Question: ALL ANSWER BY PAPER, NOT BY EXCEL PLEASE QUESTION 1) ANSWER ALL PARTS a) You observe the following prices in the market: 1. A 3-month

ALL ANSWER BY PAPER, NOT BY EXCEL PLEASE

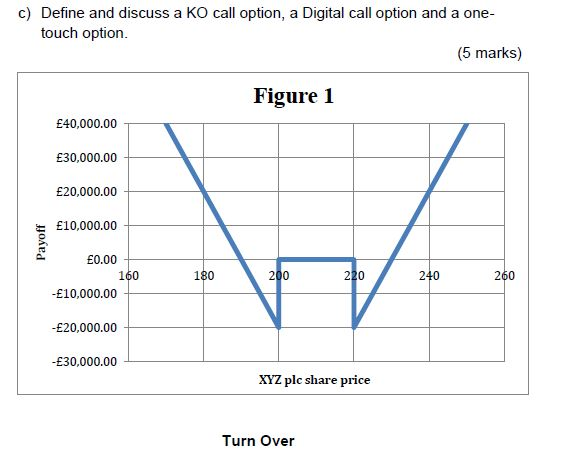

QUESTION 1) ANSWER ALL PARTS a) You observe the following prices in the market: 1. A 3-month plain vanilla put option with a strike of 200 on XYZ Ic shares is currently worth 3. 2. A 3-month plain vanilla call option with a strike of 220 on XYZ plc shares is currently worth 2.5 Show how you can replicate the payoff depicted in Figure 1 using the above options and two digital options to make the overall strategy zero cost. Calculate the price of the individual components and of the overall investment strategy. (10 marks) b) Graphically show the difference between the strategy in Figure 1 and a Strangle (long a put and long a call with higher strike price written on the same underlying asset) constructed using the options above. Critically discuss under which situation the Strangle is more appealing than the payoff depicted in Figure 1 (10 marks) QUESTION 1) ANSWER ALL PARTS a) You observe the following prices in the market: 1. A 3-month plain vanilla put option with a strike of 200 on XYZ Ic shares is currently worth 3. 2. A 3-month plain vanilla call option with a strike of 220 on XYZ plc shares is currently worth 2.5 Show how you can replicate the payoff depicted in Figure 1 using the above options and two digital options to make the overall strategy zero cost. Calculate the price of the individual components and of the overall investment strategy. (10 marks) b) Graphically show the difference between the strategy in Figure 1 and a Strangle (long a put and long a call with higher strike price written on the same underlying asset) constructed using the options above. Critically discuss under which situation the Strangle is more appealing than the payoff depicted in Figure 1 (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts