Question: Ariel & Jasmine opened a dance studio named A & J Dance Limited on September 1, 2019. During their first month they experienced the following:

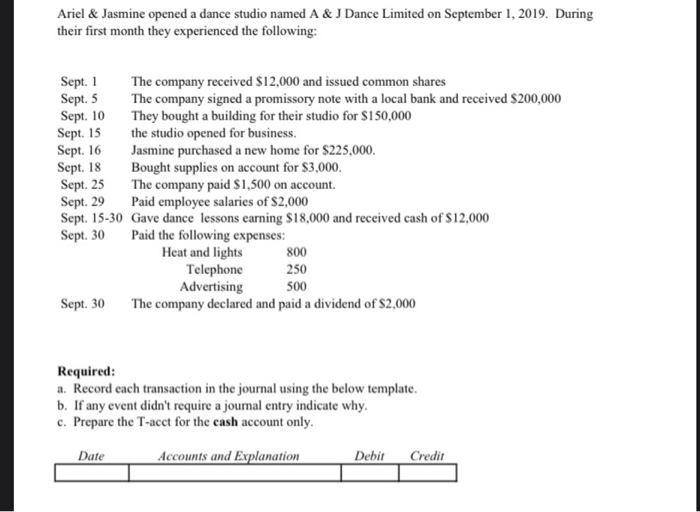

Ariel & Jasmine opened a dance studio named A & J Dance Limited on September 1, 2019. During their first month they experienced the following: Sept. 1 The company received $12,000 and issued common shares Sept. 5 The company signed a promissory note with a local bank and received $200,000 Sept. 10 They bought a building for their studio for $150,000 Sept. 15 the studio opened for business. Sept. 16 Jasmine purchased a new home for $225,000. Sept. 18 Bought supplies on account for $3,000. Sept. 25 The company paid $1,500 on account Sept. 29 Paid employee salaries of $2,000 Sept. 15-30 Gave dance lessons earning $18,000 and received cash of $12,000 Sept. 30 Paid the following expenses: Heat and lights 800 Telephone 250 Advertising Sept. 30 The company declared and paid a dividend of $2,000 500 Required: a. Record each transaction in the journal using the below template. b. If any event didn't require a journal entry indicate why. c. Prepare the T-acct for the cash account only. Date Accounts and Explanation Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts