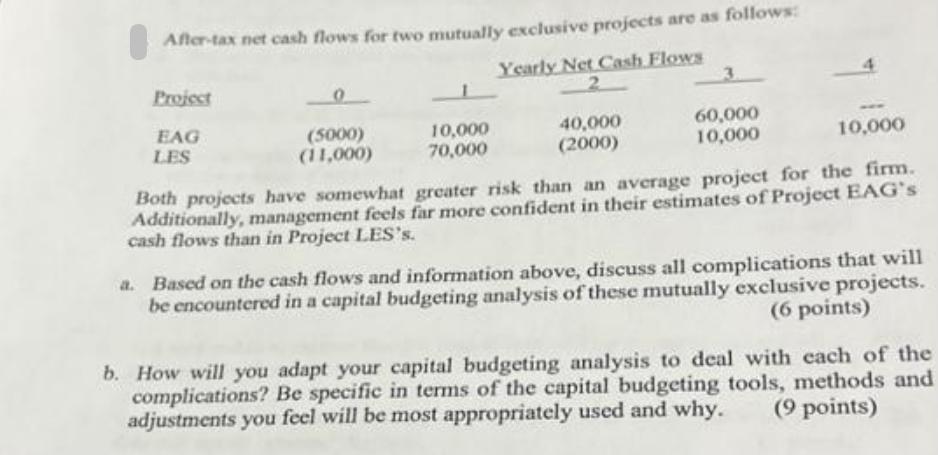

Question: After-tax net cash flows for two mutually exclusive projects are as follows: Yearly Net Cash Flows 2 Project EAG LES (5000) (11,000) 10,000 70,000

After-tax net cash flows for two mutually exclusive projects are as follows: Yearly Net Cash Flows 2 Project EAG LES (5000) (11,000) 10,000 70,000 40,000 (2000) 3 60,000 10,000 10,000 Both projects have somewhat greater risk than an average project for the firm. Additionally, management feels far more confident in their estimates of Project EAG's cash flows than in Project LES's. a. Based on the cash flows and information above, discuss all complications that will be encountered in a capital budgeting analysis of these mutually exclusive projects. (6 points) b. How will you adapt your capital budgeting analysis to deal with each of the complications? Be specific in terms of the capital budgeting tools, methods and (9 points) adjustments you feel will be most appropriately used and why.

Step by Step Solution

3.43 Rating (153 Votes )

There are 3 Steps involved in it

a Complications in Capital Budgeting Analysis 1 Unequal Cash Flow Timing The cash flows for both projects occur at different time periods Project EAG has cash flows in years 2 3 and 4 while Project LE... View full answer

Get step-by-step solutions from verified subject matter experts