Question: PLEASE HELP, I am currently working with a team that will not help me with anything. I have currently done the whole 2 first parts

PLEASE HELP, I am currently working with a team that will not help me with anything. I have currently done the whole 2 first parts by myself. Any or all parts of this question would be greatly appreciated.

PART 3: After your team has provided their input on the effect the acquisition will have on their department, perform an overall analysis to explain your recommendation to the CEO. Your analysis should include the following:

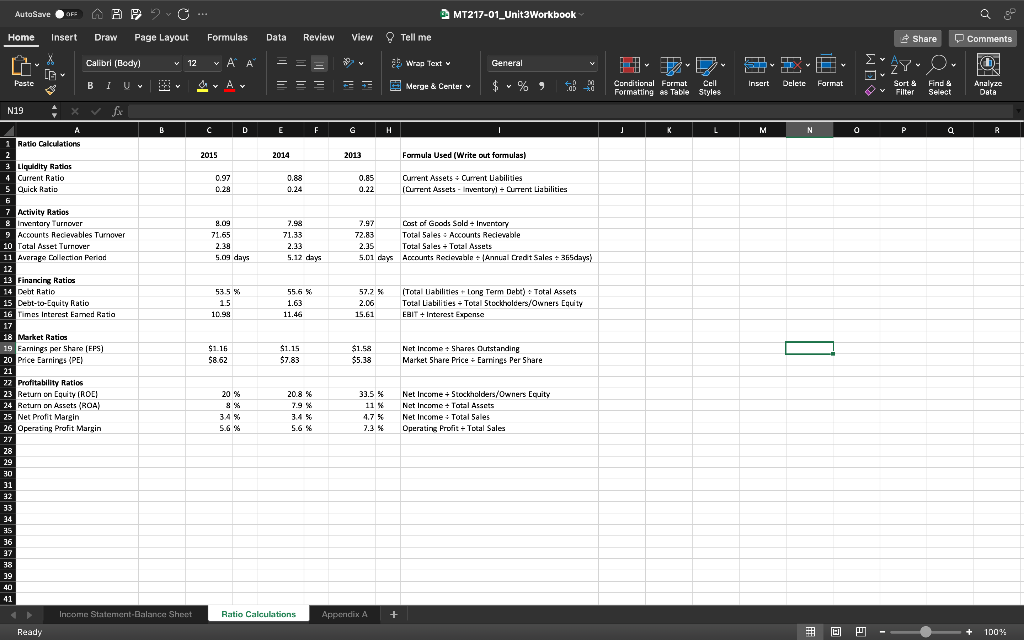

- Explain how the company is trending based on the year-over-year ratios.

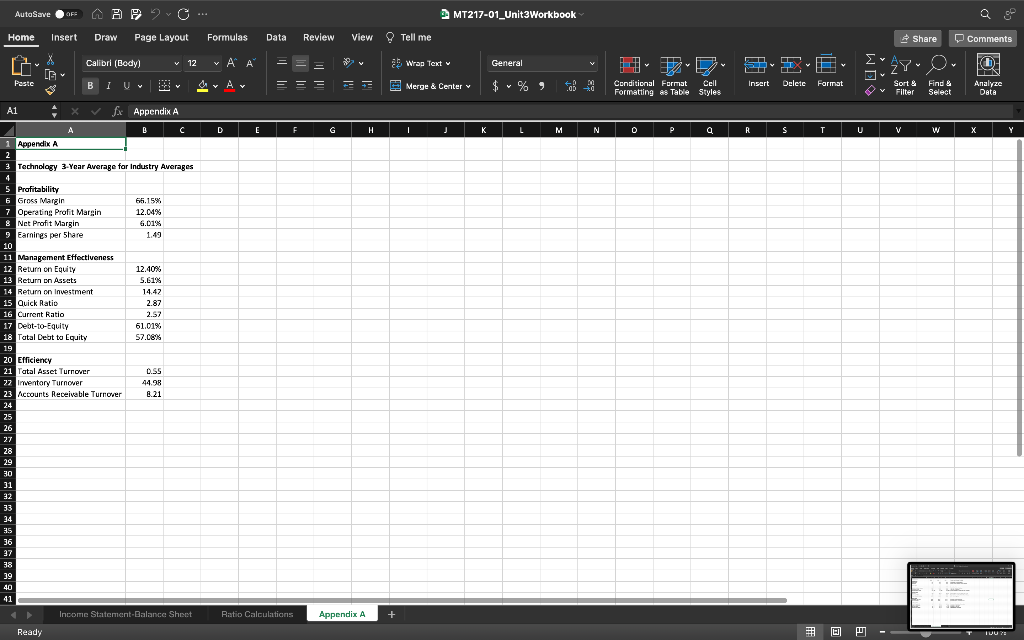

- Compare the company to the industry average in Appendix A in the Excel workbook in areas of profitability, management effectiveness, and efficiency.

- Based on the above, summarize the pros and cons of ABC Company using both the year-over-year ratio analysis from Part 1 and the industry average comparisons from Part 3.

- Provide the teams final recommendation as to whether or not the CEO should invest in ABC Company.

AutoSave OF C... MT217-01_Unit 3 Workbook Home Insert Draw Page Layout Formulas Data Review View Tell me Share 0 Comments Calibri (Body) v 12 v A A ab Wrap Text General X G AYO v FD) IN Analyze Data Paste I U ar A, Av Y = = = Y Merge & Center Insert Delete $ - % Format Conditional Format Cell Formatting es Table Styles V Sort & Filter Find & Select C D E E F . J M M N 0 P a R 2015 2014 2013 Formula Used (Write out formulas) 0.97 0.29 0.88 0.24 0.85 0.22 Current Assets - Current Liabilities (Current Assets - Inventoryl - Current Liabilities 2.09 71.65 2.39 5.09 days 7.98 71.33 2.33 5.12 days 7.97 Cost of Goods Sald Inventory 72.83 Total Sales : Accounts Recievable 2.35 Total Sales + Total Assets 5.01 days Accounts Recievable - Annual Credit Sales + 365days) 53.5 % 1.5 10.98 55.6 % 1.63 11.46 57.2 K 2.06 15.61 (Total liabilities + long Term Debt) - Total Assets Total Liabilities - Total Stockholders/Owners Equity EBIT + Interest Expense $1.16 $8.62 $1.15 $7.83 $1.58 $5.38 Net Income Shares Outstanding Market Share Price - Earrines Per Share 5 N19 fx A B 1 Ratio Calculations 2 3 Liquidity Ratlas 4 Current Ratio 5 Quick Ratio 6 7 Activity Ratios & Inventary Turnover 9 Accounts Recievables Tumover 10 Total Asset Turnover 11 Average Collection Period 12 13 Financing Ratios 14 Debt Ratio 15 Debt-to-Equity Ratio 16 Times Interest Eamed Ratio 17 18 Market Ration 19 Earnings per Share (EPS) 20 Price Earnings (PE) 21 22 Profitability Ratios 23 Return on Equity (ROC) 24 Return on Assets (ROA) 25 Net Profit Margin 26 Operating Profit Margin 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 Income Statement-Balance Sheet Ready 20 % % 8 % 34% 5.6 % 20.8 % 7.9 % 3.4 % 5.6 % 33.5 % 11 4.7 % 7.3% Net Income + Stockholders/Owners Equity Net Income + Total Assets Net Income: Total Sales Operating Prolit - Total Sales Ratio Calculations Appendix A + 5 CP + 100% AutoSave OF AP C... MT217-01_Unit 3 Workbook Home Insert Draw Page Layout Formulas Data Review View Tell me Share 0 Comments Callbel (Body) v 12 ~ A ab Wrap Text General X G AY: 0 v Pastc BIU FD) IN Analyze Data ~ Ar YA = = = Merge & Center Insert Delete Conditional Format Cell Formatting es Table Styles Y Format Sort & v Filter Find & Select A1 fx Appendix A A B C D E F G H I J K L M N 0 a R S T U V W Y 1 Appendix A 2 3 Technology 3-Year Average for Industry Averages 4 5 Profitability 6 Gross Margin 66.15% Operating Prolit Margin 12.04% & Net Profit Margin 6.01% 9 Earnings per Share 1.49 10 11 Management Effectiveness 12 Return on Equity 12.10% 13 Return on Assets 5.61% 14 Return on Investment 14.42 15 Quick Ratio 2.87 16 Current Ratio 2.57 17 Debt-to-Equity 61.01% 18 Total Debt to Equity 57.08% 19 20 Efficiency 21 Tatal Asset Turnover D.SS 22 Inventory Turnover 44.98 23 Accounts Receivable Turnover . 8.21 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 LETTER Income Statement-Balance Sheet Ratio Calculations Appendix A + Ready TUU

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts