Question: After reading the facts below, use the dropdown options to calculate basis. Be sure to use the correct ordering rules for calculating basis as an

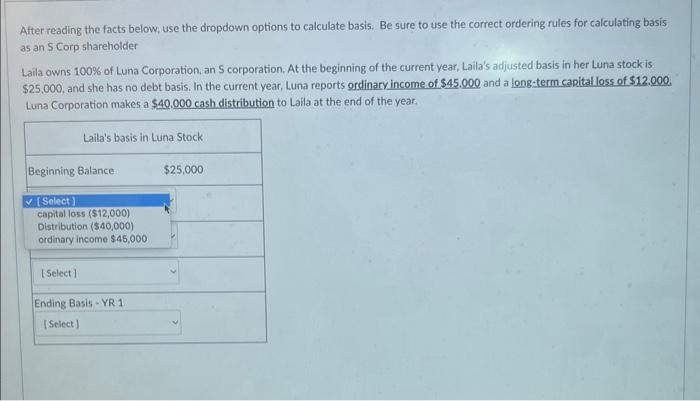

After reading the facts below, use the dropdown options to calculate basis. Be sure to use the correct ordering rules for calculating basis as an 5 corp shareholder Laila owns 100% of Luna Corporation, an S corporation. At the beginning of the current year, Laila's adjusted basis in her Luna stock is $25,000, and she has no debt basis. In the current year, Luna reports ordinary income of $45.000 and a long.term capital loss. of $12.000. Luna Corporation makes a $40,000 cash distribution to Laila at the end of the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts