Question: After reading the Broadridge Case post your thoughtful responses to the questions below. (for best results, put your salesperson hat on ) 1) Select at

After reading the Broadridge Case post your thoughtful responses to the questions below. (for best results, put your salesperson hat on )

1) Select at least three key buying influences and infer what their ratings would be based on case details or your intuition. (i.e. Buyer's Role, Response Mode, Degree of Influence, Receptivity Rating)

2) Do any key buying influences meet the criteria for a Coach? How might a Coach help Susanne in this complex sale?

3) What are the major elements of an Action Plan to win this deal from Susanne's perspective? She needs to show her sales manager that she has a set of actions to deal with Red Flags and to move this large opportunity through to completion. Be specific!

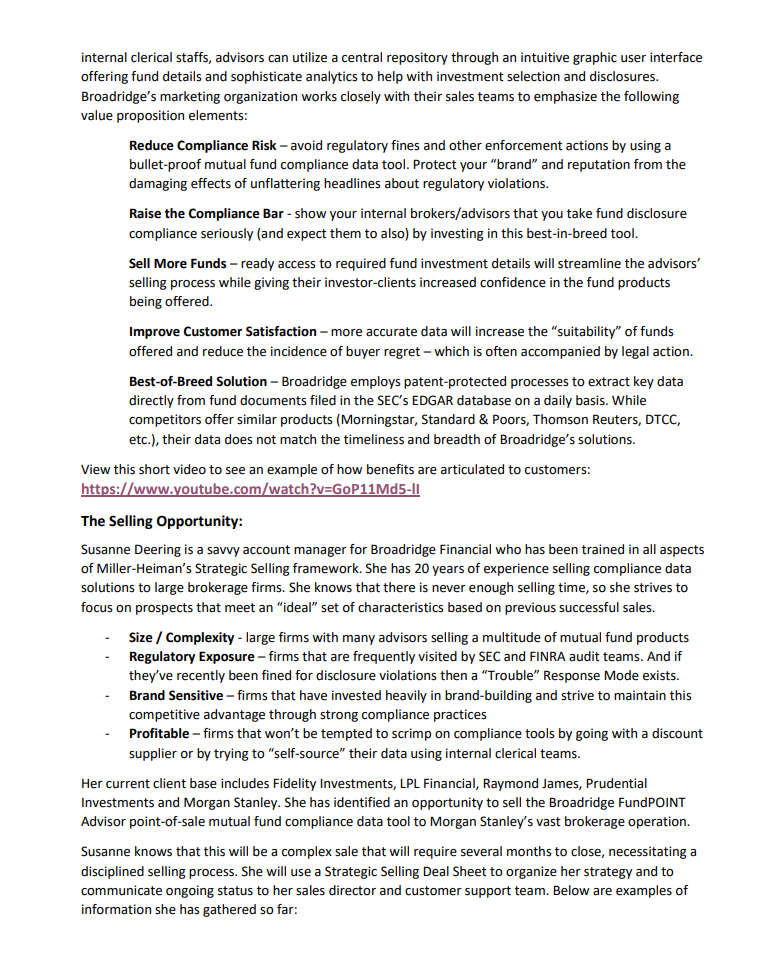

Broadridge Financial Solutions Case Selling Mutual Fund Compliance Tools - the Morgan Stanley Opportunity Seller: Broadridge Financial Solutions - a compliance data solutions provider to the Brokerage Industry Product: FundPOINT Advisor Desktop Point-of-Sale Tool Prospect: Morgan Stanley-one of the largest brokerage firms in the U.S. with over 10,000 advisors selling thousands of investment products Background: Brokerages are closely regulated by the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). Brokers are held to a particularly high standard of disclosure when selling mutual funds to investors. They must inform the investor/buyer of various aspects of a mutual fund that would determine how "suitable" it is given an individual investor's preferences for risk, fees, expense loads, liquidity, fund management tenure and investment objectives. (See addendum in this document for definitions and explanations about mutual funds and industry regulation.) Business Challenge for Brokerage firms: Failure to meet investor disclosure requirements exposes a brokerage to heavy fines from regulators, and possible legal action on the part of investors who contend that they were given inadequate or incorrect information about a mutual fund by their advisor. The challenge of obtaining, storing and disclosing correct information on ALL mutual funds is daunting. There are well over 40,000 variations of open-end mutual funds, and each one has hundreds of data points related to sales fees, expense loads, conflicts of interest, rights of accumulation, house-holding, fund manager tenure, investment objective, frequent trading rules and many other characteristics. In addition, brokerage firms may employ hundreds or thousands of individual advisors whose experience and knowledge about mutual funds varies widely. Yet, the stakes are high. In one recent enforcement action, many high profile brokerage firms were forced to pay a total of $125M pursuant to violations of disclosure requirements for conflict of interest situations. In this case, brokers channel investors into more expensive mutual funds that provide a "kick- back" commission to the seller (see attached article links). Despite the steady drumbeat of bad press and fines in the millions of dollars, most large brokerage firms still need to be convinced that their current method of gathering and maintaining mutual fund disclosure data is not adequate. They are loath to spend money on pricey compliance tools and data feeds and would rather focus their resources on sales and marketing investments. As a result, compliance solutions providers like Broadridge must craft compelling value propositions that can be effectively delivered by their sales team. The Product: Broadridge offers FundPOINT Advisor Desktop, a point-of-sale compliance tool that individual advisors can use to research details on all the mutual funds offered by their firm. Instead of thumbing through paper prospectus documents issued by the fund company or relying on haphazard collection of data by internal clerical staffs, advisors can utilize a central repository through an intuitive graphic user interface offering fund details and sophisticate analytics to help with investment selection and disclosures. Broadridge's marketing organization works closely with their sales teams to emphasize the following value proposition elements: Reduce Compliance Risk - avoid regulatory fines and other enforcement actions by using a bullet-proof mutual fund compliance data tool. Protect your "brand" and reputation from the damaging effects of unflattering headlines about regulatory violations. Raise the Compliance Bar - show your internal brokers/advisors that you take fund disclosure compliance seriously and expect them to also) by investing in this best-in-breed tool. Sell More Funds - ready access to required fund investment details will streamline the advisors' selling process while giving their investor-clients increased confidence in the fund products being offered. Improve Customer Satisfaction - more accurate data will increase the "suitability" of funds offered and reduce the incidence of buyer regret - which is often accompanied by legal action. Best-of-Breed Solution - Broadridge employs patent-protected processes to extract key data directly from fund documents filed in the SEC'S EDGAR database on a daily basis. While competitors offer similar products (Morningstar, Standard & Poors, Thomson Reuters, DTCC, etc.), their data does not match the timeliness and breadth of Broadridge's solutions. View this short video to see an example of how benefits are articulated to customers: https://www.youtube.com/watch?v=GoP11 Md5-11 The Selling Opportunity: Susanne Deering is a savvy account manager for Broadridge Financial who has been trained in all aspects of Miller-Heiman's Strategic Selling framework. She has 20 years of experience selling compliance data solutions to large brokerage firms. She knows that there is never enough selling time, so she strives to focus on prospects that meet an "ideal" set of characteristics based on previous successful sales. Size / Complexity - large firms with many advisors selling a multitude of mutual fund products Regulatory Exposure - firms that are frequently visited by SEC and FINRA audit teams. And if they've recently been fined for disclosure violations then a "Trouble" Response Mode exists. Brand Sensitive - firms that have invested heavily in brand-building and strive to maintain this competitive advantage through strong compliance practices Profitable - firms that won't be tempted to scrimp on compliance tools by going with a discount supplier or by trying to "self-source" their data using internal clerical teams. Her current client base includes Fidelity Investments, LPL Financial, Raymond James, Prudential Investments and Morgan Stanley. She has identified an opportunity to sell the Broadridge FundPOINT Advisor point-of-sale mutual fund compliance data tool to Morgan Stanley's vast brokerage operation. Susanne knows that this will be a complex sale that will require several months to close, necessitating a disciplined selling process. She will use a Strategic Selling Deal Sheet to organize her strategy and to communicate ongoing status to her sales director and customer support team. Below are examples of information she has gathered so far: Key Buying Influences for this purchase at Morgan Stanley: Degree of Influence Response Mode Receptivity Rating Role Name Carl Cashman Larry Lawyer Pilar Persuado Krishika kakarala Bonnie Bitmode Sam Sellerman Title CFO Chief Compliance Officer VP of Sales Chief Technology Officer Mgr. of Compliance Data Sales Manager Carl Cashman, CFO is a heavy hitter in this decision process. The price tag on this purchase will be $1.2 million and he is the only one authorized to sign off on that amount. hasn't seen Susanne's product demonstration yet, but feels this product is too pricey. He questions why increased vigilance among internal staffs wouldn't be sufficient to reduce Morgan Stanley's regulatory risk. Larry Lawyer, CCO is a trusted advisor to the Board of Directors on compliance issues. He has been suffering from recurring nightmares about his firm being audited by the SEC and found in violation of mutual fund trading rules. Several of his compliance peers at other Wall Street firms have had their careers ruined by failed audits, fines and damaging headlines resulting from poor mutual fund data. Pilar Persuado, VP of Sales is tired of having her sales team burdened by excessive compliance rules and procedures. She has very ambitious sales targets to reach this year and is pushing her team to sell mutual funds more aggressively. Pilar feels that existing disclosures and supporting data sources are more than adequate to balance sales with compliance. Krishika Kakarala, Chief Technology Officer is primarily concerned with specific aspects of any new IT product acquisition. She has very strict data security requirements to protect Morgan Stanley's internal systems from cyber threats and will veto any vendor's information products that fail to comply. Bonnie Bitmode, Manager of Compliance Data Operations reports to Krishika. Bonnie is much closer to the flaws and risks that exist with Morgan Stanley's current process for acquiring and disseminating key fund data elements to advisors. Mutual fund trades require costly reprocessing on a daily basis due to inaccurate sales charges and other fund features. She must work overtime to manually fix all the transactions that "kick out" due to bad data. She works closely with Sam Sellerman to reconcile them. Sam Sellerman, Mutual Fund Sales Manager, reports to Pilar Persuado. He is under intense pressure to drive sales growth through supervision of the mutual fund sales team. His advisors try hard to make compliant sales by locating accurate information on the many mutual funds in their brokerage offering but the current process is too manual and subject to mistakes. Sam eats ten rolls of Rolaids per day to deal with the stress of trying to improve his advisors' productivity in the face of daunting sales goals and ongoing compliance scrutiny. After participating in one of Susanne's demonstrations, he sees tremendous upside from acquiring the FundPOINT product. Corporate Results - Susanne knows that brokerage prospects will need to be convinced to purchase based on compelling quantifiable benefits. She uses a proprietary ROI model and data provided by Morgan Stanley to estimate the following outcomes: Cost savings from reduced risk of regulatory fines Increased revenues from more a productive advisor/sales team Lower processing costs for fund sales due to improved data accuracy Lower litigation cost from fewer lawsuits by unhappy investors Susanne calculates that this prospect will realize a 30% ROI on their investment in FundPOINT Advisor driven largely by productivity gains and increased revenues among their very large team of advisors. Personal Wins - Susanne knows that decisions like this are not determined solely on hard facts but can also be swayed by personal factors - the aspirations, perceived risks and apprehensions of key buyers. She plans to subtly address the underlying emotions of certain key buying influences by weaving the following themes into her interpersonal interactions: Larry Lawyer / Chief Compliance Officer - sleep better at night and strengthen career prospects by acquiring the industry's best mutual fund compliance solution Pilar Persuado / VP Sales - productivity gains in her sales team will boost revenue resulting in muito dinheiro at year end when performance bonuses are paid out $$$! Bonnie and Sam - they are both looking to make the jump to higher levels in their respective functions by being "change agents" who help their organization adopt a sophisticated compliance data solution. In large organizations like Morgan Stanley, middle managers often leverage consensus-building roles in major cross-functional initiatives to gain recognition. Red Flags - Susanne has yet to meet the CFO. In addition, their CTO, Krishika is raising about FundPOINT's internal security features, and will need to be convinced by members of Broadridge's technical product team that their system has earned the latest information security certifications. A third concern is that Morningstar, an entrenched competitor in the financial data space, has established a strong presence at Morgan Stanley with their mutual fund performance analytics and will most likely be bidding on this opportunity. Strengths to Leverage - Susanne will counter the threat from Morningstar by emphasizing and exemplifying FundPOINT's superior data accuracy deriving from a patent-protected process for daily extraction of prospectus filings in the SEC'S EDGAR database. She will also utilize customer testimonials from other brokerages where favorable Results (ROls, customer satisfaction, etc.) were realized from their investment in FundPOINT. What next? In preparation for a meeting with her sales manager, Susanne is updating her Single Sales Objective with her latest estimates of how much ($1.2 million), when (March) and what (FundPOINT desktop solution + implementation team support + training for 10,000 advisors + 1 year of free customer support). She is also assessing each key buying influence for Role (Economic, Technical, User & Coach), Degree of Influence (H,M,L) and Response Mode (Growth, Trouble, Even Keel or Overconfident). She wants to have an Action Plan prepared for her manager that addresses existing Red Flags and identifies specific "next steps" to move this deal to closure. These need to be time-specific and show ownership on her part ("I will..." not "we should..."). Broadridge Financial Solutions Case Selling Mutual Fund Compliance Tools - the Morgan Stanley Opportunity Seller: Broadridge Financial Solutions - a compliance data solutions provider to the Brokerage Industry Product: FundPOINT Advisor Desktop Point-of-Sale Tool Prospect: Morgan Stanley-one of the largest brokerage firms in the U.S. with over 10,000 advisors selling thousands of investment products Background: Brokerages are closely regulated by the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). Brokers are held to a particularly high standard of disclosure when selling mutual funds to investors. They must inform the investor/buyer of various aspects of a mutual fund that would determine how "suitable" it is given an individual investor's preferences for risk, fees, expense loads, liquidity, fund management tenure and investment objectives. (See addendum in this document for definitions and explanations about mutual funds and industry regulation.) Business Challenge for Brokerage firms: Failure to meet investor disclosure requirements exposes a brokerage to heavy fines from regulators, and possible legal action on the part of investors who contend that they were given inadequate or incorrect information about a mutual fund by their advisor. The challenge of obtaining, storing and disclosing correct information on ALL mutual funds is daunting. There are well over 40,000 variations of open-end mutual funds, and each one has hundreds of data points related to sales fees, expense loads, conflicts of interest, rights of accumulation, house-holding, fund manager tenure, investment objective, frequent trading rules and many other characteristics. In addition, brokerage firms may employ hundreds or thousands of individual advisors whose experience and knowledge about mutual funds varies widely. Yet, the stakes are high. In one recent enforcement action, many high profile brokerage firms were forced to pay a total of $125M pursuant to violations of disclosure requirements for conflict of interest situations. In this case, brokers channel investors into more expensive mutual funds that provide a "kick- back" commission to the seller (see attached article links). Despite the steady drumbeat of bad press and fines in the millions of dollars, most large brokerage firms still need to be convinced that their current method of gathering and maintaining mutual fund disclosure data is not adequate. They are loath to spend money on pricey compliance tools and data feeds and would rather focus their resources on sales and marketing investments. As a result, compliance solutions providers like Broadridge must craft compelling value propositions that can be effectively delivered by their sales team. The Product: Broadridge offers FundPOINT Advisor Desktop, a point-of-sale compliance tool that individual advisors can use to research details on all the mutual funds offered by their firm. Instead of thumbing through paper prospectus documents issued by the fund company or relying on haphazard collection of data by internal clerical staffs, advisors can utilize a central repository through an intuitive graphic user interface offering fund details and sophisticate analytics to help with investment selection and disclosures. Broadridge's marketing organization works closely with their sales teams to emphasize the following value proposition elements: Reduce Compliance Risk - avoid regulatory fines and other enforcement actions by using a bullet-proof mutual fund compliance data tool. Protect your "brand" and reputation from the damaging effects of unflattering headlines about regulatory violations. Raise the Compliance Bar - show your internal brokers/advisors that you take fund disclosure compliance seriously and expect them to also) by investing in this best-in-breed tool. Sell More Funds - ready access to required fund investment details will streamline the advisors' selling process while giving their investor-clients increased confidence in the fund products being offered. Improve Customer Satisfaction - more accurate data will increase the "suitability" of funds offered and reduce the incidence of buyer regret - which is often accompanied by legal action. Best-of-Breed Solution - Broadridge employs patent-protected processes to extract key data directly from fund documents filed in the SEC'S EDGAR database on a daily basis. While competitors offer similar products (Morningstar, Standard & Poors, Thomson Reuters, DTCC, etc.), their data does not match the timeliness and breadth of Broadridge's solutions. View this short video to see an example of how benefits are articulated to customers: https://www.youtube.com/watch?v=GoP11 Md5-11 The Selling Opportunity: Susanne Deering is a savvy account manager for Broadridge Financial who has been trained in all aspects of Miller-Heiman's Strategic Selling framework. She has 20 years of experience selling compliance data solutions to large brokerage firms. She knows that there is never enough selling time, so she strives to focus on prospects that meet an "ideal" set of characteristics based on previous successful sales. Size / Complexity - large firms with many advisors selling a multitude of mutual fund products Regulatory Exposure - firms that are frequently visited by SEC and FINRA audit teams. And if they've recently been fined for disclosure violations then a "Trouble" Response Mode exists. Brand Sensitive - firms that have invested heavily in brand-building and strive to maintain this competitive advantage through strong compliance practices Profitable - firms that won't be tempted to scrimp on compliance tools by going with a discount supplier or by trying to "self-source" their data using internal clerical teams. Her current client base includes Fidelity Investments, LPL Financial, Raymond James, Prudential Investments and Morgan Stanley. She has identified an opportunity to sell the Broadridge FundPOINT Advisor point-of-sale mutual fund compliance data tool to Morgan Stanley's vast brokerage operation. Susanne knows that this will be a complex sale that will require several months to close, necessitating a disciplined selling process. She will use a Strategic Selling Deal Sheet to organize her strategy and to communicate ongoing status to her sales director and customer support team. Below are examples of information she has gathered so far: Key Buying Influences for this purchase at Morgan Stanley: Degree of Influence Response Mode Receptivity Rating Role Name Carl Cashman Larry Lawyer Pilar Persuado Krishika kakarala Bonnie Bitmode Sam Sellerman Title CFO Chief Compliance Officer VP of Sales Chief Technology Officer Mgr. of Compliance Data Sales Manager Carl Cashman, CFO is a heavy hitter in this decision process. The price tag on this purchase will be $1.2 million and he is the only one authorized to sign off on that amount. hasn't seen Susanne's product demonstration yet, but feels this product is too pricey. He questions why increased vigilance among internal staffs wouldn't be sufficient to reduce Morgan Stanley's regulatory risk. Larry Lawyer, CCO is a trusted advisor to the Board of Directors on compliance issues. He has been suffering from recurring nightmares about his firm being audited by the SEC and found in violation of mutual fund trading rules. Several of his compliance peers at other Wall Street firms have had their careers ruined by failed audits, fines and damaging headlines resulting from poor mutual fund data. Pilar Persuado, VP of Sales is tired of having her sales team burdened by excessive compliance rules and procedures. She has very ambitious sales targets to reach this year and is pushing her team to sell mutual funds more aggressively. Pilar feels that existing disclosures and supporting data sources are more than adequate to balance sales with compliance. Krishika Kakarala, Chief Technology Officer is primarily concerned with specific aspects of any new IT product acquisition. She has very strict data security requirements to protect Morgan Stanley's internal systems from cyber threats and will veto any vendor's information products that fail to comply. Bonnie Bitmode, Manager of Compliance Data Operations reports to Krishika. Bonnie is much closer to the flaws and risks that exist with Morgan Stanley's current process for acquiring and disseminating key fund data elements to advisors. Mutual fund trades require costly reprocessing on a daily basis due to inaccurate sales charges and other fund features. She must work overtime to manually fix all the transactions that "kick out" due to bad data. She works closely with Sam Sellerman to reconcile them. Sam Sellerman, Mutual Fund Sales Manager, reports to Pilar Persuado. He is under intense pressure to drive sales growth through supervision of the mutual fund sales team. His advisors try hard to make compliant sales by locating accurate information on the many mutual funds in their brokerage offering but the current process is too manual and subject to mistakes. Sam eats ten rolls of Rolaids per day to deal with the stress of trying to improve his advisors' productivity in the face of daunting sales goals and ongoing compliance scrutiny. After participating in one of Susanne's demonstrations, he sees tremendous upside from acquiring the FundPOINT product. Corporate Results - Susanne knows that brokerage prospects will need to be convinced to purchase based on compelling quantifiable benefits. She uses a proprietary ROI model and data provided by Morgan Stanley to estimate the following outcomes: Cost savings from reduced risk of regulatory fines Increased revenues from more a productive advisor/sales team Lower processing costs for fund sales due to improved data accuracy Lower litigation cost from fewer lawsuits by unhappy investors Susanne calculates that this prospect will realize a 30% ROI on their investment in FundPOINT Advisor driven largely by productivity gains and increased revenues among their very large team of advisors. Personal Wins - Susanne knows that decisions like this are not determined solely on hard facts but can also be swayed by personal factors - the aspirations, perceived risks and apprehensions of key buyers. She plans to subtly address the underlying emotions of certain key buying influences by weaving the following themes into her interpersonal interactions: Larry Lawyer / Chief Compliance Officer - sleep better at night and strengthen career prospects by acquiring the industry's best mutual fund compliance solution Pilar Persuado / VP Sales - productivity gains in her sales team will boost revenue resulting in muito dinheiro at year end when performance bonuses are paid out $$$! Bonnie and Sam - they are both looking to make the jump to higher levels in their respective functions by being "change agents" who help their organization adopt a sophisticated compliance data solution. In large organizations like Morgan Stanley, middle managers often leverage consensus-building roles in major cross-functional initiatives to gain recognition. Red Flags - Susanne has yet to meet the CFO. In addition, their CTO, Krishika is raising about FundPOINT's internal security features, and will need to be convinced by members of Broadridge's technical product team that their system has earned the latest information security certifications. A third concern is that Morningstar, an entrenched competitor in the financial data space, has established a strong presence at Morgan Stanley with their mutual fund performance analytics and will most likely be bidding on this opportunity. Strengths to Leverage - Susanne will counter the threat from Morningstar by emphasizing and exemplifying FundPOINT's superior data accuracy deriving from a patent-protected process for daily extraction of prospectus filings in the SEC'S EDGAR database. She will also utilize customer testimonials from other brokerages where favorable Results (ROls, customer satisfaction, etc.) were realized from their investment in FundPOINT. What next? In preparation for a meeting with her sales manager, Susanne is updating her Single Sales Objective with her latest estimates of how much ($1.2 million), when (March) and what (FundPOINT desktop solution + implementation team support + training for 10,000 advisors + 1 year of free customer support). She is also assessing each key buying influence for Role (Economic, Technical, User & Coach), Degree of Influence (H,M,L) and Response Mode (Growth, Trouble, Even Keel or Overconfident). She wants to have an Action Plan prepared for her manager that addresses existing Red Flags and identifies specific "next steps" to move this deal to closure. These need to be time-specific and show ownership on her part ("I will..." not "we should...")Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts