Question: After your team has provided their input on the effect the acquisition will have on their department, perform an overall analysis to explain your recommendation

After your team has provided their input on the effect the acquisition will have on their department, perform an overall analysis to explain your recommendation to the CEO. Your analysis should include the following:

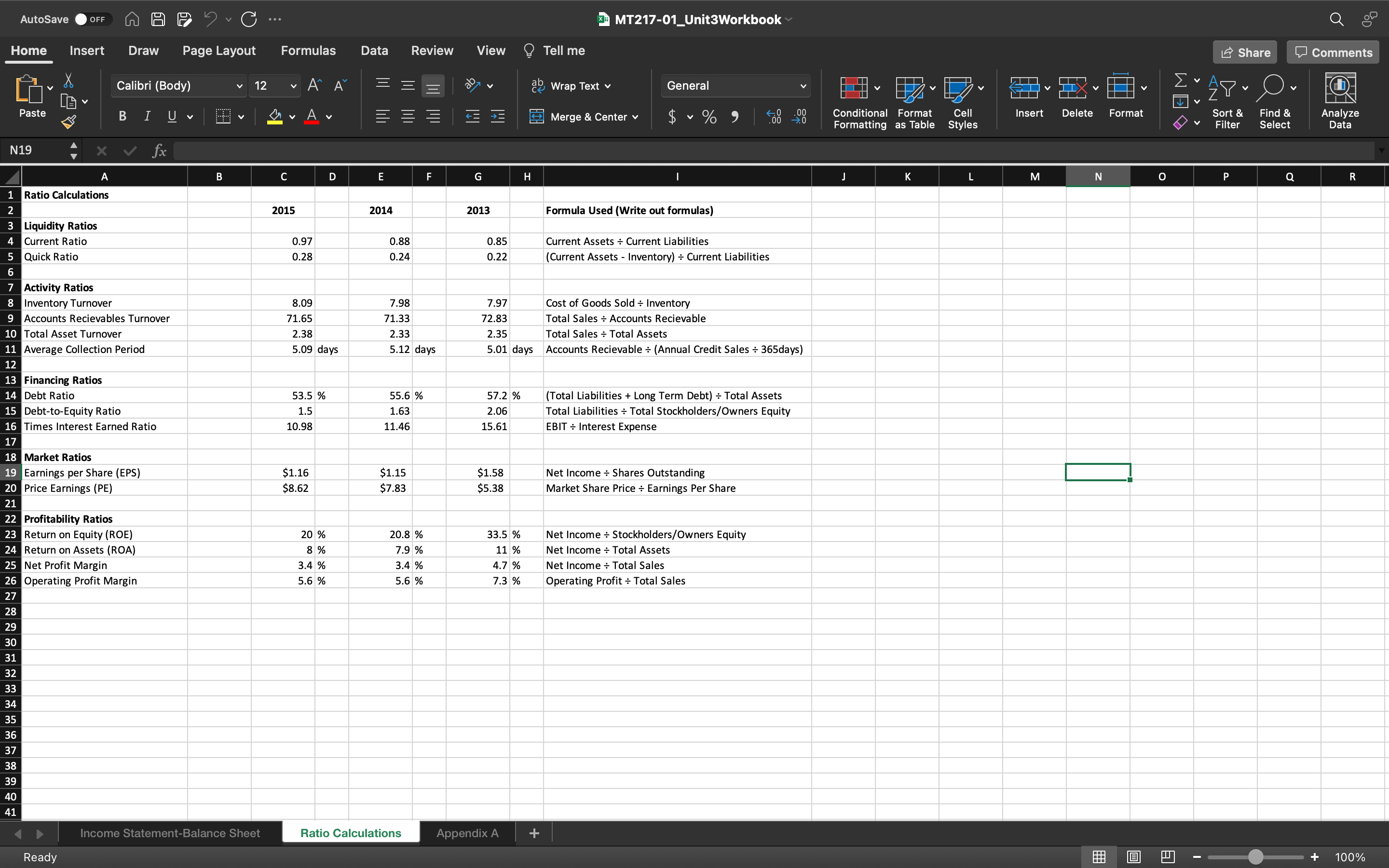

- Explain how the company is trending based on the year-over-year ratios.

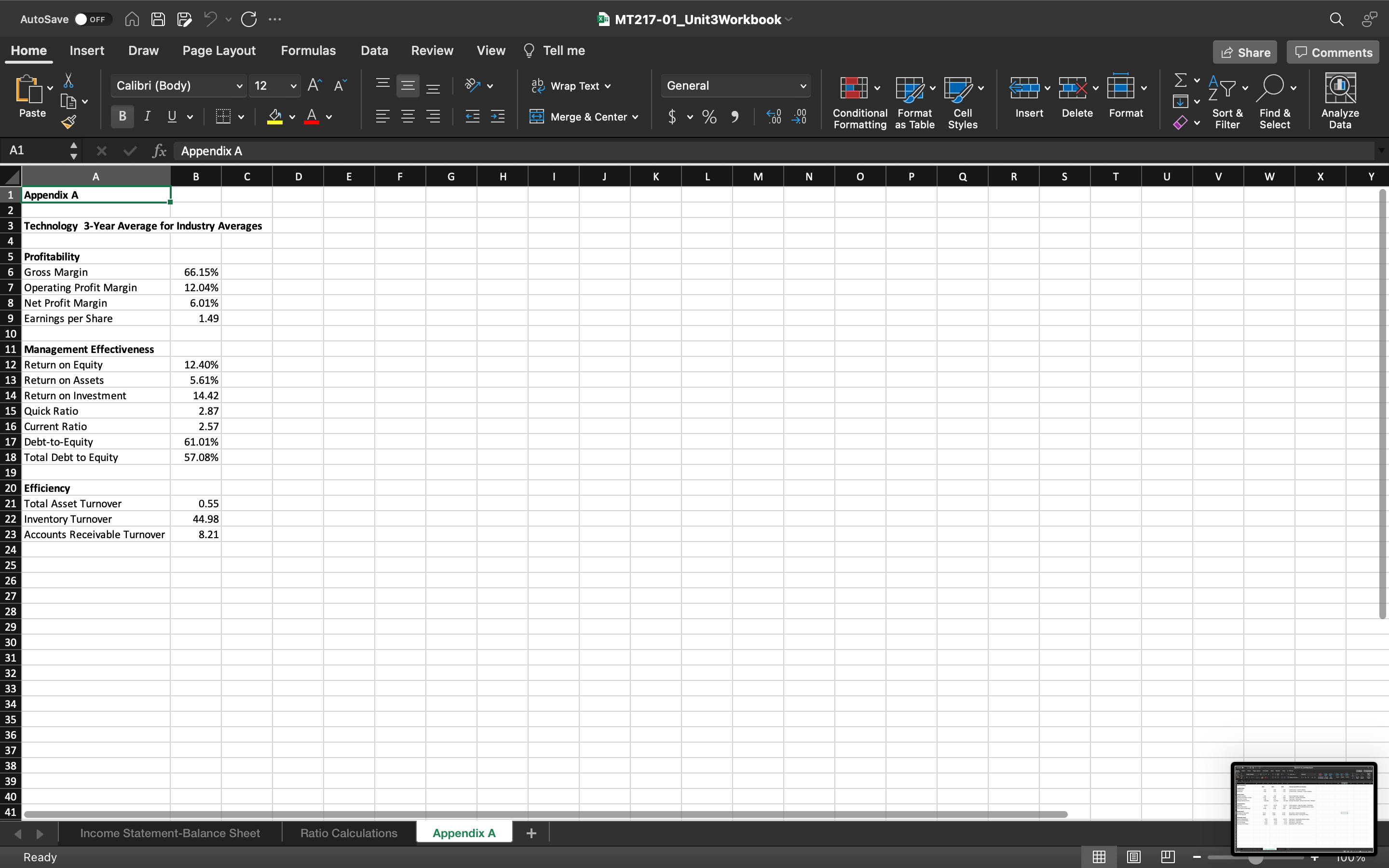

- Compare the company to the industry average in Appendix A in the Excel workbook in areas of profitability, management effectiveness, and efficiency.

- Based on the above, summarize the pros and cons of ABC Company using both the year-over-year ratio analysis from Part 1 and the industry average comparisons from Part 3.

- Provide the team's final recommendation as to whether or not the CEO should invest in ABC Company.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts