Question: after steps to work this out based on this being the only info given on second page. i understand the process but i keep getting

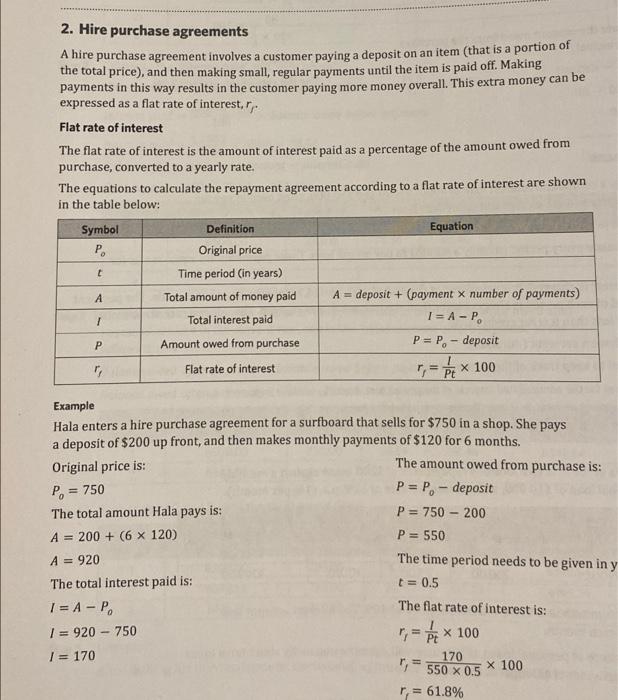

is higher? Mei has entered a hire purchase agreement to buy a road bike, normally valued at $2500. She pays a on deposit of $750, and makes monthly payments of $320. If the flat interest rate on the bike is 6.8%, how many payments does the agreement last for? 2. Hire purchase agreements A hire purchase agreement involves a customer paying a deposit on an item (that is a portion of the total price), and then making small, regular payments until the item is paid off. Making payments in this way results in the customer paying more money overall. This extra money can be expressed as a flat rate of interest, r,. Flat rate of interest The flat rate of interest is the amount of interest paid as a percentage of the amount owed from purchase, converted to a yearly rate. The equations to calculate the repayment agreement according to a flat rate of interest are shown in the table below: Symbol Definition Equation Original price t Time period (in years) A Total amount of money paid A = deposit + (payment x number of payments) I = A - P I Total interest paid P Amount owed from purchase P= P,- deposit Flat rate of interest = x 100 Example Hala enters a hire purchase agreement for a surfboard that sells for $750 in a shop. She pays a deposit of $200 up front, and then makes monthly payments of $120 for 6 months. Original price is: The amount owed from purchase is: Po = 750 P= P, - deposit The total amount Hala pays is: P=750-200 A = 200+ (6 x 120) P = 550 A = 920 The time period needs to be given in y The total interest paid is: t = 0.5 1 = A - Po The flat rate of interest is: 1=920- 750 r= x 100 / = 170 170 = 550 x 0.5 x 100 r,= 61.8%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts