Question: after QUESTION 5. REQUIRED Study the information given below and answer the following questions: 5.1 Calculate the Payback Period of Project A (expressed in years,

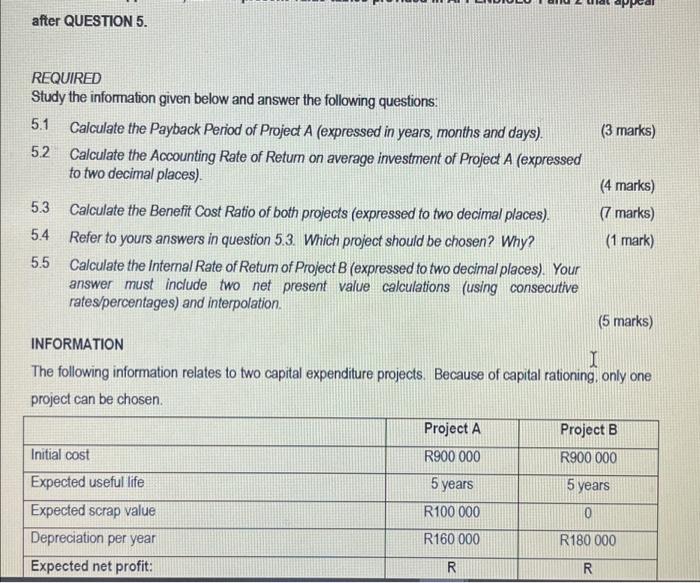

REQUIRED Study the information given below and answer the following questions: 5.1 Calculate the Payback Period of Project A (expressed in years, months and days). ( 3 marks) 5.2 Calculate the Accounting Rate of Retum on average investment of Project A (expressed to two decimal places). ( 4 marks) 5.3 Calculate the Benefit Cost Ratio of both projects (expressed to two decimal places). ( 7 marks) 5.4 Refer to yours answers in question 5.3. Which project should be chosen? Why? ( 1 mark) 5.5 Calculate the Intermal Rate of Retum of Project B (expressed to two decimal places). Your answer must include two net present value calculations (using consecutive rates/percentages) and interpolation. ( 5 marks) INFORMATION The following information relates to two capital expenditure projects. Because of capital rationing, only one project can be chosen

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts