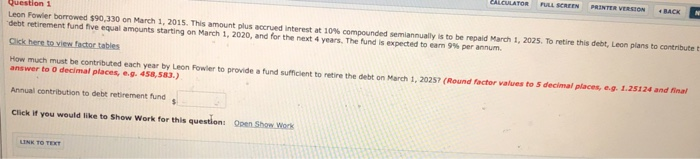

Question: ALCULATOR FULL SCREEN PRINTER VERSION BACK , 2S To mire thil debt Leon par, tme but, t Leon Fowler debt retirement fund five equal amounts

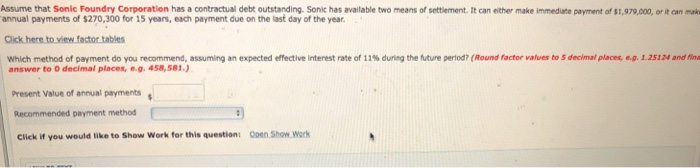

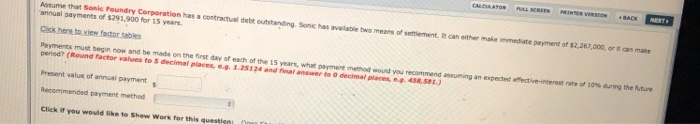

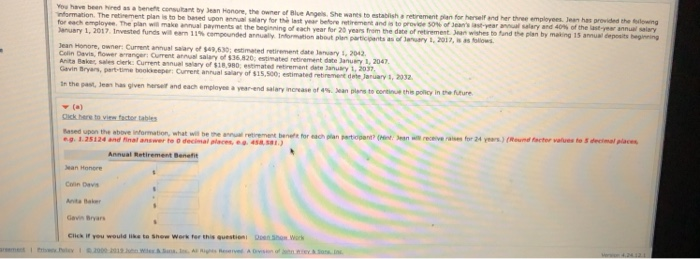

ALCULATOR FULL SCREEN PRINTER VERSION BACK , 2S To mire thil debt Leon par, tme but, t Leon Fowler debt retirement fund five equal amounts starting on March 1, 2020, and for the next 4 years. The fund is expected to earm 9% per annum borrowed S90 330 on March 1 2015. This amount plus accrued interest at 1 % compounded sema nually is to be repaid Mar How much must be contributed each year by Leon Fowler to provide a fund sufficient to retire the debt on March 1, 20257 (Round factor values to 5 decimal places, e.g. 1.25124 and Rinal answer to 0 decimal places, e.g. 458,583. Annual contribution to debt retirement fund s Click if you would like to Show Work for this question: Open Shaw Work LINK TO Assume that Sonic Foundry Corporation has a contractual debt outstanding. Sonic has available two means of settlement. It can either make immediate payment of $1,979,000, or it can mak annual payments of $270,300 for 15 years, each payment due on the last day of the year Click here to view factor tables Which method of payment do you reco mend assuming an expected effective interest rate of 11% d ing the future period? (Round factor values to Sdec answer to O decimal places, e.g. 458,581 alp ee line andn Present Value of annual payments Recommended payment method Click if you would like to Show Work for this question: Ooen Show Work Assume that Sonic roundry Corperation has a contractual debt outstanding. Sonic has available two means of settlement. itcan either make immediate peyment of $2,267,000, or it can make annual payments of $291,900 for 15 years Cick here to view faxtor tables ymets must begin row and be made on the first day of each ofthe Syears, what pamer mee dwoud you recommend assuring an expected effective-interest rate of 10% ang me Mure peried? (Round factor values to 5 decimal places, e-g. 1.25124 and final answer to o decimal places, e9. 458,581.) Present value of annual payment Recemmended payment method Click if you would like to Show Work for this questi have bean hNired as a benete consultant by Jean Honore, the owner of Blue Angels She wanes to establish a retirement plian for herself and her three employees. Jean has provided the elowing information. The retiement plan is to be bated upon ennual salary for each employee, The for the last year before retirement and is to provie eaniast-year mac salary and 40% of the last-year annual plan wil make annual payments January 1, 2017 Invested funds wil eem 11% compounded annual, intormation at the beginning of each year for 20 years from the dabe of d retirement sean wishes to fund the plan by mating 15 anual deposits beginning about plan particpents as of euary i, 2017, is as follows nger: arrent ar nusi salary of S36 820: est mated retrement date Janury . anuary t, 2037 Davis, fower erra 1, 2047 Anita Baker, sales clerk: Current annua Gavin Bryars, part-time bookkeeper: Current annual selary of $18,980 estimated retirement date 3 salary of $15,500: estimated retirement dete Jaruary 1, 2032 leen has given and each employee a year-end salary novase of 4%. Jean plens to cortin, this policy in tne ick hers to viewfactor tables tased upon the above information, what wilt be the aeual retirement bene' for ach plan pertiopent? be theual eg.1.25124 and final answer te 0 decimal places, ea 458S1 Annual Retirement Beneit ean Honore Colin Davis Anta Baker Gavin Bryars Click if you would like to Shew work fer this question ho Wrk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts