Question: Alexis opened a dance studio, where she gave lessons to children after school and couples at night. The business is organized as a sole proprietorship

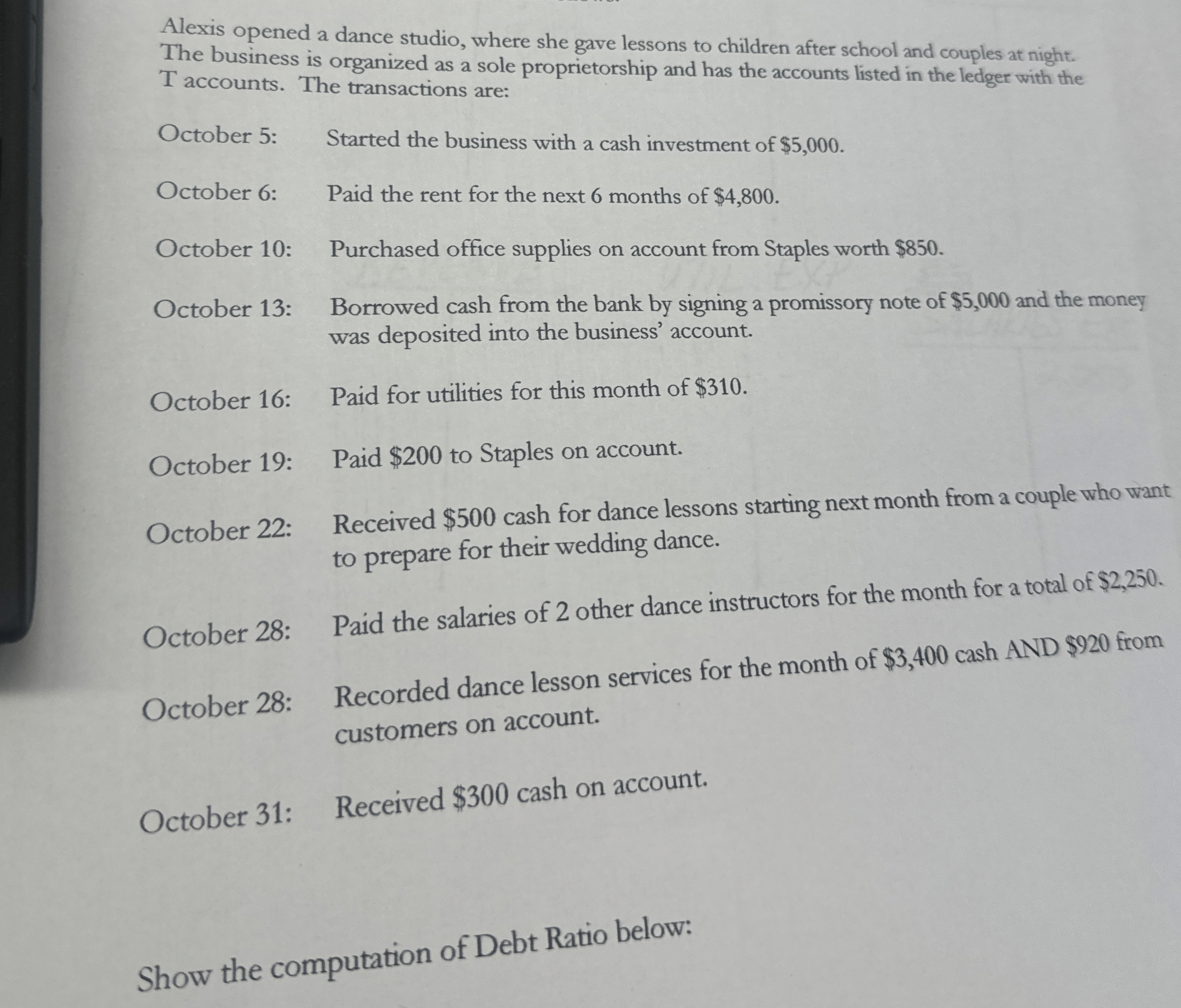

Alexis opened a dance studio, where she gave lessons to children after school and couples at night. The business is organized as a sole proprietorship and has the accounts listed in the ledger with the T accounts. The transactions are:

October : Started the business with a cash investment of $

October : Paid the rent for the next months of $

October : Purchased office supplies on account from Staples worth $

October : Borrowed cash from the bank by signing a promissory note of $ and the money was deposited into the business' account.

October : Paid for utilities for this month of $

October : Paid $ to Staples on account.

October : Received $ cash for dance lessons starting next month from a couple who want to prepare for their wedding dance.

October : Paid the salaries of other dance instructors for the month for a total of $

October : Recorded dance lesson services for the month of $ cash AND $ from customers on account.

October : Received $ cash on account.

Show the computation of Debt Ratio below:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock