Question: Crane Sporting is a listed company in New York. Its current before-interest, after-tax operating cash flow is $200 million. The cash flows are expected

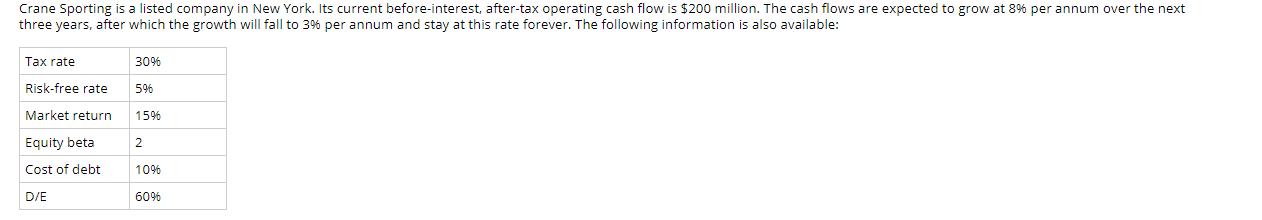

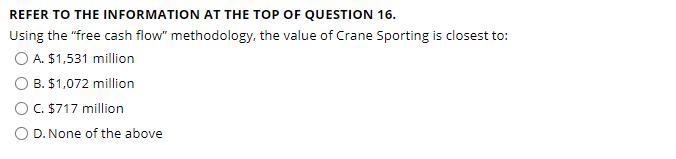

Crane Sporting is a listed company in New York. Its current before-interest, after-tax operating cash flow is $200 million. The cash flows are expected to grow at 8% per annum over the next three years, after which the growth will fall to 3% per annum and stay at this rate forever. The following information is also available: Tax rate Risk-free rate Market return Equity beta Cost of debt D/E 30% 5% 15% 2 10% 60% REFER TO THE INFORMATION AT THE TOP OF QUESTION 16. Using the "free cash flow" methodology, the value of Crane Sporting is closest to: O A. $1,531 million O B. $1,072 million C. $717 million D. None of the above

Step by Step Solution

3.54 Rating (157 Votes )

There are 3 Steps involved in it

Wd Weight of Debt x We Weight of Equity 1x Debt Equity 60 x 1x 60 16 x 06 x 0375 1x 0625 rd Cost of ... View full answer

Get step-by-step solutions from verified subject matter experts