Question: After pay 5 milion for a feability study Goodwind wiote a proposal with the following cash flow estimates for a 10-year capital project Equipment Cost

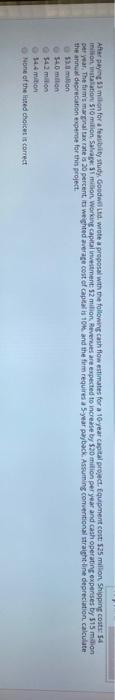

After pay 5 milion for a feability study Goodwind wiote a proposal with the following cash flow estimates for a 10-year capital project Equipment Cost 525 million Shipping costs: 14 million station 510 milion Salvage Simion, Working capital investment 52 million. Revenwes are expected to increase by $20 million per year and cash operating expenses by 515 min per year. The forms marginal tax rates 20 percent its weighted average cost of capital 10%, and the firm requires a year payback. Assuming conventional straight line depreciation calculate the annual deprecation expense for the project 53.0 millon Hiton 54.2 milion 14.4 min None of the listed choice is correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts