 1-month Forward F (USD/GBP) 1.4403 F(GBP/USD) 0.6943 3-month Forward F (USD/GBP) 1.4407 F(GBP/USD) 0.6941 6-month Forward F.(USD/GBP) 1.4416 F.(GBP/USD) 0.6937 . Suppose I enter an uncovered forward contract to buy 10,000 GBP in exchange for dollars 3 months from now. As soon as I receive the 10,000 GBP, I plan to sell them for dollars Is this strategy equivalent to being long or short British pounds? If, 3 months from now, the spot price (USD/GBP) is 1.6, what is my net payoff (in dollars)? Solution: I have to pay 10,000*1.4407 for something that I can now sell at 10,000*1.6, so I gain $1593 If, 3 months from now, the spot price S(USD/GBP) is 1.3, what is my net payoff (in dollars)? Compute the payoff . . 50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts