Question: ALL ANSWER BY PAPER, NOT BY EXCEL PLEASE.? a) Tne followng contingent premium option allows vou to pav nothing today at time t- 0, but

ALL ANSWER BY PAPER, NOT BY EXCEL PLEASE.?

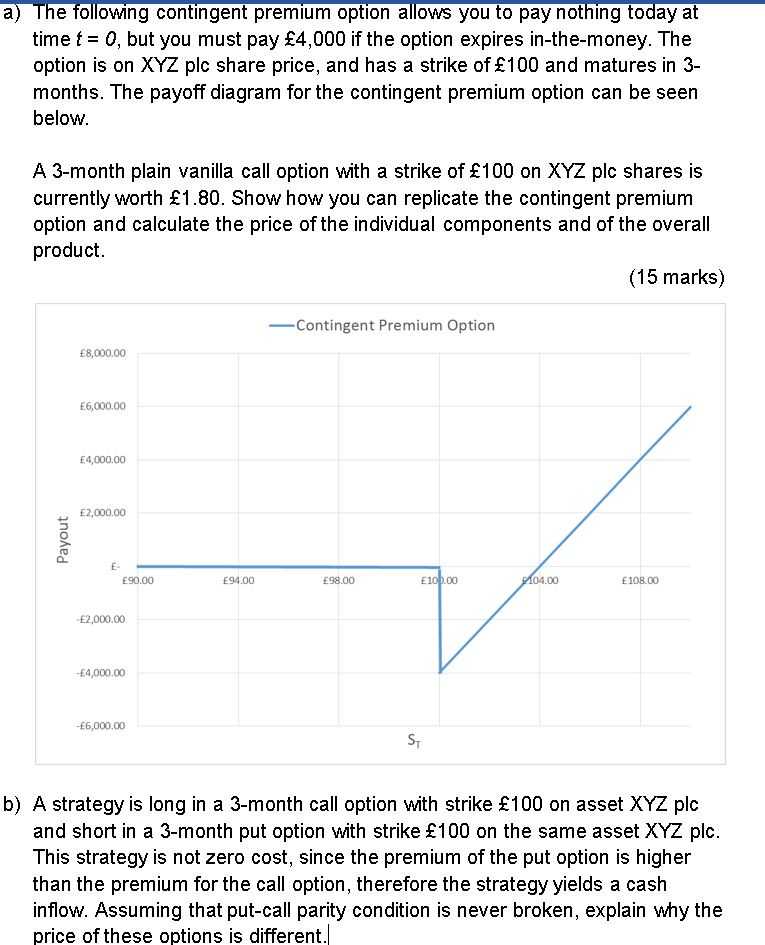

a) Tne followng contingent premium option allows vou to pav nothing today at time t- 0, but you must pay 4,000 if the option expires in-the-money. The option is on XYZ plc share price, and has a strike of 100 and matures in 3- months. The payoff diagram for the contingent premium option can be seen below A 3-month plain vanilla call option with a strike of 100 on XYZ plc shares is currently worth 1.80. Show how you can replicate the contingent premium option and calculate the price of the individual components and of the overall product (15 marks) Contingent Premium Option E8,000.00 E6,000.00 E4,000.00 E2,000.00 aL E90.00 E94.00 E98.00 E108.00 E2,000.00 4,000.00 -E6,000.00 ST b) A strategy is long in a 3-month call option with strike 100 on asset XYZ plc and short in a 3-month put option with strike 100 on the same asset XYZ plc This strategy is not zero cost, since the premium of the put option is higher than the premium for the call option, therefore the strategy yields a cash inflow. Assuming that put-call parity condition is never broken, explain why the price of these options is different.| a) Tne followng contingent premium option allows vou to pav nothing today at time t- 0, but you must pay 4,000 if the option expires in-the-money. The option is on XYZ plc share price, and has a strike of 100 and matures in 3- months. The payoff diagram for the contingent premium option can be seen below A 3-month plain vanilla call option with a strike of 100 on XYZ plc shares is currently worth 1.80. Show how you can replicate the contingent premium option and calculate the price of the individual components and of the overall product (15 marks) Contingent Premium Option E8,000.00 E6,000.00 E4,000.00 E2,000.00 aL E90.00 E94.00 E98.00 E108.00 E2,000.00 4,000.00 -E6,000.00 ST b) A strategy is long in a 3-month call option with strike 100 on asset XYZ plc and short in a 3-month put option with strike 100 on the same asset XYZ plc This strategy is not zero cost, since the premium of the put option is higher than the premium for the call option, therefore the strategy yields a cash inflow. Assuming that put-call parity condition is never broken, explain why the price of these options is different.|

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts