Question: Ali plc is preparing its financial statements for the year ended 31 December 2021. During the year, it disposed of a building (for proceeds

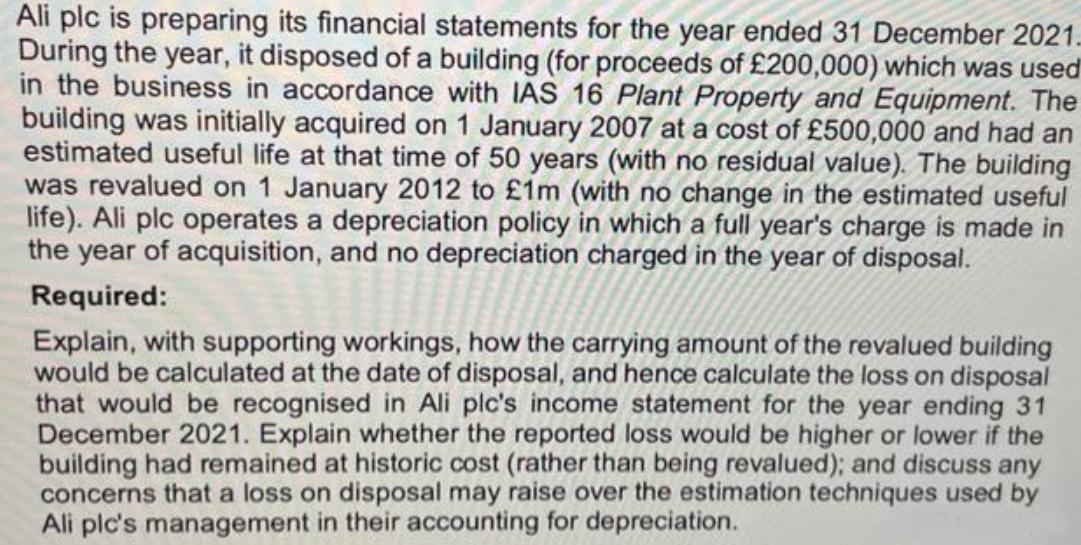

Ali plc is preparing its financial statements for the year ended 31 December 2021. During the year, it disposed of a building (for proceeds of 200,000) which was used in the business in accordance with IAS 16 Plant Property and Equipment. The building was initially acquired on 1 January 2007 at a cost of 500,000 and had an estimated useful life at that time of 50 years (with no residual value). The building was revalued on 1 January 2012 to 1m (with no change in the estimated useful life). Ali plc operates a depreciation policy in which a full year's charge is made in the year of acquisition, and no depreciation charged in the year of disposal. Required: Explain, with supporting workings, how the carrying amount of the revalued building would be calculated at the date of disposal, and hence calculate the loss on disposal that would be recognised in Ali plc's income statement for the year ending 31 December 2021. Explain whether the reported loss would be higher or lower if the building had remained at historic cost (rather than being revalued); and discuss any concerns that a loss on disposal may raise over the estimation techniques used by Ali plc's management in their accounting for depreciation.

Step by Step Solution

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Acquisition Date 112007 7 Life 50 yrs Depreciation per year Revaluation ... View full answer

Get step-by-step solutions from verified subject matter experts