Question: AL QUESTION 1 (16 MARKS In year 2015. ABC Inc. has the following capital structure: Type of Financing Characteristics Bonds Coupon interest rate: NO INTEREST

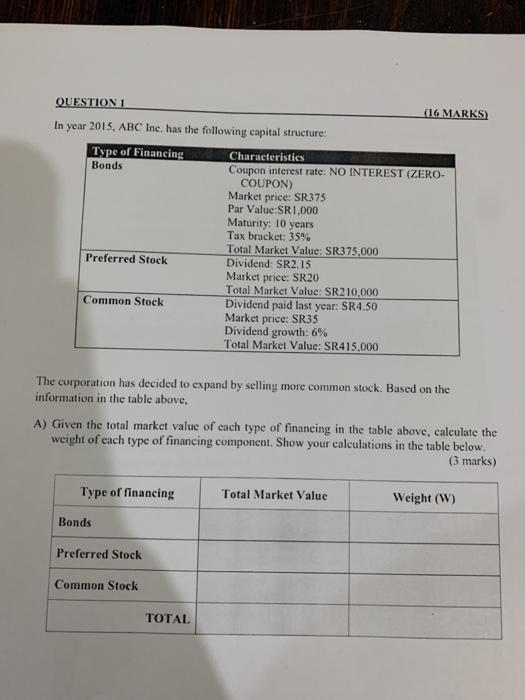

AL QUESTION 1 (16 MARKS In year 2015. ABC Inc. has the following capital structure: Type of Financing Characteristics Bonds Coupon interest rate: NO INTEREST (ZERO- COUPON) Market price: SR375 Par Value:SR1,000 Maturity: 10 years Tax bracket: 35% Total Market Value: SR375.000 Preferred Stock Dividend: SR2.15 Market price: SR20 Total Market Value: SR210.000 Common Stock Dividend paid last year: SR4.50 Market price: SR35 Dividend growth: 6% Total Market Value: SR415.000 The corporation has decided to expand by selling more common stock. Based on the information in the table above. A) Given the total market value of each type of financing in the table above, calculate the weight of each type of financing component. Show your calculations in the table below. (3 marks) Type of financing Total Market Value Weight (W) Bonds Preferred Stock Common Stock TOTAL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts