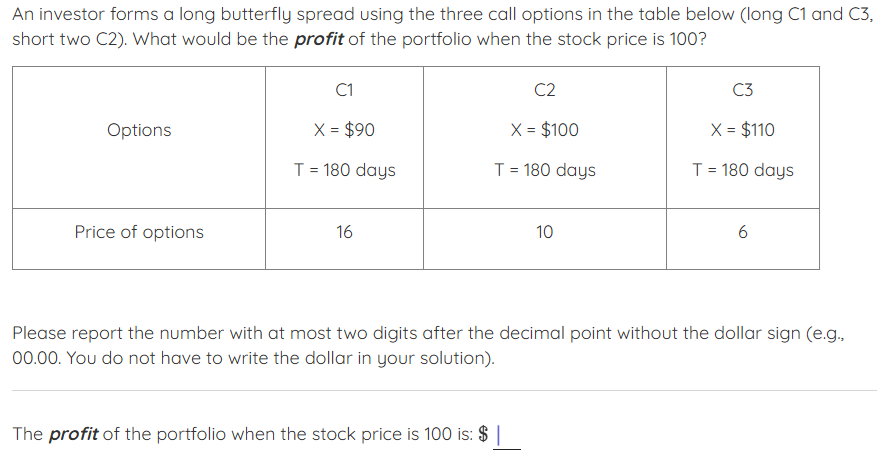

Question: An investor forms a long butterfly spread using the three call options in the table below ( long C 1 and C 3 , short

An investor forms a long butterfly spread using the three call options in the table below long C and C short two C What would be the profit of the portfolio when the stock price is Please report the number with at most two digits after the decimal point without the dollar sign eg You do not have to write the dollar in your solution The profit of the portfolio when the stock price is is: $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock