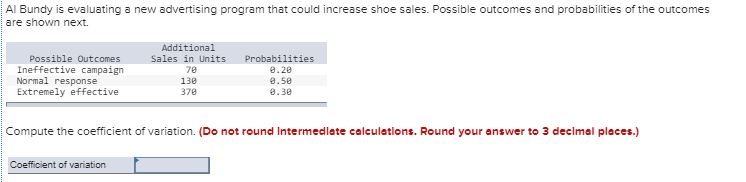

Question: Al Bundy is evaluating a new advertising program that could increase shoe sales. Possible outcomes and probabilities of the outcomes are shown next. Additional Sales

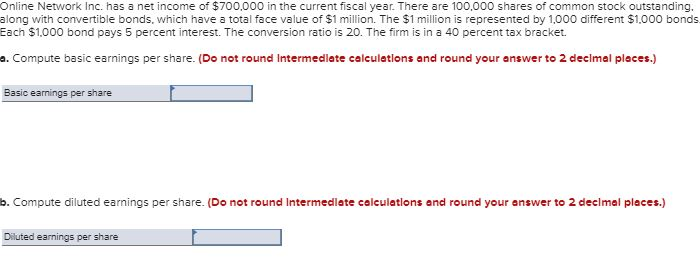

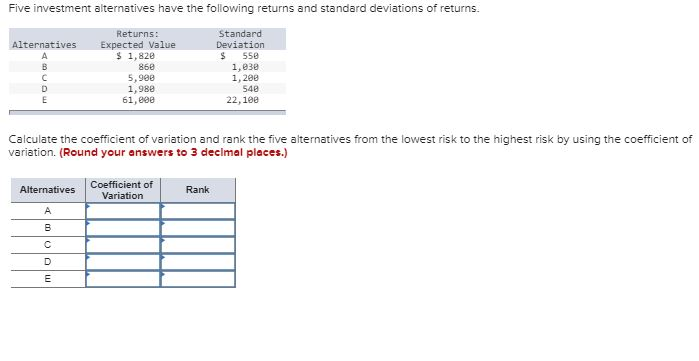

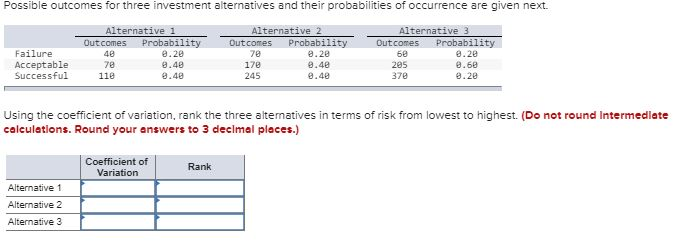

Al Bundy is evaluating a new advertising program that could increase shoe sales. Possible outcomes and probabilities of the outcomes are shown next. Additional Sales in Units Possible Outcomes Probabilities Ineffective campaign Normal response Extremely effective 78 0.28 0.5e 138 378 0.30 Compute the coefficient of variation. (Do not round Intermediate calculations. Round your answer to 3 decimal places.) Coefficient of variation Online Network Inc. has a net income of $700,000 in the current fiscal year. There are 100,000 shares of common stock outstanding, along with convertible bonds, which have a total face value of $1 million. The $1 million is represented by 1,000 different $1,000 bonds. Each $1,000 bond pays 5 percent interest. The conversion ratio is 20. The firm is in a 40 percent tax bracket a. Compute basic earnings per share. (Do not round intermediate calculations and round your answer to 2 decimal places.) Basic earnings per share . Compute diluted earnings per share. (Do not round Intermediate caiculations and round your answer to 2 declmal places.) Diluted earninas per share Five investment alternatives have the following returns and standard deviations of returns. Returns: Standard Expected Value S 1,820 868 Alternatives Deviation A 558 1,e3e 1,208 548 C 5,908 1,980 61,eee E 22,10e Calculate the coefficient of variation and rank the five alternatives from the lowest risk to the highest risk by using the coefficient of variation. (Round your answers to 3 decimal places.) Coefficient of Alternatives Rank Variation A D E Possible outcomes for three investment alternatives and their probabilities of occurrence are given next Alternative 1 Alternative 2 Alternative 3 Probability Probability Qutcomes 48 Probability Outcomes Outcomes Failure 0.20 78 8.28 0.28 Acceptable Successful 78 17e 0.48 285 8.48 8.68 118 0.40 245 0.40 37e 0.20 Using the coefficient of variation, rank the three altematives in terms of risk from lowest to highest. (Do not round Intermediate calculations. Round your answers to 3 decimal places.) Coefficient of Rank Variation Alternative 1 Alternative 2 Alternative 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts