Question: All else constant, a bond will sell at when the coupon rate is the yield to maturity. is the price a dealer will pay to

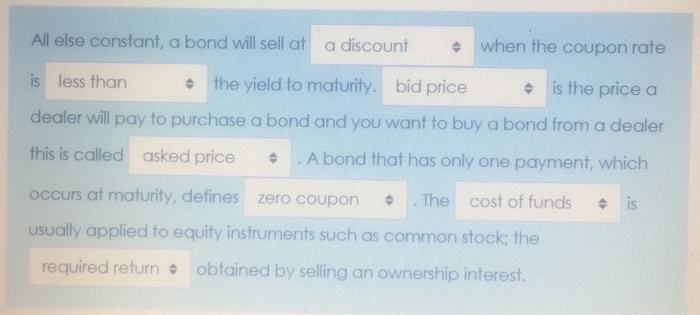

All else constant, a bond will sell at when the coupon rate is the yield to maturity. is the price a dealer will pay to purchase a bond and you want to buy a bond from a dealer this is called A bond that has only one payment, which occurs at maturity, defines . The is usually applied to equity instruments such as common stock; the obtained by selling an ownership interest. All else constant, a bond will sell at a discount when the coupon rate is less than the yield to maturity. bid price is the price a dealer will pay to purchase a bond and you want to buy a bond from a dealer this is called asked price A bond that has only one payment, which is occurs at maturity, defines zero coupon . The cost of funds usually applied to equity instruments such as common stock; the required return obtained by selling an ownership interest. All else constant, a bond will sell at when the coupon rate is the yield to maturity. is the price a dealer will pay to purchase a bond and you want to buy a bond from a dealer this is called A bond that has only one payment, which occurs at maturity, defines . The is usually applied to equity instruments such as common stock; the obtained by selling an ownership interest. All else constant, a bond will sell at a discount when the coupon rate is less than the yield to maturity. bid price is the price a dealer will pay to purchase a bond and you want to buy a bond from a dealer this is called asked price A bond that has only one payment, which is occurs at maturity, defines zero coupon . The cost of funds usually applied to equity instruments such as common stock; the required return obtained by selling an ownership interest

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts