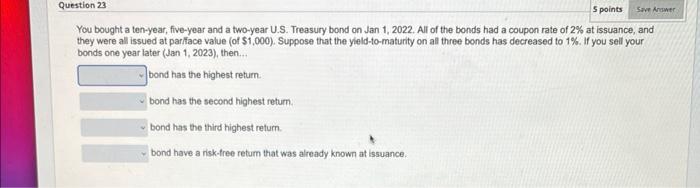

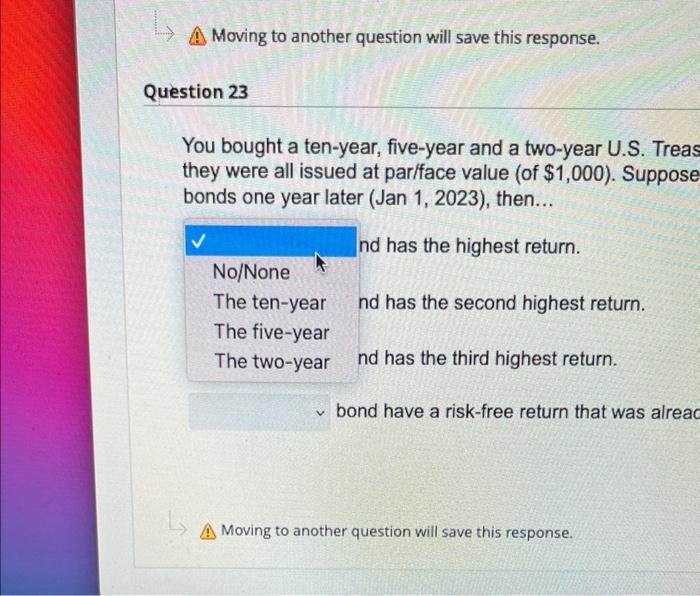

Question: all drop down boxes contain the same options for all for questions You bought a ten-year, five-year and a two-year U.S. Treasury bond on Jan

You bought a ten-year, five-year and a two-year U.S. Treasury bond on Jan 1, 2022. All of the bonds had a coupon rate of 2% at issuance, and they were all issued at parfface value (of $1,000 ). Suppose that the yield-to-maturity on all three bonds has decreased to 1%. If you sell your bonds one year later (Jan 1, 2023), then. bond has the highest return. bond has the second highest retum. bond has the third highest return. bond have a risk-tree retum that was already known at issuance. Moving to another question will save this response. estion 23 You bought a ten-year, five-year and a two-year U.S. Treas they were all issued at par/face value (of $1,000 ). Suppose bonds one year later (Jan 1, 2023), then... nd has the highest return. nd has the second highest return. nd has the third highest return. bond have a risk-free return that was alreac Moving to another question will save this response

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts