Question: After doing a complex amortization calculation to find the payment, we often will calculate how much interest a borrower pays over the life of the

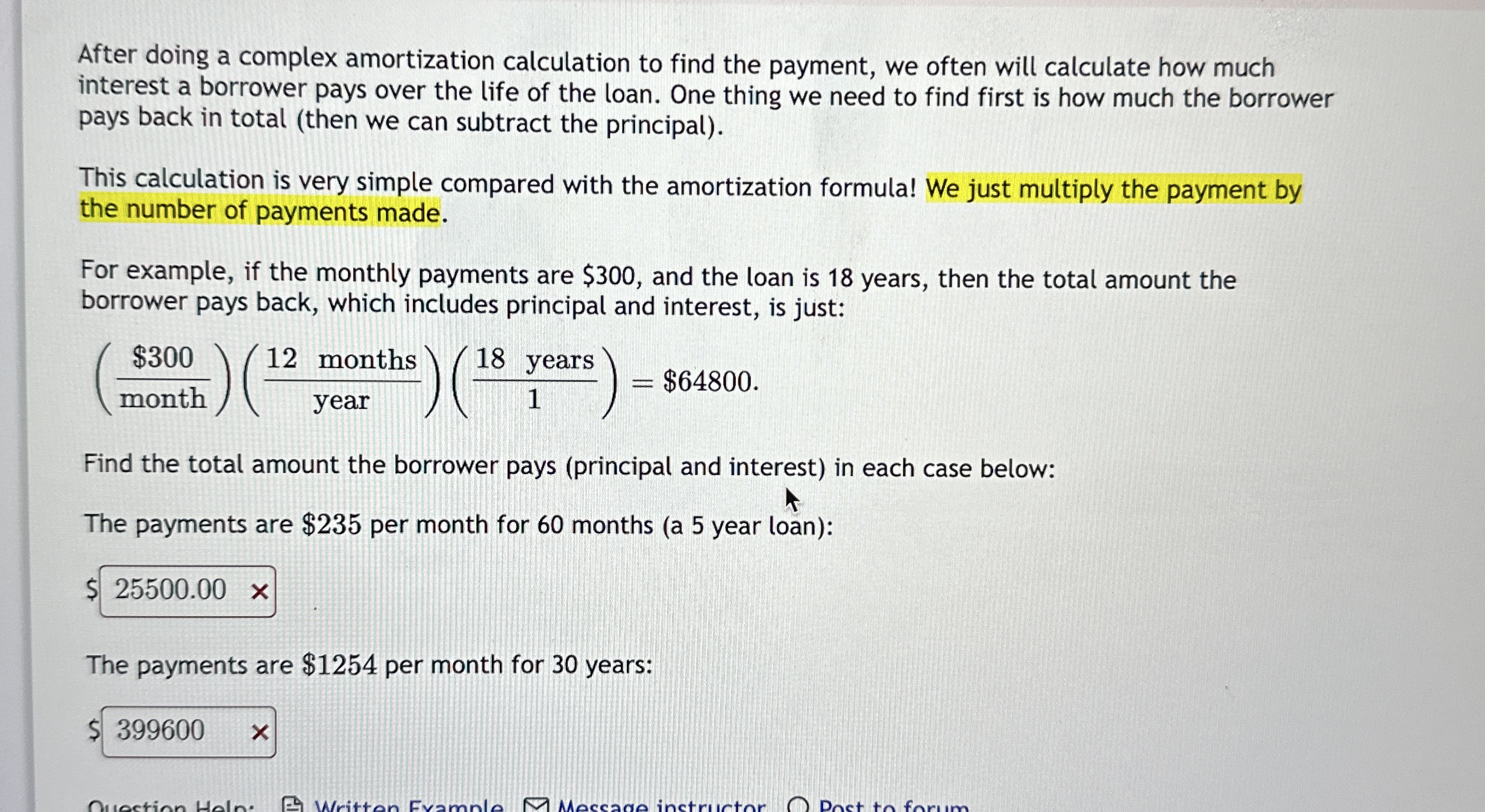

After doing a complex amortization calculation to find the payment, we often will calculate how much

interest a borrower pays over the life of the loan. One thing we need to find first is how much the borrower

pays back in total then we can subtract the principal

This calculation is very simple compared with the amortization formula! We just multiply the payment by

the number of payments made.

For example, if the monthly payments are $ and the loan is years, then the total amount the

borrower pays back, which includes principal and interest, is just:

$

Find the total amount the borrower pays principal and interest in each case below:

The payments are $ per month for months a year loan:

The payments are $ per month for years:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock