Question: ALL ANSWER BY PAPER, NOT BY EXCEL PLEASE QUESTION 5) ANSWER ALL PARTS You observe the following option prices on crude oil (current price 38):

ALL ANSWER BY PAPER, NOT BY EXCEL PLEASE

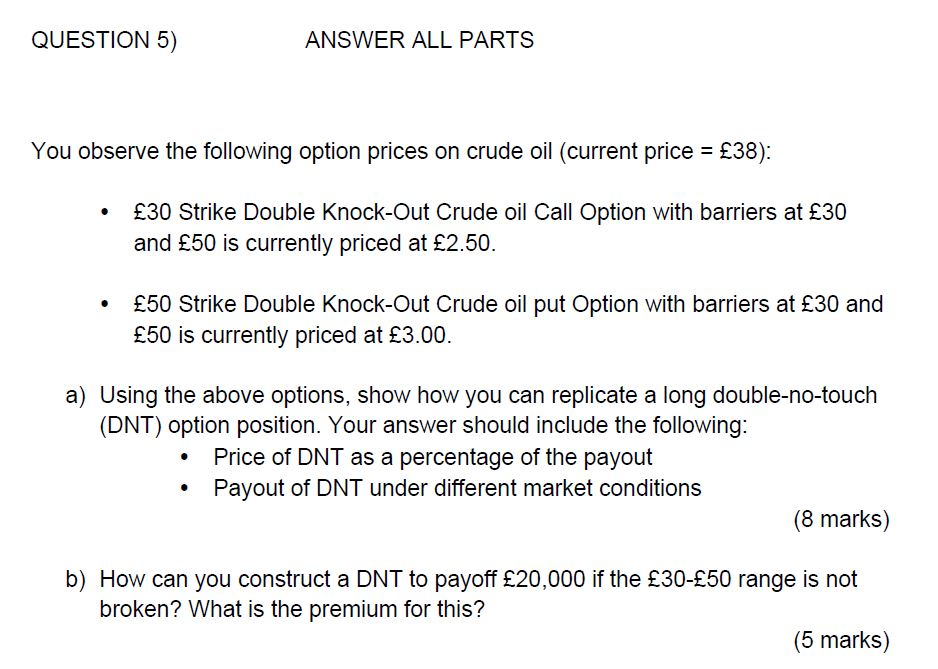

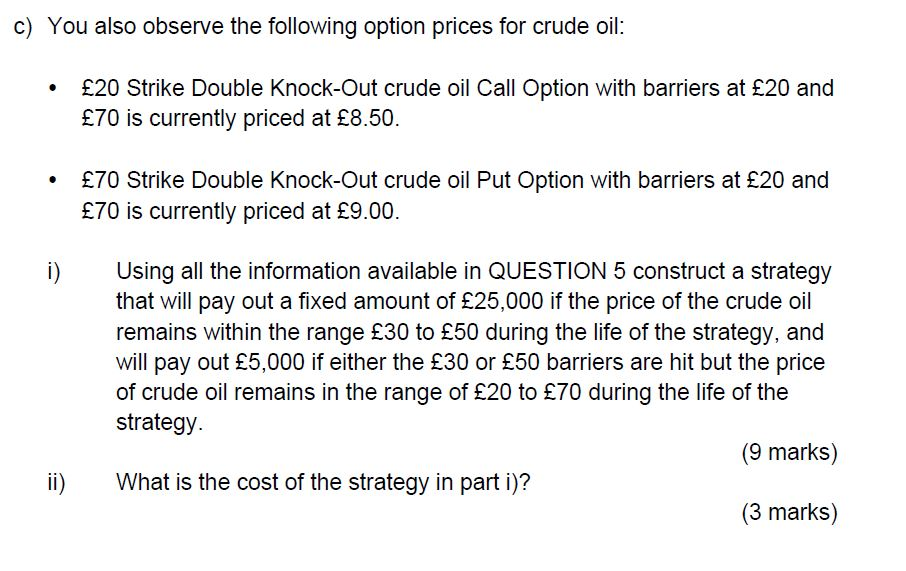

QUESTION 5) ANSWER ALL PARTS You observe the following option prices on crude oil (current price 38): 30 Strike Double Knock-Out Crude oil Call Option with barriers at 30 and 50 is currently priced at 2.50. ' 50 Strike Double Knock-Out Crude oil put Option with barriers at 30 and 50 is currently priced at 3.00. a) Using the above options, show how you can replicate a long double-no-touch (DNT) option position. Your answer should include the following: Price of DNT as a percentage of the payout Payout of DNT under different market conditions (8 marks) b) How can you construct a DNT to payoff 20,000 if the 30-50 range is not broken? What is the premium for this? (5 marks) QUESTION 5) ANSWER ALL PARTS You observe the following option prices on crude oil (current price 38): 30 Strike Double Knock-Out Crude oil Call Option with barriers at 30 and 50 is currently priced at 2.50. ' 50 Strike Double Knock-Out Crude oil put Option with barriers at 30 and 50 is currently priced at 3.00. a) Using the above options, show how you can replicate a long double-no-touch (DNT) option position. Your answer should include the following: Price of DNT as a percentage of the payout Payout of DNT under different market conditions (8 marks) b) How can you construct a DNT to payoff 20,000 if the 30-50 range is not broken? What is the premium for this

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts