Question: Alecia Henfield: Attempt 1 FINANCIAL STATEMENT ANALYSIS Michael Scott has asked you to analyze Dunder Mifflin Paper Company, Inc.'s Financial Statements below. by calculating and

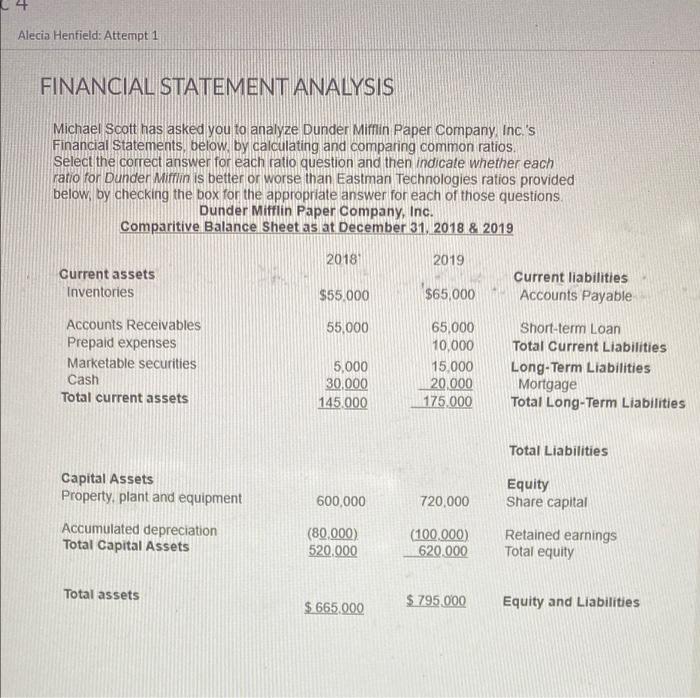

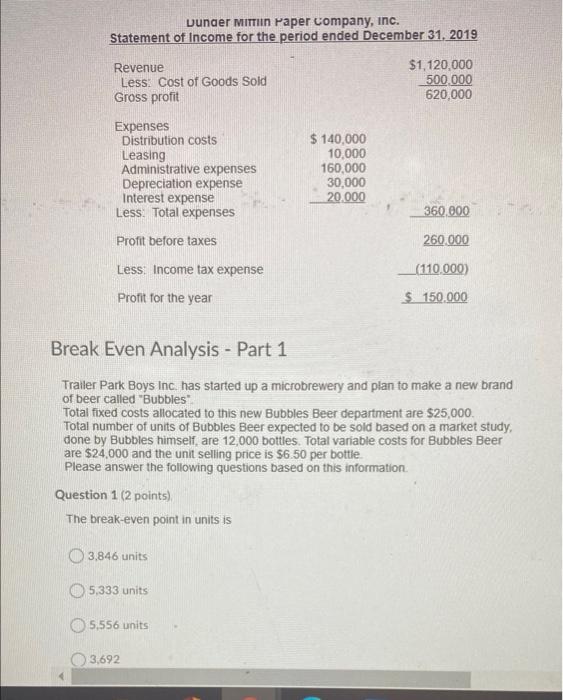

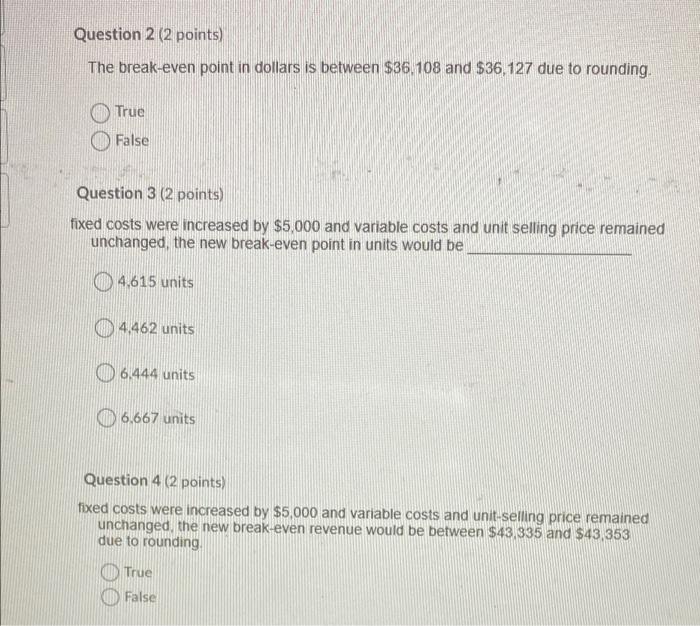

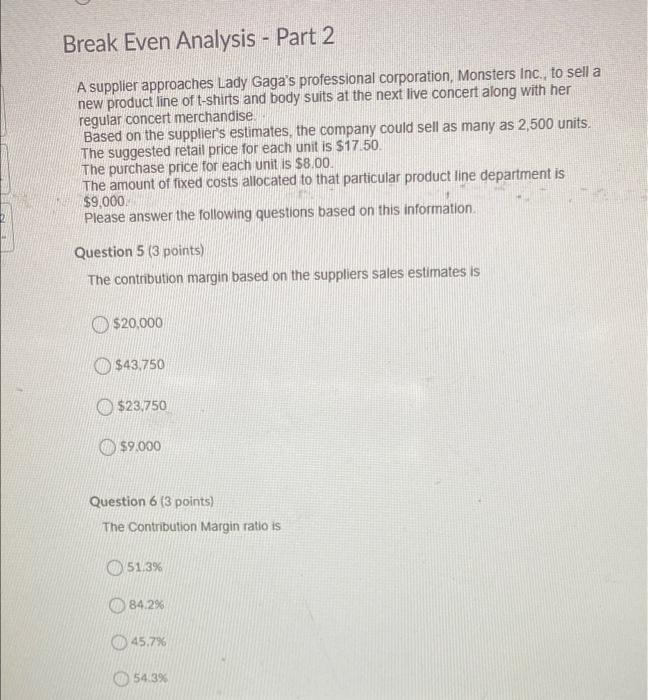

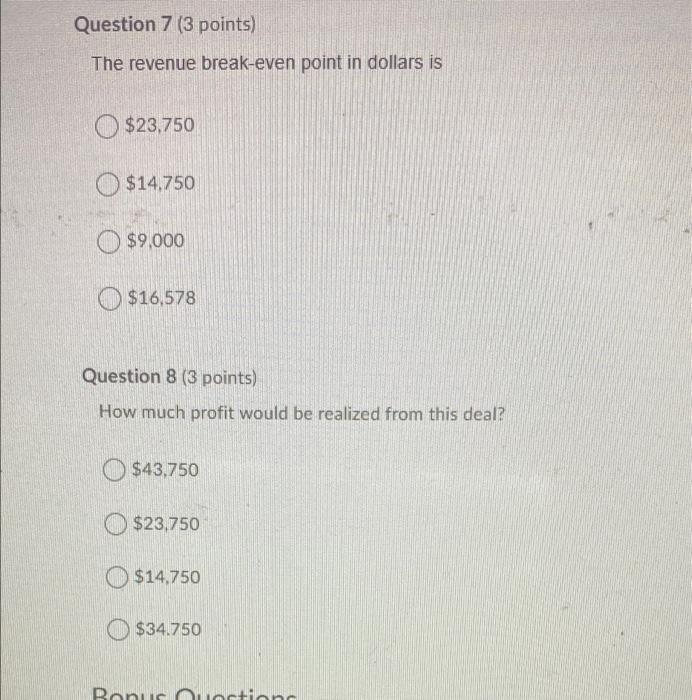

Alecia Henfield: Attempt 1 FINANCIAL STATEMENT ANALYSIS Michael Scott has asked you to analyze Dunder Mifflin Paper Company, Inc.'s Financial Statements below. by calculating and comparing common ratios Select the correct answer for each ratio question and then indicate whether each ratio for Dunder Mifflin is better or worse than Eastman Technologies ratios provided below by checking the box for the appropriate answer for each of those questions, Dunder Mifflin Paper Company, Inc. Comparitive Balance Sheet as at December 31, 2018 & 2019 2018 2019 Current assets Inventories Current liabilities Accounts Payable $55.000 $65,000 55,000 Accounts Receivables Prepaid expenses Marketable securities Cash Total current assets 5,000 30.000 145.000 65,000 10.000 15 000 20.000 175.000 Short-term Loan Total Current Liabilities Long-Term Liabilities Mortgage Total Long-Term Liabilities Total Liabilities Capital Assets Property, plant and equipment 600,000 720,000 Equity Share capital Accumulated depreciation Total Capital Assets (80,000) 520.000 (100.000) 620.000 Retained earnings Total equity Total assets $.795.000 $ 665.000 Equity and Liabilities Dunder MITTIIN Paper Company, Inc. Statement of Income for the period ended December 31, 2019 Revenue Less: Cost of Goods Sold Gross profit $1,120,000 500.000 620,000 Expenses Distribution costs Leasing Administrative expenses Depreciation expense Interest expense Less: Total expenses $ 140,000 10,000 160,000 30,000 20.000 360.000 Profit before taxes 260.000 (110.000) Less: Income tax expense Profit for the year $ 150.000 Break Even Analysis - Part 1 Trailer Park Boys Inc. has started up a microbrewery and plan to make a new brand of beer called "Bubbles" Total fixed costs allocated to this new Bubbles Beer department are $25,000 Total number of units of Bubbles Beer expected to be sold based on a market study, done by Bubbles himself, are 12,000 bottles. Total variable costs for Bubbles Beer are $24,000 and the unit selling price is $6.50 per bottle Please answer the following questions based on this information Question 1 (2 points) The break-even point in units is 3.846 units 5,333 units 5,556 units 3,692 Question 2 (2 points) The break-even point in dollars is between $36.108 and $36, 127 due to rounding. True False Question 3 (2 points) fixed costs were increased by $5,000 and variable costs and unit selling price remained unchanged the new break-even point in units would be 04.615 units 4.462 units 0 6,444 units 0 6.667 units Question 4 (2 points) fixed costs were increased by $5,000 and variable costs and unit-selling price remained unchanged the new break-even revenue would be between $43,335 and $43 353 due to rounding True False Break Even Analysis - Part 2 A supplier approaches Lady Gaga's professional corporation, Monsters Inc., to sell a new product line of t-shirts and body suits at the next live concert along with her regular concert merchandise Based on the supplier's estimates, the company could sell as many as 2,500 units. The suggested retail price for each unit is $17.50 The purchase price for each unit is $8.00. The amount of fixed costs allocated to that particular product line department is $9,000 Please answer the following questions based on this information Question 5 (3 points) The contribution margin based on the suppliers sales estimates is $20.000 $43.750 $23.750 $9.000 Question 6 (3 points) The Contribution Margin ratio is 51.3% 84.2% 45.7% 54.3% Question 7 (3 points) The revenue break-even point in dollars is $23.750 $14.750 $ $9,000 $16,578 Question 8 (3 points) How much profit would be realized from this deal? $43.750 $23.750 O $14.750 $34.750 $ BA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts