Question: After reading Chapters 5 & 6, and understanding the concepts presented in Chapters, read the IB Strategic Insight on page 167 of the textbook. Based

After reading Chapters 5 & 6, and understanding the concepts presented in Chapters, read the IB Strategic Insight on page 167 of the textbook. Based on this and additional material presented in the chapters, discuss the effect of Sarbanes-Oxley on "managing in-stock Issues in the regulated US market".

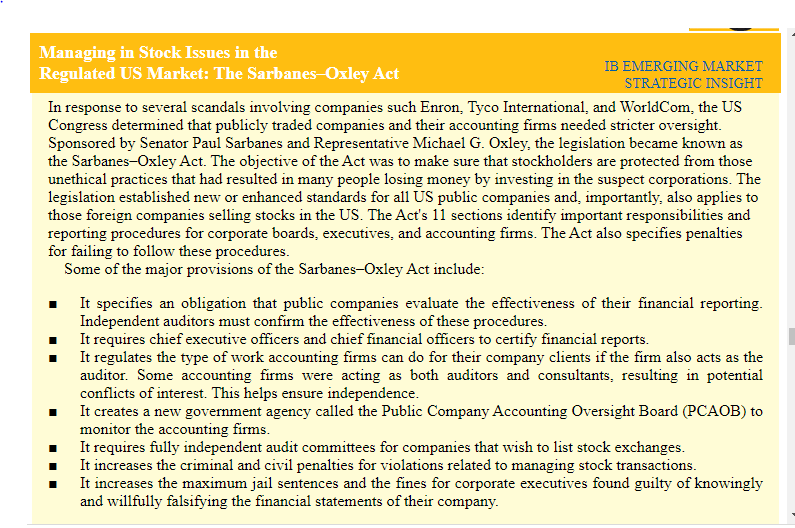

Regulated US Market: The Sarbanes-Oxley Act IB EMERGING MARKET STRATEGIC INSIGHT In response to several scandals involving companies such Enron, Tyco International, and WorldCom, the US Congress determined that publicly traded companies and their accounting firms needed stricter oversight. Sponsored by Senator Paul Sarbanes and Representative Michael G. Oxley, the legislation became known as the Sarbanes-Oxley Act. The objective of the Act was to make sure that stockholders are protected from those unethical practices that had resulted in many people losing money by investing in the suspect corporations. The legislation established new or enhanced standards for all US public companies and, importantly, also applies to those foreign companies selling stocks in the US. The Act's 11 sections identify important responsibilities and reporting procedures for corporate boards, executives, and accounting firms. The Act also specifies penalties for failing to follow these procedures. Some of the major provisions of the Sarbanes-Oxley Act include: It specifies an obligation that public companies evaluate the effectiveness of their financial reporting. Independent auditors must confirm the effectiveness of these procedures. It requires chief executive officers and chief financial officers to certify financial reports. It regulates the type of work accounting firms can do for their company clients if the firm also acts as the auditor. Some accounting firms were acting as both auditors and consultants, resulting in potential conflicts of interest. This helps ensure independence. It creates a new government agency called the Public Company Accounting Oversight Board (PCAOB) to monitor the accounting firms. It requires fully independent audit committees for companies that wish to list stock exchanges. It increases the criminal and civil penalties for violations related to managing stock transactions. It increases the maximum jail sentences and the fines for corporate executives found guilty of knowingly and willfully falsifying the financial statements of their company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts