Question: After completing the file, export it to excel and send me in my email the following: a) Trial Balance as at Jan 11, b) Income

After completing the file, export it to excel and send me in my email the following:

a) Trial Balance as at Jan 11,

b) Income statement year-to-date

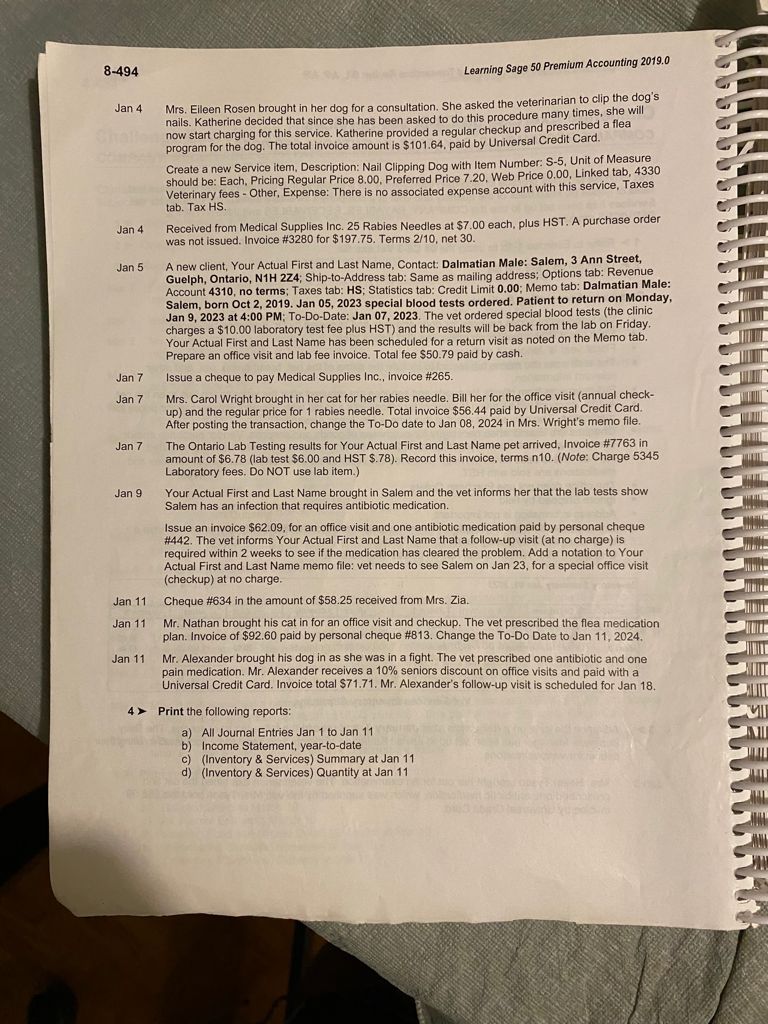

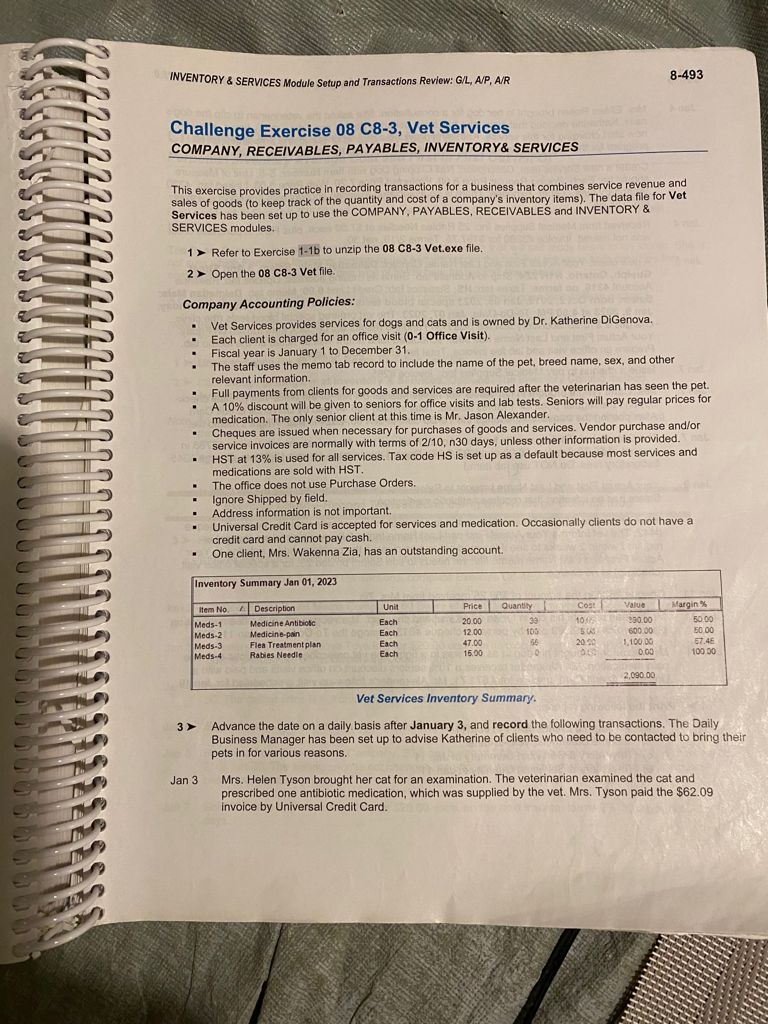

8-494 Learning Sage 50 Premium Accounting 2019.0 Jan 4 Mrs. Eileen Rosen brought in her dog for a consultation. She asked the veterinarian to clip the dog's nails. Katherine decided that since she has been asked to do this procedure many times, she will now start charging for this service. Katherine provided a regular checkup and prescribed a flea program for the dog. The total invoice amount is $101.64, paid by Universal Credit Card. Create a new Service item, Description: Nail Clipping Dog with Item Number: S-5, Unit of Measure should be: Each, Pricing Regular Price 8.00, Preferred Price 7.20, Web Price 0.00, Linked tab, 4330 Veterinary fees - Other, Expense: There is no associated expense account with this service, Taxes tab. Tax HS. Jan 4 Received from Medical Supplies Inc. 25 Rabies Needles at $7.00 each, plus HST. A purchase order was not issued. Invoice #3280 for $197.75. Terms 2/10, net 30. Jan 5 A new client, Your Actual First and Last Name, Contact: Dalmatian Male: Salem, 3 Ann Street, Guelph, Ontario, N1H 2Z4; Ship-to-Address tab: Same as mailing address; Options tab: Revenue Account 4310, no terms; Taxes tab: HS; Statistics tab: Credit Limit 0.00; Memo tab: Dalmatian Male: Salem, born Oct 2, 2019. Jan 05, 2023 special blood tests ordered. Patient to return on Monday, Jan 9, 2023 at 4:00 PM; To-Do-Date: Jan 07, 2023. The vet ordered special blood tests (the clinic charges a $10.00 laboratory test fee plus HST) and the results will be back from the lab on Friday. Your Actual First and Last Name has been scheduled for a return visit as noted on the Memo tab. Prepare an office visit and lab fee invoice. Total fee $50.79 paid by cash. Jan 7 Issue a cheque to pay Medical Supplies Inc., invoice #265. Jan 7 Mrs. Carol Wright brought in her cat for her rabies needle. Bill her for the office visit (annual check- up) and the regular price for 1 rabies needle. Total invoice $56.44 paid by Universal Credit Card. After posting the transaction, change the To-Do date to Jan 08, 2024 in Mrs. Wright's memo file. Jan 7 The Ontario Lab Testing results for Your Actual First and Last Name pet arrived, Invoice #7763 in amount of $6.78 (lab test $6.00 and HST $.78). Record this invoice, terms n10. (Note: Charge 5345 Laboratory fees. Do NOT use lab item.) Jan 9 Your Actual First and Last Name brought in Salem and the vet informs her that the lab tests show Salem has an infection that requires antibiotic medication. Issue an invoice $62.09, for an office visit and one antibiotic medication paid by personal cheque #442. The vet informs Your Actual First and Last Name that a follow-up visit (at no charge) is required within 2 weeks to see if the medication has cleared the problem. Add a notation to Your Actual First and Last Name memo file: vet needs to see Salem on Jan 23, for a special office visit checkup) at no charge. Jan 11 Cheque #634 in the amount of $58.25 received from Mrs. Zia. Jan 11 Mr. Nathan brought his cat in for an office visit and checkup. The vet prescribed the flea medication plan. Invoice of $92.60 paid by personal cheque #813. Change the To-Do Date to Jan 11, 2024. Jan 11 Mr. Alexander brought his dog in as she was in a fight. The vet prescribed one antibiotic and one pain medication. Mr. Alexander receives a 10% seniors discount on office visits and paid with a Universal Credit Card. Invoice total $71.71. Mr. Alexander's follow-up visit is scheduled for Jan 18. 4 > Print the following reports: a) All Journal Entries Jan 1 to Jan 11 g Income Statement, year-to-date (Inventory & Services) Summary at Jan 11 (Inventory & Services) Quantity at Jan 11INVENTORY & SERVICES Module Setup and Transactions Review: G/L, A/P, A/R 8-493 Challenge Exercise 08 C8-3, Vet Services COMPANY, RECEIVABLES, PAYABLES, INVENTORY& SERVICES This exercise provides practice in recording transactions for a business that combines service revenue and sales of goods (to keep track of the quantity and cost of a company's inventory items). The data file for Vet Services has been set up to use the COMPANY, PAYABLES, RECEIVABLES and INVENTORY & SERVICES modules, 1 > Refer to Exercise 1-1b to unzip the 08 C8-3 Vet.exe file. 2 > Open the 08 C8-3 Vet file. Company Accounting Policies: Vet Services provides services for dogs and cats and is owned by Dr. Katherine DiGenova. Each client is charged for an office visit (0-1 Office Visit). Fiscal year is January 1 to December 31. The staff uses the memo tab record to include the name of the pet, breed name, sex, and other relevant information. Full payments from clients for goods and services are required after the veterinarian has seen the pet. A 10% discount will be given to seniors for office visits and lab tests. Seniors will pay regular prices for medication. The only senior client at this time is Mr. Jason Alexander. Cheques are issued when necessary for purchases of goods and services. Vendor purchase and/or service invoices are normally with terms of 2/10, n30 days, unless other information is provided. HST at 13% is used for all services. Tax code HS is set up as a default because most services and medications are sold with HST. The office does not use Purchase Orders. Ignore Shipped by field. Address information is not important. Universal Credit Card is accepted for services and medication. Occasionally clients do not have a credit card and cannot pay cash. One client, Mrs. Wakenna Zia, has an outstanding account. Inventory Summary Jan 01, 2023 Item No. Description Unit Price Quantity Cost Value Margin % Meds-1 Medicine Antibiotic Each 20.00 39 950.00 50.00 Meds-2 Medicine-pain Each 12.00 600.00 60.00 Meds-3 Flea Treatment plan Each 47.00 1.100.00 67.46 Meds-4 Rabies Needle Each 15.00 100 00 2.090.00 Vet Services Inventory Summary. 3> Advance the date on a daily basis after January 3, and record the following transactions. The Daily Business Manager has been set up to advise Katherine of clients who need to be contacted to bring their pets in for various reasons. Jan 3 Mrs. Helen Tyson brought her cat for an examination. The veterinarian examined the cat and prescribed one antibiotic medication, which was supplied by the vet. Mrs. Tyson paid the $62.09 invoice by Universal Credit Card