Question: After reading this chapter, it isn't surprising that you're becoming an investment wizard. With your newfound expertise you purchase 100 shares of KSU Corporation 550

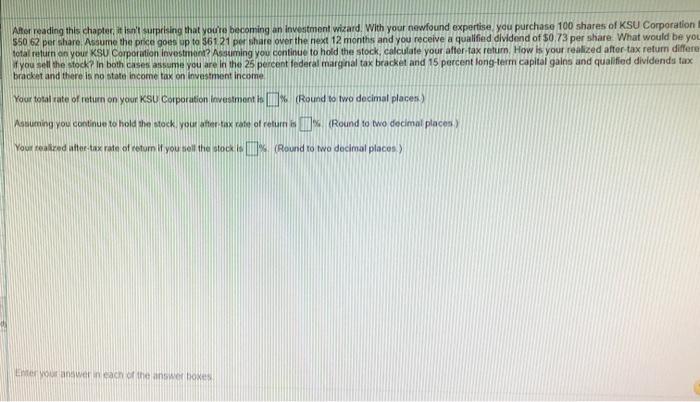

After reading this chapter, it isn't surprising that you're becoming an investment wizard. With your newfound expertise you purchase 100 shares of KSU Corporation 550 62 per share. Assume the price goes up to 36121 per share over the next 12 months and you receive a qualified dividend of $0.73 per share. What would be you total return on your KSU Corporation Investment? Assuming you continue to hold the stock, calculate your after-tax retum. How is your realized after tax retur differe Myou sell the stock in both cases assume you are in the 25 percent federal marginal tax bracket and 15 percent long-term capital gains and qualified dividends tax bracket and there is no state income tax on Investment income Your total rate of return on your KSU Corporation investment is 1 (Round to two decimal places) Asnutning you continue to hold the stock vout after tax rate of return 1% Round to two decimal places Ds (Round to wo decimal places) You realized after tax rate of retum If you sell the stock is Enter your answer in each of the answer boxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts