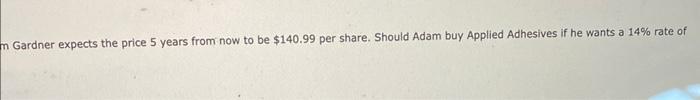

Question: 7. Ch12 Financial Planning Exercise 8 eBook Chapter 12 Financial Planning Exercise 8 Calculating expected return on a stock The price of Applied Adhesives,

7. Ch12 Financial Planning Exercise 8 eBook Chapter 12 Financial Planning Exercise 8 Calculating expected return on a stock The price of Applied Adhesives, Inc. is now $80. The company pays no dividends. Adam Gardner expects the price 5 years from now to return? Round the answer to two decimal places. -Select-, because the rate of return of the stock discussed is %. m Gardner expects the price 5 years from now to be $140.99 per share. Should Adam buy Applied Adhesives if he wants a 14% rate of

Step by Step Solution

3.58 Rating (155 Votes )

There are 3 Steps involved in it

Given Present value of stock PV 80 Time period n 5 years Required ra... View full answer

Get step-by-step solutions from verified subject matter experts