Question: QUESTION 1 (16 MARKS) In year 2015, ABC Inc. has the following capital structure: Type of Financing Bonds I Characteristics Coupon interest rate: NO INTEREST

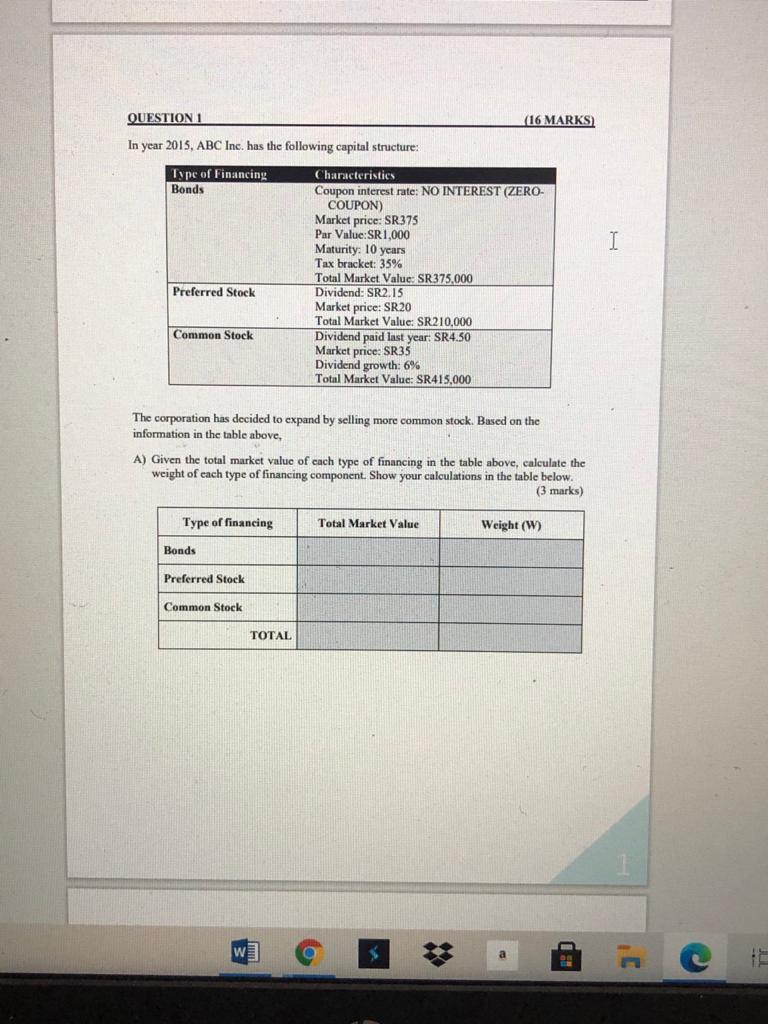

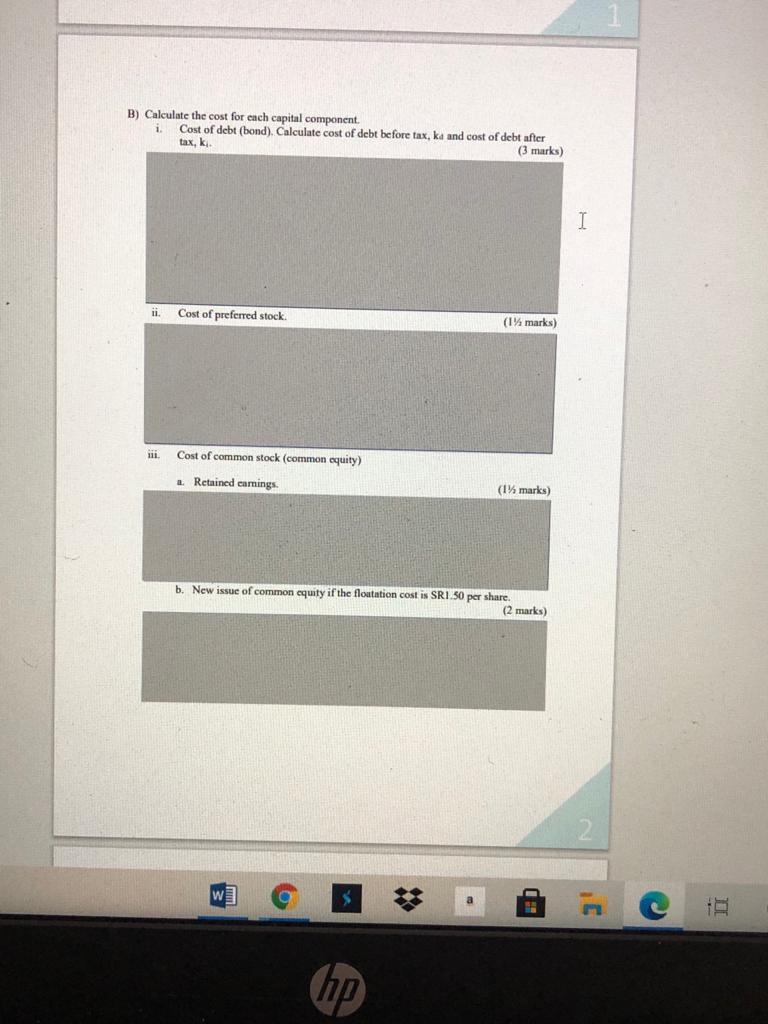

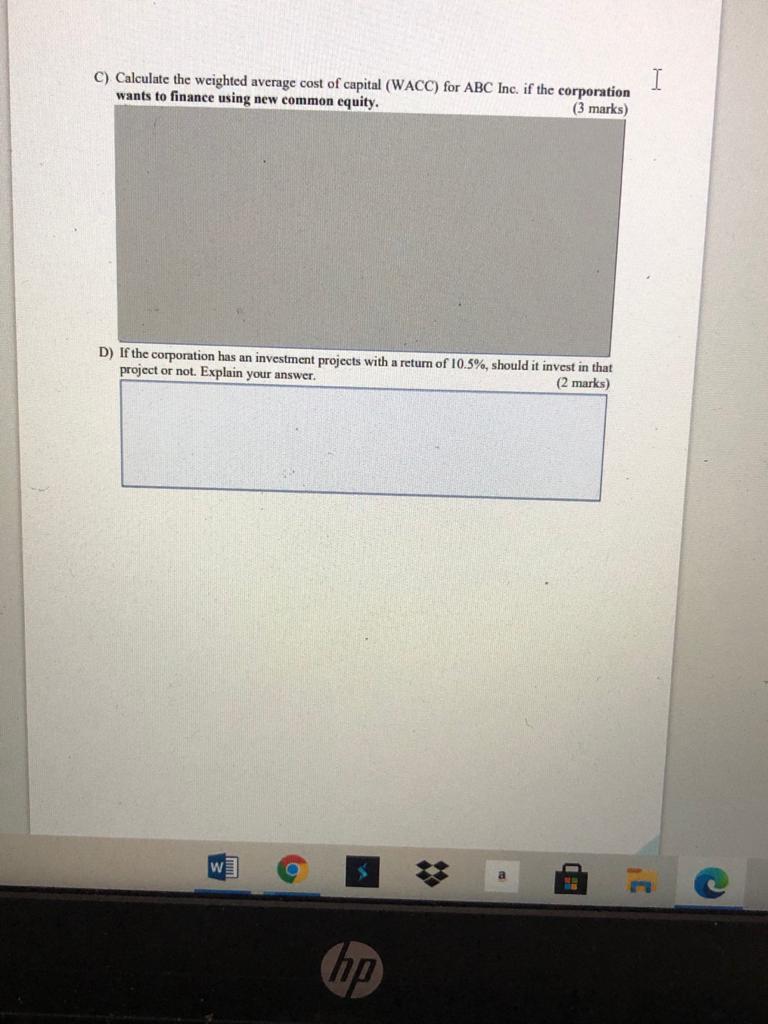

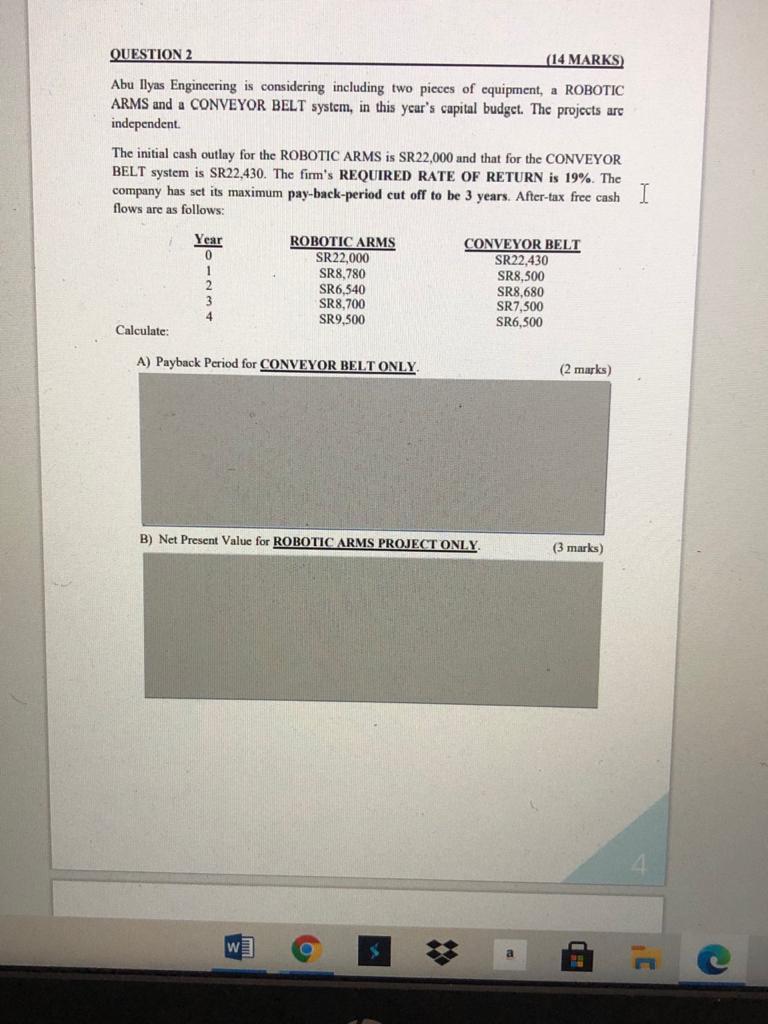

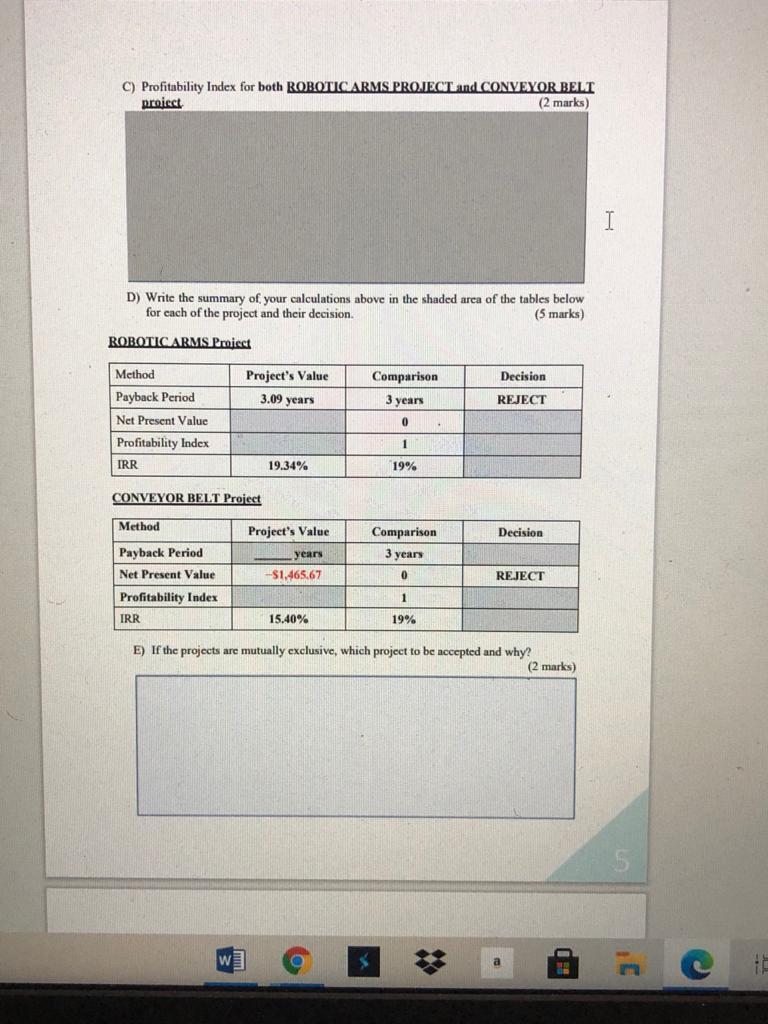

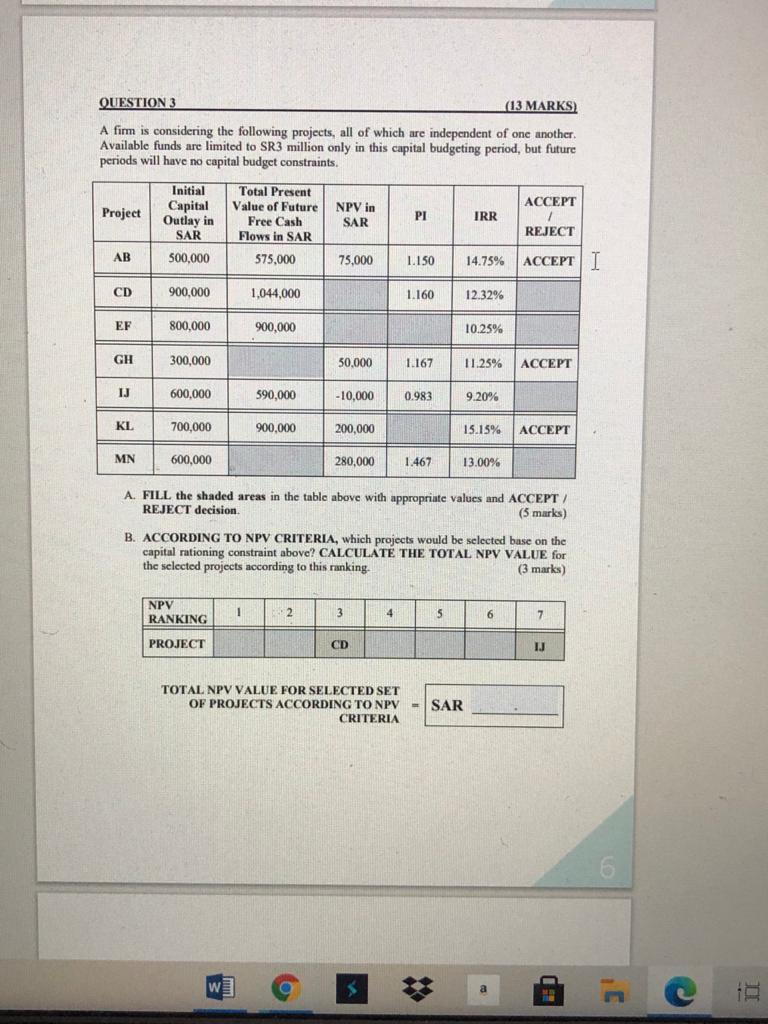

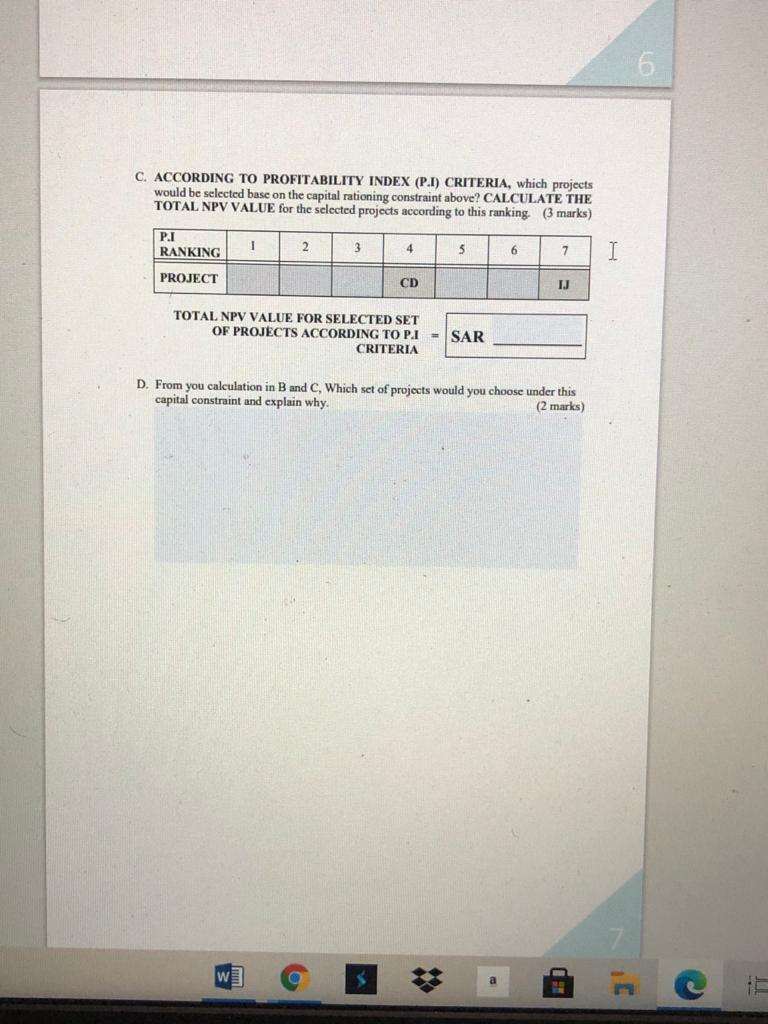

QUESTION 1 (16 MARKS) In year 2015, ABC Inc. has the following capital structure: Type of Financing Bonds I Characteristics Coupon interest rate: NO INTEREST (ZERO- COUPON) Market price: SR375 Par Value:SR1,000 Maturity: 10 years Tax bracket: 35% Total Market Value: SR375,000 Dividend: SR2.15 Market price: SR20 Total Market Value: SR210,000 Dividend paid last year: SR4.50 Market price: SR35 Dividend growth: 6% Total Market Value: SR415,000 Preferred Stock Common Stock The corporation has decided to expand by selling more common stock. Based on the information in the table above, A) Given the total market value of each type of financing in the table above, calculate weight of each type of financing component. Show your calculations in the table below. (3 marks) Type of financing Total Market Value Weight (W) Bonds Preferred Stock Common Stock TOTAL . B) Calculate the cost for each capital component. Cost of debt (bond). Calculate cost of debt before tax, ka and cost of debt after tax, ki (3 marks) I 11 Cost of preferred stock (1% marks) . Cost of common stock (common equity) a Retained earnings (1% marks) b. New issue of common equity if the floutation cost is SRI.50 per share. (2 marks) 3 a hp) C) Calculate the weighted average cost of capital (WACC) for ABC Inc. if the corporation wants to finance using new common equity. (3 marks) I D) If the corporation has an investment projects with a return of 10.5%, should it invest in that project or not. Explain your answer. (2 marks) O QUESTION 2 (14 MARKS Abu Ilyas Engineering is considering including two pieces of equipment, a ROBOTIC ARMS and a CONVEYOR BELT system, in this year's capital budget. The projects arc independent The initial cash outlay for the ROBOTIC ARMS is SR22,000 and that for the CONVEYOR BELT system is SR22,430. The firm's REQUIRED RATE OF RETURN is 19%. The company has set its maximum pay-back-period cut off to be 3 years. After-tax free cash flows are as follows: Year 0 1 2 3 ROBOTIC ARMS SR22,000 SR8,780 SR6,540 SR8,700 SR9,500 CONVEYOR BELT SR22,430 SR8.500 SR8.680 SR7,500 SR6,500 Calculate: A) Payback Period for CONVEYOR BELT ONLY (2 marks) B) Net Present Value for ROBOTIC ARMS PROJECT ONLY (3 marks) g 3 C C) Profitability Index for both ROBOTIC ARMS PROJECT and CONVEYOR BELT proiect (2 marks) I D) Write the summary of your calculations above in the shaded area of the tables below for each of the project and their decision. (5 marks) ROBOTIC ARMS Project Method Project's Value Decision Comparison 3 years 3.09 years REJECT 0 Payback Period Net Present Value Profitability Index IRR 1 19.34% 19% CONVEYOR BELT Project Method Project's Value Decision Comparison 3 years years -$1,465.67 0 REJECT Payback Period Net Present Value Profitability Index IRR 1 15.40% 19% E) If the projects are mutually exclusive, which project to be accepted and why? (2 marks) QUESTION 3 (13 MARKS) A firm is considering the following projects, all of which are independent of one another Available funds are limited to SR3 million only in this capital budgeting period, but future periods will have no capital budget constraints. Project Total Present Value of Future Free Cash Flows in SAR Initial Capital Outlay in SAR 500,000 NPV in SAR PI IRR ACCEPT 1 REJECT AB 575,000 75,000 1.150 14.75% ACCEPTI CD 900,000 1,044,000 1.160 12.32% EF 800,000 900.000 10.25% GH 300,000 50,000 1.167 11.25% accer ACCEPT IJ 600,000 590.000 -10,000 0.983 9.20% KI 700,000 900,000 200,000 15.15% ACCEPT MN 600,000 280,000 1.467 13.00% A. FILL the shaded areas in the table above with appropriate values and ACCEPT / REJECT decision (5 marks) B. ACCORDING TO NPV CRITERIA, which projects would be selected base on the capital rationing constraint above? CALCULATE THE TOTAL NPV VALUE for the selected projects according to this ranking. (3 marks) NPV RANKING 1 2 3 4 5 6 7 PROJECT CD IJ TOTAL NPV VALUE FOR SELECTED SET OF PROJECTS ACCORDING TO NPV CRITERIA - SAR 6 W C. ACCORDING TO PROFITABILITY INDEX (P.I) CRITERIA, which projects would be selected base on the capital rationing constraint above? CALCULATE THE TOTAL NPV VALUE for the selected projects according to this ranking (3 marks) P.I RANKING 1 2 3 4 5 6 7 I PROJECT CD IJ TOTAL NPV VALUE FOR SELECTED SET OF PROJECTS ACCORDING TO P.I CRITERIA - SAR D. From you calculation in B and C, Which set of projects would you choose under this capital constraint and explain why. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts