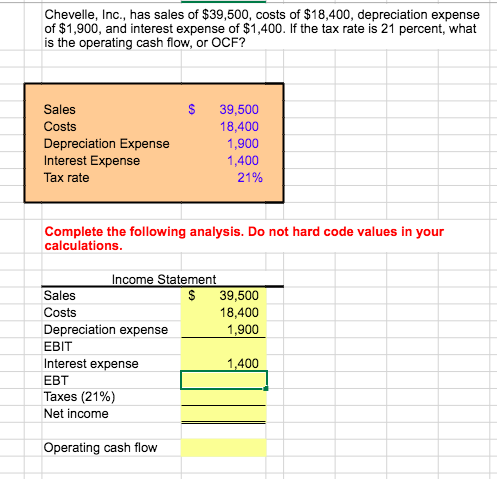

Question: *All answers must be entered as a FORMULA PLEASE* Problem: Income Statement Chevelle, Inc., has sales of $39,500, costs of $18,400, depreciation expense of $1,900,

*All answers must be entered as a FORMULA PLEASE*

Problem: Income Statement

Chevelle, Inc., has sales of $39,500, costs of $18,400, depreciation expense of $1,900, and interest expense of $1,400. If the tax rate is 21 percent, what is the operating cash flow, or OCF? $ Sales Costs Depreciation Expense Interest Expense Tax rate 39,500 18,400 1,900 1,400 21% Complete the following analysis. Do not hard calculations. values in your Income Statement Sales 39,500 Costs 18,400 Depreciation expense 1,900 EBIT Interest expense 1,400 EBT Taxes (21%) Net income Operating cash flow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts