Question: all current solutions on website are wrong. The Sampsons want a life insurance policy that will provide for the family in the event of Dave's

all current solutions on website are wrong.

all current solutions on website are wrong.

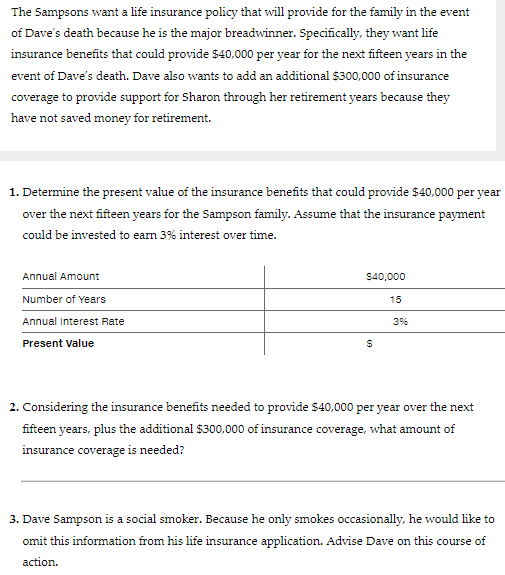

The Sampsons want a life insurance policy that will provide for the family in the event of Dave's death because he is the major breadwinner. Specifically, they want life insurance benefits that could provide $40,000 per year for the next fifteen years in the event of Dave's death. Dave also wants to add an additional $300,000 of insurance coverage to provide support for Sharon through her retirement years because they have not saved money for retirement. 1. Determine the present value of the insurance benefits that could provide $40,000 per year over the next fifteen years for the Sampson family. Assume that the insurance payment could be invested to earn 3% interest over time. S40,000 15 Annual Amount Number of years Annual Interest Rate Present Value 3% S 2. Considering the insurance benefits needed to provide $40,000 per year over the next fifteen years, plus the additional $300,000 of insurance coverage, what amount of insurance coverage is needed? 3. Dave Sampson is a social smoker. Because he only smokes occasionally, he would like to omit this information from his life insurance application. Advise Dave on this course of action. The Sampsons want a life insurance policy that will provide for the family in the event of Dave's death because he is the major breadwinner. Specifically, they want life insurance benefits that could provide $40,000 per year for the next fifteen years in the event of Dave's death. Dave also wants to add an additional $300,000 of insurance coverage to provide support for Sharon through her retirement years because they have not saved money for retirement. 1. Determine the present value of the insurance benefits that could provide $40,000 per year over the next fifteen years for the Sampson family. Assume that the insurance payment could be invested to earn 3% interest over time. S40,000 15 Annual Amount Number of years Annual Interest Rate Present Value 3% S 2. Considering the insurance benefits needed to provide $40,000 per year over the next fifteen years, plus the additional $300,000 of insurance coverage, what amount of insurance coverage is needed? 3. Dave Sampson is a social smoker. Because he only smokes occasionally, he would like to omit this information from his life insurance application. Advise Dave on this course of action

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts