Question: You are an audit staff for Toma and Greenburg LLP and you are assigned to the audit of Kamavaki Corporation's payables accounts. Kamayaki has

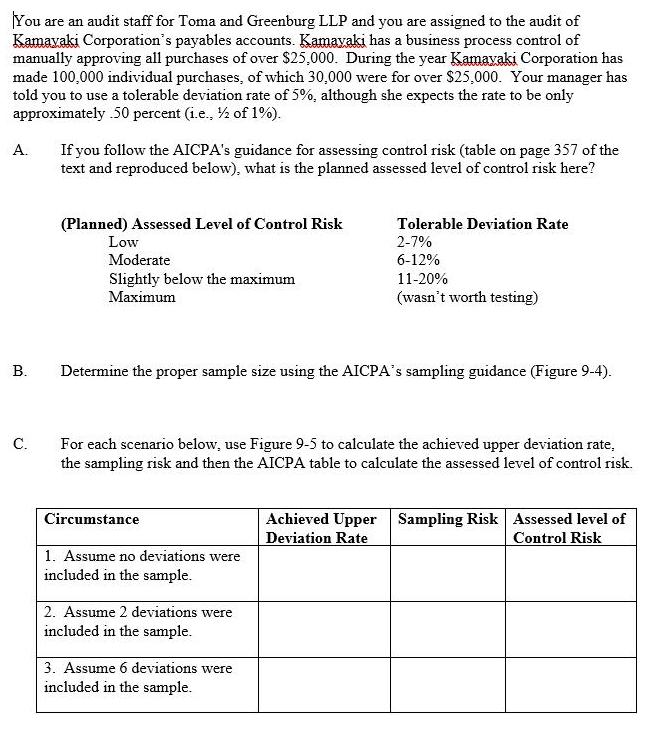

You are an audit staff for Toma and Greenburg LLP and you are assigned to the audit of Kamavaki Corporation's payables accounts. Kamayaki has a business process control of manually approving all purchases of over $25,000. During the year Kamavaki Corporation has made 100,000 individual purchases, of which 30,000 were for over $25,000. Your manager has told you to use a tolerable deviation rate of 5%, although she expects the rate to be only approximately .50 percent (i.e., of 1%). . If you follow the AICPA's guidance for assessing control risk (table on page 357 of the text and reproduced below), what is the planned assessed level of control risk here? (Planned) Assessed Level of Control Risk Tolerable Deviation Rate Low 2-7% Moderate 6-12% Slightly below the maximum Maximum 11-20% (wasn't worth testing) . Determine the proper sample size using the AICPA's sampling guidance (Figure 9-4). . For each scenario below, use Figure 9-5 to calculate the achieved upper deviation rate, the sampling risk and then the AICPA table to calculate the assessed level of control risk. Achieved Upper Sampling Risk Assessed level of Deviation Rate Circumstance Control Risk 1. Assume no deviations were included in the sample. 2. Assume 2 deviations were included in the sample. 3. Assume 6 deviations were included in the sample.

Step by Step Solution

3.33 Rating (159 Votes )

There are 3 Steps involved in it

Audit control is the process of assuring companies aims and objectives are achieved in functional ef... View full answer

Get step-by-step solutions from verified subject matter experts